Introduction

eToro is one of the most popular online trading platforms, known for its social trading features, ease of use, and diverse investment options. Founded in 2007, eToro started as a forex trading platform but has since expanded to include stocks, ETFs, commodities, and cryptocurrencies.

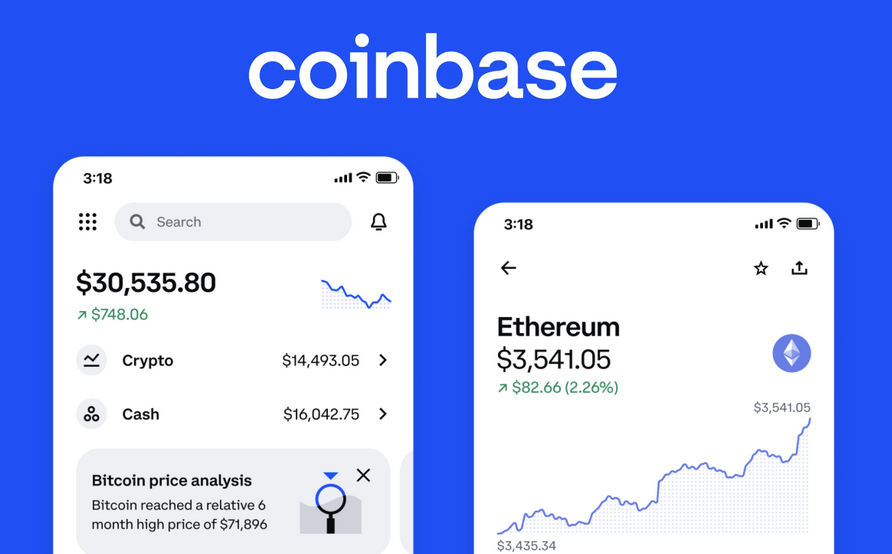

Unlike traditional cryptocurrency exchanges like Binance, Kraken, or Coinbase, eToro offers a unique copy trading feature that allows users to automatically replicate the trades of professional investors. This makes it a great option for beginners who want to learn from experienced traders.

eToro is a regulated platform operating in multiple jurisdictions, including the United States, Europe, Australia, and the UK. It is a trusted choice for investors looking to trade multiple asset classes in one place.

What This Review Covers

✅ Key Features – What makes eToro unique?

✅ Security and Regulation – Is eToro safe?

✅ Trading Options – What assets can you trade?

✅ Fees and Costs – Is eToro affordable?

✅ User Experience – Is eToro easy to use?

✅ Pros and Cons – The strengths and weaknesses of eToro.

✅ Comparison with Binance, Kraken, and Coinbase – Which platform is better?

By the end of this review, you will have a detailed understanding of eToro and whether it’s the right platform for you.

1. What is eToro? A Brief Overview

eToro is a multi-asset brokerage and social trading platform that allows users to trade:

- Cryptocurrencies

- Stocks and ETFs

- Forex (Foreign Exchange)

- Commodities (Gold, Oil, Silver, etc.)

Unlike Binance or Kraken, which are crypto-only exchanges, eToro provides access to both traditional and digital assets.

What Makes eToro Different?

✔ Social Trading – Users can follow and copy professional traders.

✔ Multi-Asset Trading – Trade stocks, forex, crypto, and more on a single platform.

✔ Beginner-Friendly – A simple interface designed for new investors.

✔ Regulated Platform – eToro is licensed in the US, UK, Europe, and Australia.

✔ Commission-Free Stock Trading – Buy real stocks with zero commission.

With over 30 million registered users, eToro is one of the largest trading platforms in the world.

2. eToro Security and Regulation: Is eToro Safe?

Regulatory Compliance

eToro is a highly regulated trading platform, holding licenses from multiple financial authorities:

✔ United States – Registered with FINRA and SEC for US traders.

✔ United Kingdom – Licensed by the Financial Conduct Authority (FCA).

✔ European Union – Regulated by CySEC (Cyprus Securities and Exchange Commission).

✔ Australia – Supervised by ASIC (Australian Securities and Investments Commission).

Unlike Binance, which has faced regulatory issues in multiple countries, eToro is fully compliant with financial regulations, making it a safer option for long-term investors.

Security Features

✔ Two-Factor Authentication (2FA) – Adds an extra layer of security.

✔ Cold Storage for Crypto – Protects funds from hacks.

✔ SSL Encryption – Ensures all user data remains secure.

✔ Segregated Funds – Customer funds are kept separate from company funds.

eToro has a strong track record in security, and unlike some exchanges that have suffered hacks, eToro has never been hacked.

3. Trading Options: What Can You Trade on eToro?

eToro is a multi-asset platform, meaning users can trade a variety of financial instruments.

Cryptocurrency Trading on eToro

eToro supports 80+ cryptocurrencies, including:

✅ Bitcoin (BTC)

✅ Ethereum (ETH)

✅ Cardano (ADA)

✅ Solana (SOL)

✅ Dogecoin (DOGE) & Shiba Inu (SHIB)

While Binance offers over 350 cryptocurrencies, eToro focuses on the most popular and established digital assets.

Stock and ETF Trading on eToro

Unlike Binance or Kraken, eToro allows users to invest in real stocks and ETFs, including:

✔ Apple (AAPL), Amazon (AMZN), Tesla (TSLA), Microsoft (MSFT), and more.

✔ S&P 500 ETFs, Nasdaq ETFs, and International ETFs.

Users can buy real stocks with zero commission, making eToro a cost-effective choice for stock investors.

Forex and Commodity Trading

eToro also offers forex trading and commodities, including:

✔ EUR/USD, GBP/USD, USD/JPY, and more forex pairs.

✔ Gold, Silver, Oil, and Natural Gas.

This makes eToro a diversified trading platform where users can invest in crypto, stocks, forex, and commodities all in one place.

4. eToro Copy Trading: How Does It Work?

One of eToro’s biggest advantages is its Copy Trading feature, which allows users to automatically copy the trades of professional investors.

How Copy Trading Works

- Choose a trader – Browse profiles of top traders on eToro.

- Allocate funds – Decide how much to invest in copying the trader.

- Auto-trade – eToro will automatically replicate the trades of the chosen investor.

Benefits of Copy Trading

✔ Great for beginners – Learn from experienced traders.

✔ Hands-free trading – No need to actively manage trades.

✔ Transparency – View the full trading history and performance of top traders.

eToro’s social trading feature makes it unique compared to Binance, Coinbase, or Kraken, which do not offer automated copy trading.

5. eToro Fees and Commissions: Is eToro Expensive?

eToro has different fee structures depending on the asset class.

| Fee Type | eToro Standard Fees |

|---|---|

| Crypto Trading Fees | 1% per trade |

| Stock & ETF Trading | $0 (zero commission) |

| Forex Trading | 1 pip per trade |

| Withdrawal Fees | $5 per withdrawal |

| Inactivity Fee | $10 per month (after 12 months of inactivity) |

How Does eToro Compare to Other Platforms?

| Platform | Crypto Trading Fees | Stock Trading Fees |

|---|---|---|

| eToro | 1% per trade | $0 commission |

| Binance | 0.1% per trade | Not available |

| Coinbase | 1.49% per trade | Not available |

While eToro’s crypto fees are higher than Binance, its zero-commission stock trading makes it an excellent choice for stock investors.

6. Pros and Cons of eToro

Pros:

✅ Multi-Asset Platform – Trade crypto, stocks, ETFs, forex, and commodities.

✅ Social Trading & Copy Trading – Follow and copy professional traders.

✅ Regulated and Secure – Fully compliant with financial authorities.

✅ Zero-Commission Stock Trading – Buy real stocks without paying fees.

✅ User-Friendly Interface – Designed for beginners and experienced traders.

Cons:

❌ Higher Crypto Trading Fees – 1% per trade (higher than Binance).

❌ Limited Crypto Selection – Only 80+ cryptos (Binance has 350+).

❌ Withdrawal Fees – $5 per withdrawal.

❌ Not Available in All Countries – Some regions have restrictions.

Final Verdict: Should You Use eToro?

eToro is one of the best platforms for multi-asset trading, offering stocks, crypto, forex, and commodities in one place.

✔ If you want a regulated platform with stock and crypto trading, choose eToro.

✔ If you want the lowest crypto trading fees, choose Binance.

✔ If you want the safest and most regulated crypto exchange, choose coinbase or Kraken.