Introduction

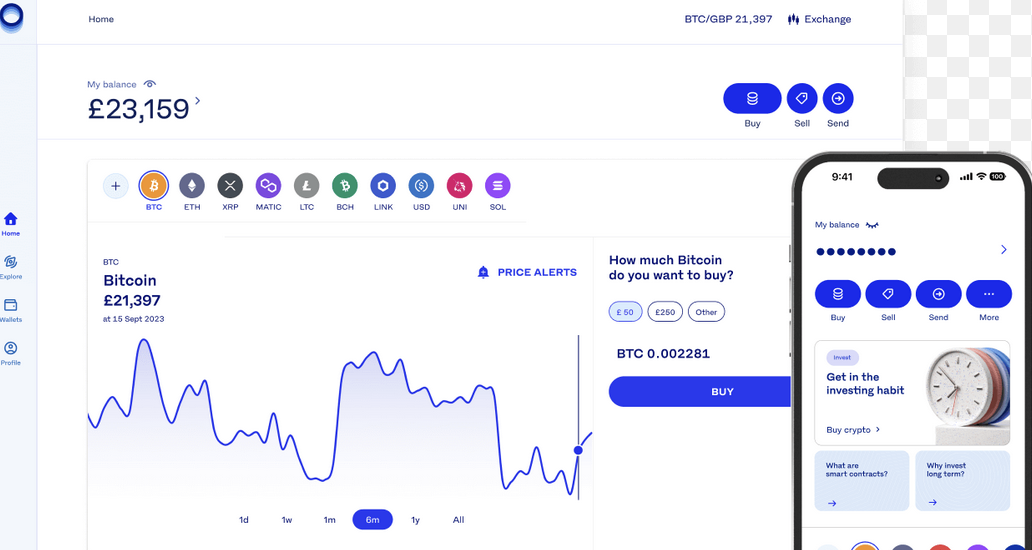

Luno is a user-friendly cryptocurrency exchange, known for its simple interface, strong security, and focus on emerging markets like Africa, Asia, and Latin America. Founded in 2013, Luno has grown to serve over 10 million users in 40+ countries, making it a popular choice for beginners entering the crypto space.

Unlike Binance or Bybit, which cater to advanced traders with futures and margin trading, Luno is designed for beginners who want an easy way to buy, sell, and store cryptocurrencies. It supports fiat-to-crypto transactions in several local currencies, making it one of the best exchanges for users in regions where crypto adoption is growing.

What This Review Covers

✔ Key Features – What makes Luno unique?

✔ Security and Regulation – Is Luno safe?

✔ Trading Options – What assets can you trade?

✔ Fees and Costs – Is Luno affordable?

✔ User Experience – Is Luno easy to use?

✔ Pros and Cons – Strengths and weaknesses of Luno.

✔ Comparison with Binance, Kraken, and Coinbase – Which platform is better?

By the end of this review, you’ll know if Luno is the right crypto exchange for you.

1. What is Luno? A Brief Overview

Luno is a cryptocurrency exchange and wallet provider that allows users to buy, sell, and store crypto assets easily. It was originally founded in South Africa and the UK in 2013 but has since expanded to serve users in Africa, Asia, and South America.

Unlike Kraken or Bybit, which focus on high-volume traders, Luno is built for beginners who want a safe and simple way to start investing in crypto.

Why is Luno Popular?

✅ Beginner-Friendly – Simple and intuitive interface.

✅ Supports Local Currencies – Allows users to buy crypto using local fiat currencies.

✅ Secure and Regulated – Complies with financial laws in multiple countries.

✅ Luno Savings – Earn interest on Bitcoin (BTC) deposits.

✅ Mobile-First Approach – Designed for easy access on smartphones.

With over 10 million users and strong regulatory compliance, Luno is one of the best exchanges for first-time crypto investors.

2. Luno Security and Regulation: Is It Safe?

Security Features

Luno has implemented strong security measures to protect user funds.

✔ Cold Storage Wallets – 95% of funds are stored offline to prevent hacks.

✔ Two-Factor Authentication (2FA) – Users must verify logins and withdrawals.

✔ Multi-Signature Wallets – Enhances transaction security.

✔ KYC Verification – Mandatory identity verification to prevent fraud.

✔ Real-Time Fraud Monitoring – AI-based risk detection for suspicious activity.

Unlike Binance (hacked in 2019 for $40M) or Coinbase (multiple account breaches in 2021), Luno has never suffered a major hack, making it one of the safest exchanges for beginners.

Regulatory Compliance

Luno is a licensed and regulated exchange in multiple countries, making it a trusted option for fiat-to-crypto transactions.

✔ Registered with the FCA (UK) – Compliant with UK financial regulations.

✔ Licensed in Malaysia, South Africa, Indonesia, and Nigeria.

✔ Follows AML (Anti-Money Laundering) and KYC (Know Your Customer) regulations.

Unlike Bybit or OKX, which operate without full regulation in some countries, Luno is a legally compliant platform, making it a safe choice for long-term investors.

3. Luno Trading Options: What Can You Trade?

Luno offers a limited selection of cryptocurrencies but focuses on high-quality, widely used assets.

Cryptocurrencies Available on Luno

✔ Bitcoin (BTC)

✔ Ethereum (ETH)

✔ Ripple (XRP)

✔ Litecoin (LTC)

✔ Bitcoin Cash (BCH)

✔ USD Coin (USDC)

While Binance and Bybit offer 350+ cryptocurrencies, Luno only supports 10-15 major assets, making it less attractive for altcoin traders but ideal for beginners.

Fiat Currency Support

One of Luno’s biggest advantages is that it supports multiple local currencies, allowing users to buy crypto directly using fiat.

✔ South African Rand (ZAR)

✔ Nigerian Naira (NGN)

✔ Malaysian Ringgit (MYR)

✔ Euro (EUR)

✔ Indonesian Rupiah (IDR)

Unlike Kraken or Bybit, which primarily cater to USD and EUR deposits, Luno is one of the best exchanges for users in emerging markets.

4. Luno Savings: Earn Interest on Bitcoin

Luno allows users to earn passive income by depositing Bitcoin (BTC) into Luno Savings.

✔ Up to 4% APY on Bitcoin deposits.

✔ No lock-up period – Withdraw anytime.

✔ Secure & Insured – Funds are protected by Luno’s security policies.

While Binance and Crypto.com offer more staking options, Luno’s Bitcoin savings feature is a great option for long-term BTC holders.

5. Luno Fees: Is It Affordable?

Luno uses a tiered fee structure, rewarding high-volume traders with lower fees.

Trading Fees

| 30-Day Trading Volume | Maker Fee | Taker Fee |

|---|---|---|

| $0 – $10,000 | 0.10% | 0.50% |

| $10,000 – $50,000 | 0.08% | 0.45% |

| $50,000 – $100,000 | 0.05% | 0.40% |

✔ Higher fees for small traders but lower for high-volume traders.

✔ Zero deposit fees for most fiat methods.

✔ Withdrawal fees vary by country and currency.

How Does Luno Compare to Other Platforms?

| Exchange | Spot Trading Fees | Futures Trading Fees |

|---|---|---|

| Luno | 0.10% – 0.50% | ❌ No Futures |

| Binance | 0.10% | 0.02% – 0.04% |

| Kraken | 0.16% – 0.26% | 0.02% – 0.05% |

| Coinbase | 1.49% | ❌ No Futures |

Luno’s fees are higher than Binance but lower than Coinbase, making it a mid-range option for casual traders.

6. Pros and Cons of Luno

Pros:

✅ Beginner-Friendly Interface – Simple and easy to use.

✅ Supports Local Currencies – ZAR, NGN, MYR, EUR, IDR.

✅ Regulated & Secure – Fully licensed in multiple countries.

✅ Luno Savings – Earn passive income on Bitcoin.

✅ Strong Security Measures – No history of major hacks.

Cons:

❌ Limited Crypto Selection – Only 10-15 cryptocurrencies available.

❌ Higher Trading Fees for Small Traders – 0.50% taker fee for low-volume users.

❌ No Futures or Margin Trading – Not ideal for advanced traders.

❌ Not Available in the U.S. – U.S. users must use alternatives like Coinbase or Kraken.

7. Luno vs. Binance vs. Kraken vs. Coinbase

| Feature | Luno | Binance | Kraken | Coinbase |

|---|---|---|---|---|

| Best For | Beginners & Emerging Markets | Low Fees & Altcoins | Advanced Trading | U.S. Users |

| Crypto Selection | 10+ | 350+ | 200+ | 250+ |

| Trading Fees | 0.10% – 0.50% | 0.10% | 0.16% – 0.26% | 1.49% |

| Regulation | ✅ Yes | ❌ No | ✅ Yes | ✅ Yes |

| Futures Trading | ❌ No | ✅ Yes | ✅ Yes | ❌ No |

Luno is best for beginners and emerging market users, while Binance and Kraken are better for advanced traders.

Final Verdict: Is Luno Worth Using?

Luno is a great exchange for beginners and users in emerging markets, offering:

✔ A simple, beginner-friendly platform.

✔ Strong security and regulatory compliance.

✔ Local fiat currency support.

However, for advanced traders, Binance or Kraken might be better choices.