Disclaimer: This article (best crypto to buy now) is for informational purposes only and is not financial advice. Cryptocurrency investments are risky and volatile. Always do your own research (DYOR) and consult a financial advisor before investing. Invest responsibly.

Introduction

The world of cryptocurrency has evolved far beyond Bitcoin, transforming from a niche digital currency into a multi-trillion-dollar ecosystem filled with innovative projects. While Bitcoin remains the most recognized name in the industry, many new and emerging cryptocurrencies are making waves with unique technologies, real-world applications, and impressive growth potential. These projects are not just about digital payments—they’re reshaping finance, gaming, data storage, the metaverse, and even global supply chains.

As of 2025, the crypto market is more dynamic than ever, driven by advancements in blockchain scalability, decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 technologies. Whether you’re a seasoned investor or new to the crypto space, identifying the right cryptocurrencies to invest in can be overwhelming with thousands of options available.

In this guide, we’ll explore the top 10 best cryptocurrencies to buy right now, excluding Bitcoin. These projects were selected based on factors like:

- Technological innovation

- Market performance and trading volume

- Adoption rates and ecosystem growth

- Real-world use cases and future potential

Each cryptocurrency is reviewed in detail, covering its current price, historical performance, trading volume, and recent developments. We’ve also included pros and cons tables to help you make informed investment decisions.

Whether you’re looking for the next big Layer 1 blockchain like Ethereum or Solana, or emerging stars like Aptos and Render Token, this article will guide you through the best opportunities in the crypto space for 2025

Top 10 Best Crypto to Buy Now in 2025

| Logo | Cryptocurrency | Ticker | Current Price (Feb 2025) | All-Time High (ATH) | Market Cap | Key Features |

|---|---|---|---|---|---|---|

|

Ethereum | ETH | $2,495.76 | $4,878.26 (Nov 2021) | $300B+ | Smart Contracts, DeFi, NFTs |

|

Solana | SOL | $195.38 | $260.06 (Nov 2021) | $75B+ | Ultra-Fast TPS, Low Fees, DeFi & NFTs |

|

Polkadot | DOT | $4.35 | $55.13 (Nov 2021) | $5B+ | Cross-Chain Interoperability, Parachains |

|

Avalanche | AVAX | $23.87 | $146.22 (Nov 2021) | $8B+ | High TPS, Low Fees, Custom Subnets |

|

Chainlink | LINK | $17.93 | $52.88 (May 2021) | $9B+ | Decentralized Oracles, Real-World Data |

|

Arbitrum | ARB | $0.4069 | $1.70 (2023) | $2B+ | Layer 2 Scaling, Low Gas Fees |

|

Optimism | OP | $0.9880 | $3.22 (2023) | $1.5B+ | Ethereum Layer 2, Fast Transactions |

|

Aptos | APT | $5.42 | $19.92 (2023) | $3B+ | High TPS, Move Language, Secure Smart Contracts |

|

Render Token | RNDR | $4.14 | $13.61 (Mar 2024) | $1B+ | Decentralized GPU Rendering, Metaverse |

|

The Graph | GRT | $0.1242 | $2.88 (Feb 2021) | $1.2B+ | Blockchain Data Indexing, Web3 Infrastructure |

1. Ethereum (ETH)

Overview:

Ethereum stands as the second-largest cryptocurrency by market capitalization and is renowned for its pioneering smart contract functionality. Launched in 2015 by Vitalik Buterin, Ethereum has evolved into a robust platform supporting a vast array of decentralized applications (dApps), decentralized finance (DeFi) protocols, and non-fungible tokens (NFTs).

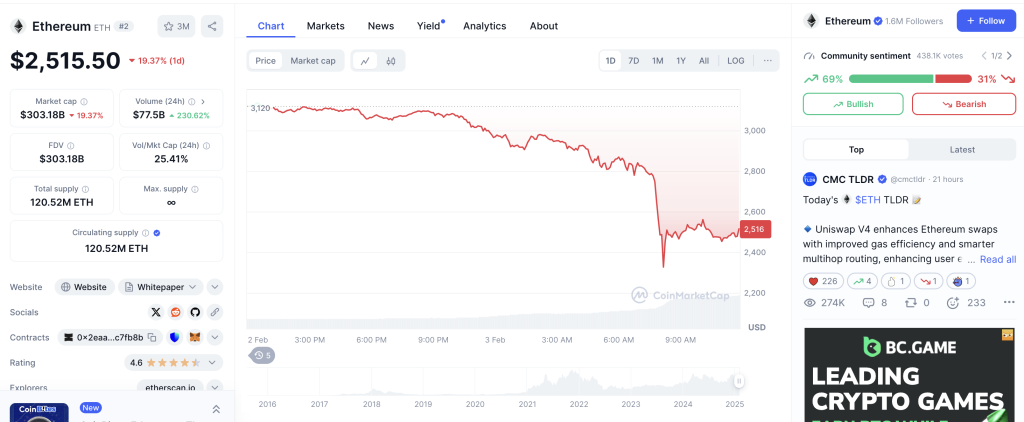

Market Performance:

As of February 3, 2025, Ethereum is trading at approximately $2,495.76, reflecting a recent decline influenced by broader market trends and geopolitical factors. Despite this, Ethereum’s extensive adoption and continuous development efforts position it as a resilient asset in the crypto space.

Investment Potential:

Ethereum’s versatility and widespread adoption make it a compelling investment. Its role as the backbone for DeFi and NFTs, coupled with ongoing upgrades aimed at improving scalability and reducing transaction costs, suggests a promising outlook.

Pros and Cons of Ethereum:

| Pros | Cons |

|---|---|

| Leading smart contract platform | Historically high gas fees |

| Strong developer and user community | Faces competition from newer blockchains |

| Successful transition to PoS | Scalability improvements still ongoing |

| Wide range of applications | Regulatory uncertainties |

2. Solana (SOL)

Overview:

Solana is a high-performance blockchain known for its impressive transaction speeds and low fees. Launched in 2020, Solana has quickly gained traction as a platform for DeFi applications, NFTs, and decentralized exchanges (DEXs), thanks to its ability to process over 65,000 transactions per second (TPS).

Market Performance:

As of February 3, 2025, Solana is trading at approximately $195.38, reflecting a 7.48% decrease from the previous close. The day’s trading range has seen a high of $215.27 and a low of $181.14.

Investment Potential:

Solana’s rapid transaction capabilities and expanding ecosystem make it a compelling option for investors seeking exposure to high-performance blockchain platforms. The network’s ability to attract high-profile projects and substantial capital inflows suggests a robust and growing ecosystem.

Pros and Cons of Solana:

| Pros | Cons |

|---|---|

| Ultra-fast transaction speeds | Occasional network stability issues |

| Low transaction fees | Concerns about decentralization |

| Growing ecosystem with diverse applications | Faces competition from other Layer 1 blockchains |

| Significant institutional interest | Regulatory uncertainties |

3. Polkadot (DOT)

Overview:

Polkadot is a next-generation blockchain protocol designed to connect multiple specialized blockchains into a unified network. Founded by Dr. Gavin Wood, co-founder of Ethereum, Polkadot aims to facilitate cross-chain transfers of any data or asset types, enhancing interoperability across various blockchains.

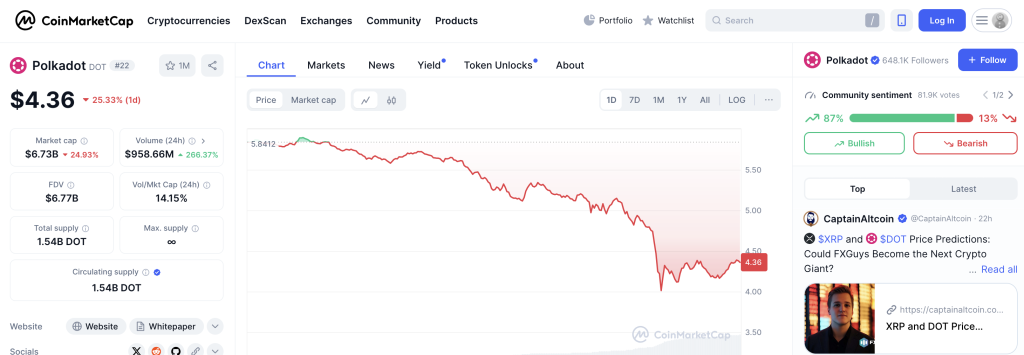

Market Performance:

As of February 3, 2025, Polkadot (DOT) is trading at approximately $4.35, experiencing a slight decrease of 0.25% from the previous close. The day’s trading range has seen a high of $5.90 and a low of $4.10. Over the past week, DOT has faced a decline of approximately 26.70%, underperforming compared to the broader cryptocurrency market.

Investment Potential:

Polkadot’s unique architecture, which includes the relay chain and parachains, offers scalability and flexibility, making it a promising platform for various decentralized applications. Its focus on interoperability positions it well to play a crucial role in the evolving blockchain ecosystem. However, investors should be mindful of its price volatility and the competitive landscape of blockchain platforms.

Pros and Cons of Polkadot:

| Pros | Cons |

|---|---|

| Facilitates cross-chain interoperability | Complex governance model |

| Scalable through parachain architecture | Competitive parachain slot auctions |

| Strong development team and community | Faces competition from other Layer 1 blockchains |

| Energy-efficient consensus mechanism | Price volatility in bear markets |

4. Avalanche (AVAX)

Overview:

Avalanche is an open-source platform designed for launching decentralized applications (dApps) and custom blockchain networks. It aims to deliver high throughput, low latency, and scalability without compromising decentralization. Avalanche’s unique consensus mechanism allows it to process thousands of transactions per second, making it a strong competitor to Ethereum and other Layer 1 blockchains.

Key Features:

- High Scalability: Supports over 4,500 transactions per second (TPS) with near-instant finality.

- Customizable Subnets: Allows developers to create tailor-made blockchains for specific use cases.

- Low Fees: Transactions on Avalanche are fast and cost-effective, making it ideal for DeFi applications.

- Eco-Friendly: Uses a Proof of Stake (PoS) mechanism, significantly reducing energy consumption compared to Proof of Work (PoW) systems.

Market Performance:

As of February 3, 2025, Avalanche (AVAX) is trading at approximately $23.87, reflecting a 23.54% decrease from the previous close. The trading range for the day has been between $31.54 (high) and $22.66 (low). Despite recent market fluctuations, Avalanche maintains strong trading volume, indicating continued investor interest.

Historical Price Movement:

Avalanche reached an all-time high of around $146.22 in November 2021. Since then, it has experienced significant volatility, with price corrections influenced by broader market trends. The current price reflects a substantial discount from its peak, potentially offering attractive entry points for long-term investors.

Investment Potential:

Avalanche’s fast-growing DeFi ecosystem, coupled with its innovative subnet technology, positions it as one of the most promising Layer 1 platforms. Its ability to scale without compromising security or decentralization makes it an attractive option for developers and enterprises. As the crypto ecosystem evolves, Avalanche’s adaptability and performance could drive substantial growth.

Pros and Cons of Avalanche:

| Pros | Cons |

|---|---|

| High throughput and fast transaction finality | Smaller ecosystem compared to Ethereum |

| Low transaction fees | Complex subnet architecture for beginners |

| Strong DeFi adoption and institutional interest | Faces stiff competition from Solana, Polkadot, and Ethereum |

| Eco-friendly PoS consensus mechanism | Occasional network congestion during peak usage |

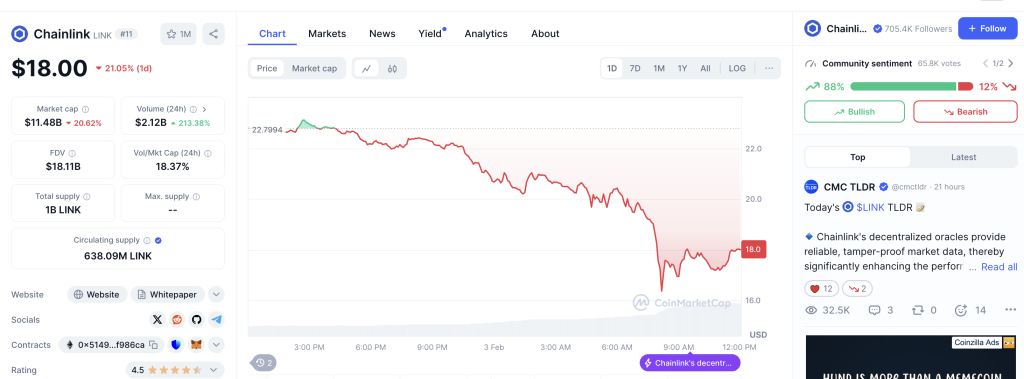

5. Chainlink (LINK)

Overview:

Chainlink is a decentralized oracle network that connects smart contracts with real-world data, enabling blockchain applications to interact with external systems securely. It plays a crucial role in the DeFi ecosystem by providing reliable data feeds for various financial products.

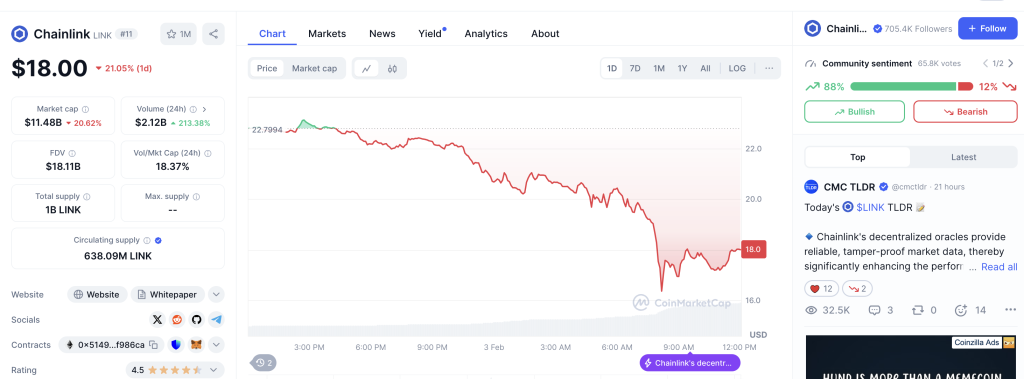

Market Performance:

As of February 3, 2025, Chainlink (LINK) is trading at approximately $17.93, reflecting a decrease of 21.33% from the previous close. The day’s trading range has seen a high of $23.10 and a low of $16.47.

Historical Price Movement:

Chainlink reached its all-time high of $52.88 on May 10, 2021. Since then, it has experienced significant volatility, with notable declines during market downturns. The current price reflects a substantial decrease from its peak, indicating potential opportunities for investors considering entry points.

Investment Potential:

Chainlink’s essential role in connecting smart contracts to real-world data makes it a cornerstone of the DeFi ecosystem. Its extensive network of data providers and consumers creates a strong network effect, enhancing its value proposition. As the demand for decentralized applications grows, Chainlink’s services are likely to remain in high demand.

Pros and Cons of Chainlink:

| Pros | Cons |

|---|---|

| Essential for DeFi and smart contracts | Dependent on the growth of DeFi sector |

| Strong partnerships with major institutions | Complex technology for new investors |

| Reliable, secure data feeds | Faces competition from other oracle projects |

| Expanding beyond blockchain into traditional finance | Price can stagnate in bear markets |

6. Arbitrum (ARB)

Overview:

Arbitrum is a Layer 2 scaling solution for Ethereum that improves transaction speed and reduces costs while maintaining Ethereum’s security. It uses optimistic rollups to bundle transactions off-chain before settling them on-chain.

Market Performance:

As of February 3, 2025, Arbitrum (ARB) is trading at approximately $0.4069, reflecting a decrease of 29.05% from the previous close. The day’s trading range has seen a high of $0.5776 and a low of $0.3781.

Historical Price Movement:

Arbitrum’s token has experienced significant volatility since its launch, with price movements influenced by broader market trends and developments within the Ethereum ecosystem. The current price reflects a substantial decrease from its initial trading levels, which may present opportunities for investors considering long-term positions.

Investment Potential:

As Ethereum faces scalability challenges, Arbitrum’s role as a Layer 2 solution is critical. Its low fees and fast transactions make it a preferred choice for developers and users alike. The growing adoption of Arbitrum by major DeFi platforms underscores its potential for sustained growth.

Pros and Cons of Arbitrum:

| Pros | Cons |

|---|---|

| Reduces Ethereum gas fees significantly | Heavy reliance on Ethereum ecosystem |

| Fast transactions with low costs | Faces competition from other Layer 2 solutions |

| Strong DeFi adoption | Limited interoperability beyond Ethereum |

| Continuous upgrades and active community | Potential regulatory risks for DeFi apps |

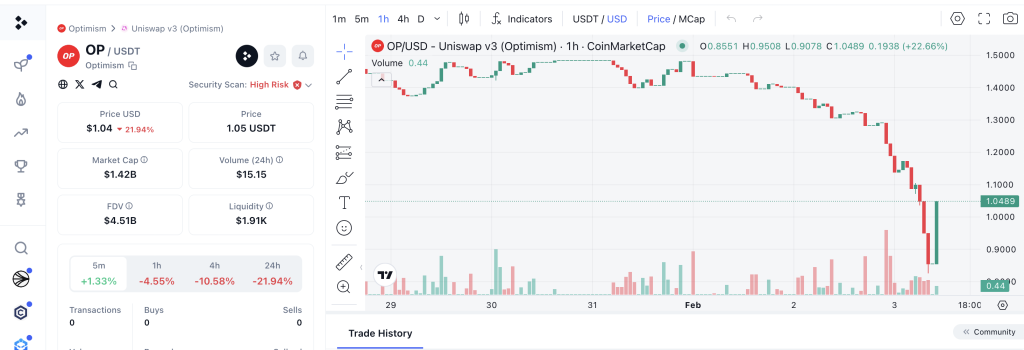

7. Optimism (OP)

Overview:

Optimism is another Layer 2 scaling solution for Ethereum, designed to improve transaction speeds and reduce costs using optimistic rollups. It focuses on simplicity and ease of development for Ethereum-based dApps.

Market Performance:

As of February 3, 2025, Optimism (OP) is trading at approximately $0.9880, reflecting a decrease of 25.15% from the previous close. The day’s trading range has seen a high of $1.34 and a low of $0.8489.

Historical Price Movement:

Optimism’s token has shown volatility since its introduction, with price fluctuations influenced by market dynamics and the adoption rate of its scaling solutions. The current price represents a decline from previous highs, which may offer entry points for investors with a long-term perspective.

Investment Potential:

Optimism’s ability to enhance Ethereum’s performance while maintaining security makes it a solid investment. Its community-driven governance model adds to its long-term sustainability. As more dApps seek scalable solutions, Optimism is well-positioned to capture a significant share of the market.

Pros and Cons of Optimism:

| Pros | Cons |

|---|---|

| Low transaction fees | Competition from other Layer 2 solutions |

| Strong integration with Ethereum | Still early in adoption curve |

| Growing DeFi ecosystem | Limited cross-chain capabilities |

| Eco-friendly scaling solution | Vulnerable to regulatory changes |

8. Aptos (APT)

Overview:

Aptos is a next-generation Layer 1 blockchain designed for scalability, security, and reliability. It was created by former Meta (Facebook) employees who worked on the Diem blockchain project. Aptos leverages a new smart contract programming language called Move, which offers enhanced safety and performance features. This blockchain aims to solve common issues faced by earlier Layer 1 networks, such as congestion, high fees, and slow transaction speeds.

Key Features:

- Move Programming Language: Designed for secure, efficient smart contract execution.

- High Throughput: Capable of processing over 150,000 transactions per second (TPS) using parallel execution, making it one of the fastest blockchains to date.

- Low Latency: Transactions achieve sub-second finality, crucial for real-time applications like gaming and financial services.

- Strong Security: Implements advanced cryptographic techniques and an efficient consensus mechanism for enhanced security.

Market Performance:

As of February 3, 2025, Aptos (APT) is trading at approximately $5.42, reflecting a 22.57% decrease from the previous close. The day’s trading range has seen a high of $7.09 and a low of $4.96. Over the past week, APT has experienced a downward trend, which aligns with broader market corrections affecting the crypto space.

Historical Price Movement:

Aptos launched its mainnet in late 2022, and its token saw an initial surge due to hype around its advanced technology and strong backing from venture capital firms. The all-time high was around $19.92, reached in early 2023 during a bullish market phase. Since then, like many altcoins, APT has faced significant volatility, influenced by macroeconomic factors and fluctuations in investor sentiment.

Investment Potential:

Aptos’s cutting-edge technology, particularly its use of the Move language, positions it as a strong contender in the Layer 1 blockchain space. Its high throughput and scalability make it suitable for a wide range of applications, from DeFi and NFTs to real-time gaming. As blockchain adoption grows, Aptos’s performance-oriented infrastructure could attract both developers and investors.

However, it faces stiff competition from other Layer 1 projects like Solana, Avalanche, and Ethereum 2.0. Additionally, as a relatively new project, its long-term sustainability will depend on continued ecosystem development and real-world adoption.

Pros and Cons of Aptos:

| Pros | Cons |

|---|---|

| High transaction speed and scalability | New project with limited track record |

| Innovative Move programming language | Faces competition from Solana and NEAR |

| Strong development team from Meta | Adoption still in early stages |

| Growing ecosystem in DeFi and NFTs | Market volatility risks |

9. Render Token (RNDR)

Overview:

Render Token is a decentralized GPU rendering network built on the Ethereum blockchain. It connects artists and studios in need of GPU computing power with mining partners willing to rent their GPU capabilities. This network facilitates the rendering of complex graphics for applications such as 3D models, visual effects, and virtual reality.

Market Performance:

As of February 3, 2025, Render Token (RNDR) is trading at approximately $4.14, reflecting a decrease of 22.33% from the previous close. The day’s trading range has seen a high of $5.36 and a low of $3.60. Over the past week, RNDR has declined by about 37%, underperforming the global cryptocurrency market.

Historical Price Movement:

Render Token reached its all-time high of $13.61 on March 17, 2024. Since then, it has experienced significant volatility, with notable declines during market downturns. The current price reflects a substantial decrease from its peak, indicating potential opportunities for investors considering entry points.

Investment Potential:

Render Token’s unique use case in decentralized GPU rendering positions it well in industries requiring high-performance graphics processing, such as gaming, virtual reality, and artificial intelligence. As demand for these technologies grows, RNDR could see increased adoption. However, investors should be mindful of its niche market and the inherent volatility of the cryptocurrency space.

Pros and Cons of Render Token:

| Pros | Cons |

|---|---|

| Unique use case in 3D rendering | Niche market may limit adoption |

| Strong partnerships in creative industries | Dependent on growth of VR/AR sectors |

| Real-world applications beyond crypto | Not as mainstream as DeFi tokens |

| Growing demand in AI and metaverse | Price volatility |

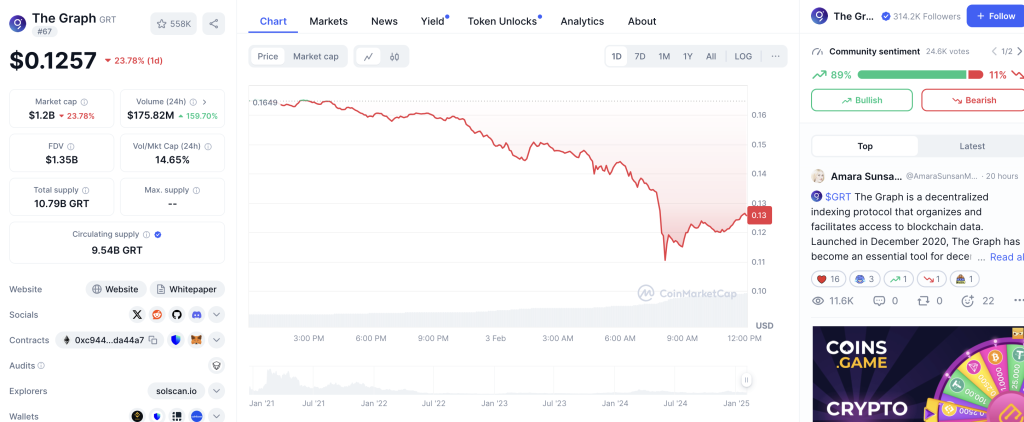

10. The Graph (GRT)

Overview:

The Graph is a decentralized protocol for indexing and querying blockchain data. It allows developers to efficiently access data from various blockchains, enabling the creation of decentralized applications (dApps) with improved performance. The Graph supports networks like Ethereum and IPFS, making it a critical component of the Web3 ecosystem.

Market Performance:

As of February 3, 2025, The Graph (GRT) is trading at approximately $0.1242, reflecting a decrease of 24.83% from the previous close. The day’s trading range has seen a high of $0.1657 and a low of $0.1132. Over the past week, GRT has declined by about 18.37%, underperforming the global cryptocurrency market.

Historical Price Movement:

The Graph reached its all-time high of $2.88 on February 12, 2021. Since then, it has experienced significant volatility, with notable declines during market downturns. The current price reflects a substantial decrease from its peak, indicating potential opportunities for investors considering entry points.

Investment Potential:

As the backbone of Web3 data infrastructure, The Graph’s demand will increase as more dApps require efficient data querying solutions. Its role in enabling decentralized applications across various blockchains positions it as a valuable asset in the evolving crypto landscape. However, investors should be aware of its price volatility and the competitive environment within the blockchain indexing sector.

Pros and Cons of The Graph:

| Pros | Cons |

|---|---|

| Essential infrastructure for Web3 | Less hype compared to other altcoins |

| Supports multiple blockchains | Complexity for new users |

| Strong developer community | Dependent on growth of dApps |

| Critical role in DeFi data indexing | Price sensitivity to market trends |

Things to Consider Before Investing in Crypto

Investing in cryptocurrency can be highly rewarding, but it comes with significant risks due to the market’s volatility and evolving regulations. Whether you’re a beginner or an experienced investor, here are the key factors to consider before diving into the crypto world:

🚀 1. Volatility and Market Risks

Cryptocurrencies are known for extreme price fluctuations. A coin’s value can surge or crash within hours due to market sentiment, regulatory news, or technological developments.

- Tip: Only invest money you can afford to lose.

🔐 2. Security of Your Assets

Unlike traditional banks, cryptocurrencies rely on self-custody. If you lose your private keys, your assets could be gone forever.

- Use: Hardware wallets for long-term storage and strong, unique passwords for online platforms.

- Enable: Two-factor authentication (2FA) for added security.

🌐 3. Regulation and Legal Compliance

Crypto regulations vary by country and can impact the legality, taxation, and accessibility of certain assets.

- Research: Local crypto laws and potential tax implications before investing.

📈 4. Fundamental and Technical Analysis

Understanding the project’s fundamentals is key:

- Whitepaper: Check the project’s purpose, technology, and roadmap.

- Team: Look for experienced developers and transparent leadership.

- Market Data: Analyze historical price trends, trading volume, and market cap.

💼 5. Diversification

Avoid putting all your funds into a single cryptocurrency. Diversifying reduces the risk of significant losses.

- Consider: A mix of established coins (like Ethereum or Solana) and promising new projects.

⏱️ 6. Investment Horizon (Long-Term vs. Short-Term)

- Long-Term (HODLing): Beneficial for projects with strong fundamentals.

- Short-Term Trading: Requires constant market monitoring and technical analysis.

💰 7. Liquidity

Before investing, check if the cryptocurrency has high trading volume. Low-liquidity coins can be hard to sell quickly without impacting the price.

🤔 8. Utility and Real-World Use Cases

Does the coin solve a real problem or is it just speculative? Cryptos with strong use cases, like powering dApps, DeFi platforms, or NFT ecosystems, often have better long-term prospects.

📢 9. Community and Ecosystem Support

Active communities and developer ecosystems often indicate strong project health. Look for:

- Regular updates

- Partnerships

- Developer activity on platforms like GitHub

⚠️ 10. Beware of Scams and Rug Pulls

The crypto space is ripe with scams. Be cautious of:

- Guaranteed returns

- Unverified projects

- Pump-and-dump schemes

Conclusion: Best Crypto to Buy Now

As the cryptocurrency landscape continues to evolve, investing in digital assets offers both exciting opportunities and inherent risks. While Bitcoin remains the face of crypto, there’s a whole world of innovative projects beyond it—each with unique technologies, real-world applications, and growth potential.

In this guide, we’ve explored the top 10 best cryptocurrencies to buy now in 2025, including Ethereum, Solana, Avalanche, Chainlink, Aptos, and more. These projects are not just speculative assets; they’re at the forefront of decentralized finance (DeFi), Web3, NFTs, and the future of the digital economy.

However, remember that there’s no “one-size-fits-all” investment in crypto. What works for one investor might not work for another. Before making any decisions:

- Do Your Own Research (DYOR)

- Consider your risk tolerance and investment goals

- Diversify your portfolio to manage risks effectively

The crypto market can be volatile, but with the right strategy, knowledge, and patience, it offers immense potential for long-term growth. Whether you’re a seasoned investor or just starting your journey, always invest wisely and stay updated with the latest market trends.