Cryptocurrency trading has gained significant traction in the UK, with investors looking for secure and reliable platforms to buy, sell, and trade digital assets. However, with numerous exchanges available, choosing the best crypto exchange in the UK can be overwhelming.

In this guide, we will explore the top cryptocurrency exchanges in the UK, comparing their features, fees, security measures, and user-friendliness to help you make an informed decision.

Key Factors to Consider When Choosing a Crypto Exchange in the UK

Before selecting a crypto exchange, it’s crucial to evaluate key aspects that impact your trading experience:

✅ Regulation and Security

A trustworthy exchange should be regulated by the Financial Conduct Authority (FCA) in the UK. Look for platforms with strong security features such as two-factor authentication (2FA), cold storage, and insurance against breaches.

✅ Supported Cryptocurrencies

Some exchanges offer a wide range of cryptocurrencies, while others focus on Bitcoin and major altcoins. If you want access to Ethereum (ETH), Solana (SOL), or niche tokens, choose an exchange with an extensive asset selection.

✅ Fees and Trading Costs

Exchange fees vary significantly. Consider:

- Trading fees (maker/taker fees)

- Deposit and withdrawal fees

- Hidden charges

A platform with low fees can save you money in the long run.

✅ User Experience and Customer Support

A seamless and user-friendly interface is essential, whether you’re a beginner or an experienced trader. Also, check if the platform provides 24/7 customer support for assistance when needed.

✅ Payment Methods

Look for exchanges that accept bank transfers, debit/credit cards, and PayPal for easy fiat-to-crypto transactions.

Top 10 Best Crypto Exchanges in the UK

To help you choose the best crypto exchange in the UK, here’s a detailed comparison table covering the key features, fees, security, and best use cases of each platform.

| Exchange | Best For | FCA Regulated? | Trading Fees | Cryptos Supported | Deposit Methods | Security Features |

|---|---|---|---|---|---|---|

| Binance | Low fees & pro trading | ❌ No (Limited UK support) | 0.1% (lower with BNB) | 350+ | Bank transfer, P2P, Crypto | SAFU fund, 2FA, cold storage |

| Coinbase | Beginners & security | ✅ Yes | 1.49% | 100+ | Bank transfer, Debit/Credit Card, PayPal | 98% cold storage, insured funds |

| Kraken | Security & staking | ✅ Yes | 0%–0.26% | 200+ | Bank transfer, Crypto | FCA-compliant, Proof of Reserves, 2FA |

| eToro | Social & copy trading | ✅ Yes | 1% | 70+ | Bank transfer, PayPal, Debit/Credit Card | FCA-regulated, insured funds |

| Bitstamp | Institutional investors | ✅ Yes | 0.5% (lower for high volume) | 85+ | Bank transfer, Debit/Credit Card | FCA-regulated, cold storage |

| OKX | Futures & derivatives | ❌ No (Still accessible in UK) | 0.08%–0.1% | 300+ | Bank transfer, Crypto | Cold storage, 2FA, security audits |

| Crypto.com | Crypto rewards & cashback | ✅ Yes | 0.075% | 250+ | Bank transfer, Debit/Credit Card | Cold storage, insurance, 2FA |

| Bitpanda | Multi-asset trading | ✅ Yes | 1.49% | 100+ (plus stocks, ETFs, metals) | Bank transfer, PayPal, Card | FCA-compliant, cold storage |

| Bybit | Leverage & margin trading | ❌ No (Still available in UK) | 0.1% | 100+ | Crypto deposits, P2P | Cold storage, 2FA, fund insurance |

| Luno | Simplicity & long-term investors | ✅ Yes | 0.1%–0.75% | 40+ | Bank transfer, Debit/Credit Card | FCA-regulated, strong encryption |

1. Binance – Best for Low Fees & Advanced Trading

Overview

Binance is the world’s largest cryptocurrency exchange by trading volume, known for its low fees, extensive range of cryptocurrencies, and advanced trading tools. It caters to both beginners and professional traders, offering everything from spot trading and futures to staking and NFT marketplaces.

Despite facing some regulatory challenges in the UK, Binance remains accessible to UK users through its Binance Global platform, though with limited GBP deposit and withdrawal options.

Key Features of Binance

🔹 Extensive Cryptocurrency Selection

Binance supports over 350 cryptocurrencies, including:

- Major assets: Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, Cardano (ADA).

- DeFi tokens: Uniswap (UNI), Chainlink (LINK), Aave (AAVE).

- Metaverse & NFT tokens: The Sandbox (SAND), Decentraland (MANA).

- Meme coins: Dogecoin (DOGE), Shiba Inu (SHIB).

If you want access to new and trending cryptocurrencies, Binance offers one of the most comprehensive selections.

🔹 Lowest Trading Fees in the Industry

Binance is known for its low trading fees, making it one of the cheapest exchanges for UK users.

- Spot trading fees: 0.1% per trade (can be reduced further with BNB tokens).

- Futures trading fees: 0.02% maker / 0.05% taker.

- Staking and savings: Earn up to 20% APY on selected cryptocurrencies.

- P2P trading: No trading fees (only spreads apply).

Additionally, Binance offers fee discounts if you:

✅ Hold and use Binance Coin (BNB) to pay for fees.

✅ Trade large volumes (VIP tier discounts).

For traders who make frequent transactions, Binance is the most cost-effective platform.

🔹 Advanced Trading Options for Professionals

Binance is not just for beginners—it is widely used by professional traders for:

✔ Margin Trading – Trade with up to 10x leverage on spot markets.

✔ Futures & Options Trading – Access high-leverage derivatives with 125x leverage.

✔ Algorithmic & API Trading – Ideal for institutional traders using trading bots.

✔ Liquidity Pools – Participate in Binance Liquid Swap for yield farming.

These tools make Binance one of the best crypto exchanges for day traders and investors looking for advanced trading strategies.

🔹 Binance Earn – Passive Income Opportunities

Not interested in trading? Binance provides ways to earn passive income:

- Staking: Lock up crypto to earn annual rewards (APY varies per coin).

- Savings Accounts: Flexible or fixed-term savings with interest on stablecoins.

- Liquidity Farming: Provide liquidity to pools and earn rewards.

- Auto-Invest: Dollar-cost averaging (DCA) feature for long-term investors.

If you want to grow your portfolio without trading, Binance offers one of the best earning platforms in the crypto space.

🔹 NFT Marketplace & Web3 Integration

Binance isn’t just an exchange—it’s a complete crypto ecosystem, including:

- NFT Marketplace: Buy and sell NFTs directly on Binance.

- Binance Smart Chain (BSC): A blockchain supporting DeFi, dApps, and smart contracts.

- Binance Pay: A payment system allowing crypto transactions with zero fees.

This makes Binance a great option if you want to trade beyond crypto and explore NFTs and DeFi.

Security & Regulation

🔹 Is Binance Safe to Use in the UK?

Binance has strong security measures in place, including:

✅ Two-Factor Authentication (2FA) – Protects user accounts.

✅ Cold Storage – Majority of funds stored offline.

✅ SAFU Fund (Secure Asset Fund for Users) – Insurance in case of hacks.

✅ Anti-Phishing & Withdrawal Whitelists – Extra security for withdrawals.

Although Binance faced FCA regulatory issues in the UK, users can still access Binance Global, though with limited GBP deposit options.

For UK users, Binance no longer offers direct GBP deposits/withdrawals via Faster Payments, but you can still use:

- Crypto deposits & withdrawals.

- P2P trading (buying crypto from other users).

Fees & Costs

| Fee Type | Binance Fees | Industry Average |

|---|---|---|

| Spot Trading | 0.1% (lower with BNB) | 0.5% – 1.5% |

| Futures Trading | 0.02% – 0.05% | 0.1% – 0.2% |

| Deposit Fees | Free for crypto | Varies for fiat |

| Withdrawal Fees | Varies by asset | Standard network fees |

Compared to Coinbase (1.49%) and eToro (1%), Binance is significantly cheaper for trading.

Pros & Cons of Binance

✅ Pros

✔ Lowest trading fees (0.1%) – cheaper than Coinbase & eToro.

✔ Largest crypto selection (350+ coins).

✔ Advanced trading features for professional traders.

✔ Strong security with cold storage & 2FA.

✔ Multiple passive income options (staking, savings, liquidity farming).

❌ Cons

❌ Not FCA-regulated (Limited GBP deposit options).

❌ Can be complex for beginners.

❌ Futures trading requires KYC & region-based restrictions.

Who Should Use Binance?

🔹 Best for low-fee traders – Binance has the lowest trading fees in the UK.

🔹 Best for advanced traders – Margin, futures, and options available.

🔹 Best for passive income – Earn from staking, savings, and liquidity farming.

🔹 Best for diverse crypto selection – 350+ cryptocurrencies available.

🚀 If you want the lowest fees and a professional-grade platform, Binance is the best exchange for you!

🔗 Sign Up for Binance

Final Verdict – Is Binance the Best Crypto Exchange in the UK?

⭐ Rating: 9.5/10

Binance remains one of the top choices for UK traders due to low fees, deep liquidity, and advanced trading tools. However, due to FCA regulations, some GBP deposit methods are limited.

If you are a beginner, Coinbase may be a better choice.

If you are a pro trader, Binance is the best choice for low fees and professional tools.

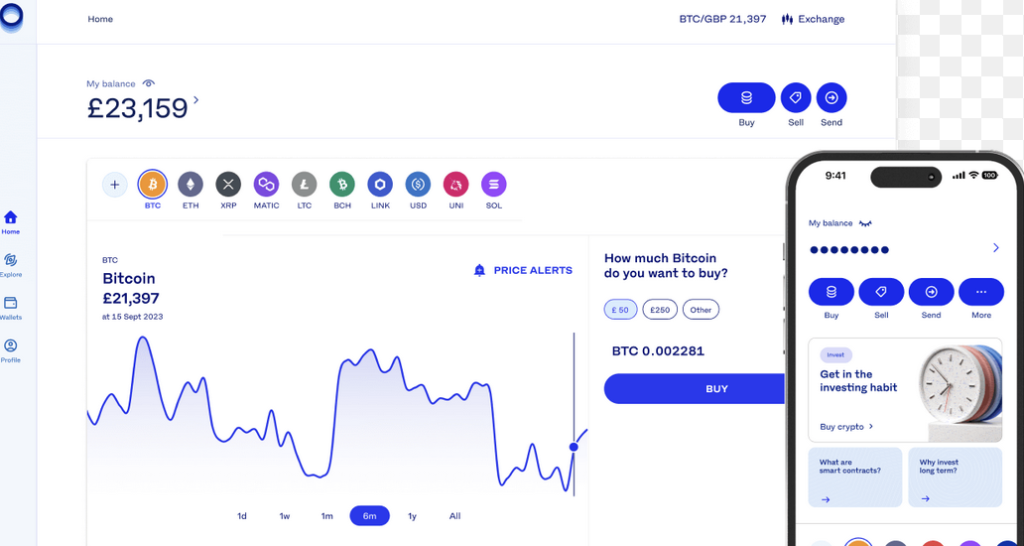

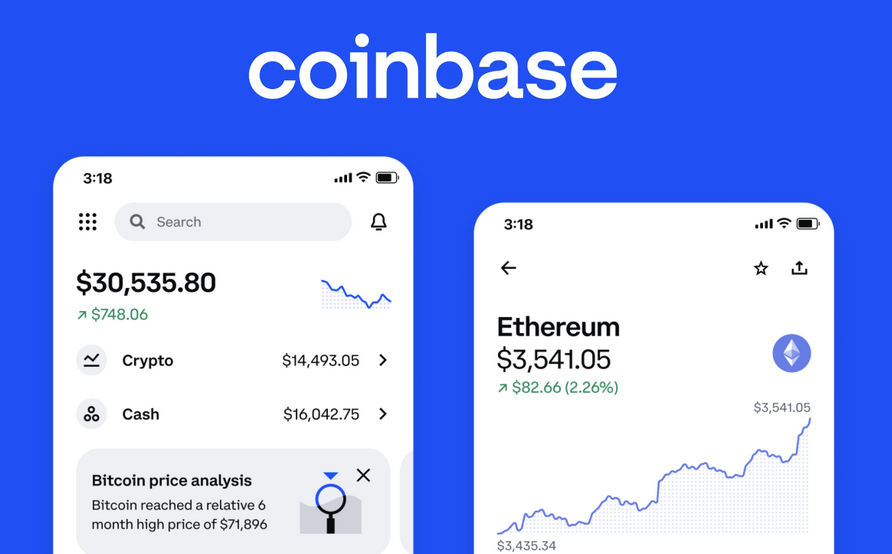

2. Coinbase – Best for Beginners & Security

Overview

Coinbase is one of the most beginner-friendly cryptocurrency exchanges, offering a simple, secure, and FCA-regulated platform for UK users. Founded in 2012, it is one of the most trusted names in the industry, making it an ideal choice for new traders looking for an easy way to buy and sell cryptocurrencies.

Unlike Binance, which caters to professional traders, Coinbase is designed for ease of use, making it a perfect choice for those new to crypto. With a clean interface, strong security, and multiple payment options, it is one of the best exchanges for UK beginners.

Key Features of Coinbase

🔹 Beginner-Friendly Interface

Coinbase has one of the easiest interfaces to use. If you are new to cryptocurrency, you can:

✅ Buy and sell crypto in one click.

✅ Use the mobile app for simple trading.

✅ Access a clean, intuitive dashboard.

Unlike Binance or Kraken, which have complex trading interfaces, Coinbase makes it super easy for beginners to start trading.

🔹 FCA-Regulated & High Security

One of the biggest advantages of Coinbase is that it is FCA-regulated in the UK, meaning it complies with strict financial laws.

✔ 98% of assets are stored in cold storage to prevent hacking.

✔ 2FA (Two-Factor Authentication) for extra security.

✔ FDIC insurance on USD balances (up to $250,000 in the US).

✔ Regular audits & compliance with UK financial regulations.

If security is your priority, Coinbase is one of the safest crypto exchanges in the UK.

🔹 Large Cryptocurrency Selection

Coinbase supports over 100 cryptocurrencies, including:

- Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP.

- DeFi tokens like Aave (AAVE) and Uniswap (UNI).

- Metaverse tokens like Decentraland (MANA) and The Sandbox (SAND).

While Coinbase has fewer coins than Binance (350+), it offers all major assets that most investors need.

🔹 Multiple Payment Methods for UK Users

Coinbase makes it easy to deposit GBP into your account using:

✔ Bank Transfers (Faster Payments Service – Free & Fast).

✔ Debit & Credit Cards (Instant but with 3.99% fee).

✔ PayPal (Easy but with high fees).

Unlike Binance, which has limited GBP deposit options, Coinbase allows direct bank transfers, making it more convenient for UK users.

🔹 Coinbase Pro – Lower Fees for Active Traders

Coinbase’s main platform is great for beginners, but if you’re looking for lower fees, you can use Coinbase Pro, which offers:

- Lower trading fees (starting at 0.5%).

- More advanced trading tools (limit orders, charting, APIs).

This makes Coinbase a good option for both beginners and intermediate traders.

Fees & Costs

| Fee Type | Coinbase Fees | Industry Average |

|---|---|---|

| Spot Trading | 1.49% | 0.5% – 1.5% |

| Coinbase Pro Trading | 0.5% | 0.1% – 0.5% |

| Deposit Fees | Free for Bank Transfers | Free – 2% |

| Card Deposits | 3.99% | 1% – 5% |

| Withdrawal Fees | Standard network fees | Varies by exchange |

How to Avoid High Fees on Coinbase

- Use Bank Transfers instead of credit/debit cards to deposit funds.

- Use Coinbase Pro for lower trading fees (0.5% instead of 1.49%).

While Binance and Kraken have lower fees, Coinbase remains a secure and beginner-friendly option.

Security & Regulation

✅ FCA-Regulated – Fully compliant with UK financial laws.

✅ 98% Cold Storage – Majority of funds stored offline for security.

✅ 2FA (Two-Factor Authentication) – Extra account protection.

✅ Insurance Protection – Covers assets in case of hacks.

If you’re worried about security, Coinbase is one of the safest choices for UK users.

Pros & Cons of Coinbase

✅ Pros

✔ Best for beginners – Easy-to-use interface.

✔ FCA-regulated & highly secure – Cold storage & insured funds.

✔ Multiple payment methods – Bank transfers, PayPal, debit cards.

✔ Coinbase Pro available – Lower fees for active traders.

❌ Cons

❌ Higher trading fees (1.49%) than Binance (0.1%).

❌ Card deposit fees (3.99%) are expensive.

❌ Fewer coins than Binance (100+ vs. 350+).

Who Should Use Coinbase?

🔹 Best for Beginners – Simple interface and easy crypto purchases.

🔹 Best for Secure Trading – FCA-regulated & insured funds.

🔹 Best for UK Bank Transfers – Faster Payments support.

🚀 If you’re new to crypto and want a secure, easy-to-use exchange, Coinbase is the best choice!

🔗 Sign Up for Coinbase

Final Verdict – Is Coinbase the Best Crypto Exchange in the UK?

⭐ Rating: 9/10

Coinbase is one of the best exchanges for beginners due to its user-friendly platform, strong security, and multiple GBP deposit options. However, it has higher fees than Binance or Kraken.

If you want a simple and secure way to buy crypto, Coinbase is highly recommended.

If you are an advanced trader, you may prefer Binance or Kraken for lower fees.

3. Kraken – Best for Security & Low Fees

Kraken is one of the most secure and trusted cryptocurrency exchanges, known for its low fees, FCA regulation, and strong security measures. Founded in 2011, it has never been hacked, making it an excellent choice for security-conscious traders. It supports over 200 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and XRP, offering a great balance of security, affordability, and functionality.

One of Kraken’s biggest advantages is its low trading fees. Unlike Coinbase, which charges 1.49% per trade, Kraken’s fees start at 0.16% for spot trading, making it much more cost-effective. For futures trading, fees are even lower, starting at 0.02%. UK users can deposit funds for free via Faster Payments, but Kraken does not support debit or credit card deposits, which might be inconvenient for some users.

Security is Kraken’s strongest feature. It is FCA-regulated in the UK and follows strict compliance standards. 95% of customer funds are stored in cold wallets, reducing the risk of cyberattacks. Users also benefit from two-factor authentication (2FA), withdrawal whitelists, and real-time fraud monitoring. Additionally, Kraken conducts Proof of Reserves audits, ensuring full transparency by verifying that all user funds are backed 1:1.

Kraken is suitable for both beginners and advanced traders. While the interface may feel slightly complex at first, it offers powerful tools such as margin trading with up to 5x leverage, futures trading, and staking. Staking allows users to earn up to 24% APY on selected cryptocurrencies like Ethereum (ETH), Polkadot (DOT), and Cosmos (ATOM).

Although Kraken doesn’t have as many coins as Binance, its strong security, FCA compliance, low fees, and staking rewards make it an excellent choice for UK traders.

Kraken Pros & Cons

| Pros | Cons |

|---|---|

| FCA-regulated and highly secure | No debit/credit card deposits |

| Never hacked, 95% cold storage for funds | Interface can be complex for beginners |

| Low trading fees (0.16%) | Fewer cryptocurrencies than Binance |

| Staking rewards up to 24% APY | |

| Free UK bank deposits (Faster Payments) |

4. eToro -Best for Social & Copy Trading

eToro is a multi-asset trading platform that allows users to trade cryptocurrencies, stocks, forex, and commodities. It is one of the best platforms for beginners due to its simple interface and social trading features, making it easy to follow and copy professional traders. eToro is FCA-regulated, ensuring a safe and compliant trading environment for UK users.

One of eToro’s standout features is Copy Trading, which allows users to automatically copy the trades of successful investors. This is ideal for beginners who may not have the time or experience to trade actively. eToro also offers a demo account with $100,000 in virtual funds, allowing users to practice before investing real money.

eToro supports over 70 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL). While its selection is smaller than Binance or Kraken, it covers the most popular assets. Users can also trade other asset classes like stocks, ETFs, and commodities, making it a great choice for diversified investing.

Unlike Binance and Kraken, eToro does not use a percentage-based trading fee. Instead, it charges a flat 1% spread on all crypto trades, which is higher than other exchanges but simplifies cost calculations. Deposits are free, but withdrawals incur a £5 fee, and there is a conversion fee if depositing in GBP, as eToro operates in USD.

Security-wise, eToro is FCA-regulated and follows strict compliance standards. It also offers cold storage for digital assets, two-factor authentication (2FA), and real-time fraud monitoring. However, crypto withdrawals are limited, as eToro encourages users to trade within its ecosystem rather than transfer funds externally.

eToro’s platform is designed for simplicity and ease of use, making it a great choice for beginners and casual investors. However, its higher trading fees and limited withdrawal options may not suit active traders.

eToro Pros & Cons

| Pros | Cons |

|---|---|

| FCA-regulated and highly secure | 1% spread fee (higher than competitors) |

| Easy-to-use platform, ideal for beginners | Limited crypto withdrawal options |

| Copy Trading lets users follow top investors | Conversion fees for GBP deposits |

| Trade crypto, stocks, forex, and commodities | |

| Free demo account for practice trading |

5. Bitstamp Review – Best for Institutional & High-Volume Traders

Bitstamp is one of the oldest cryptocurrency exchanges, founded in 2011. Known for its strong security, regulatory compliance, and deep liquidity, it is an excellent choice for institutional investors and high-volume traders. It is FCA-registered, making it one of the safest and most trusted exchanges for UK users.

Bitstamp offers 85+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP, Cardano (ADA), and Solana (SOL). While it does not have as many coins as Binance, it focuses on high-quality, well-established assets. The exchange provides high liquidity, making it ideal for traders who want fast and large transactions without price slippage.

One of Bitstamp’s biggest strengths is its competitive fee structure for large-volume traders. Trading fees start at 0.5% for trades under $10,000 and decrease as trading volume increases, going as low as 0.0% for trades above $30 million. UK users can deposit funds for free via Faster Payments, while credit/debit card deposits incur a 5% fee. Withdrawals via bank transfer cost £2, making it more affordable than some competitors.

Security is a top priority for Bitstamp. The exchange holds an FCA license, ensuring compliance with UK financial regulations. 98% of funds are stored in cold storage, and assets are insured against breaches. Users can enable two-factor authentication (2FA), address whitelisting, and email confirmations for added protection. Bitstamp has a strong reputation for reliability and has never suffered a major security breach.

Bitstamp’s interface is clean and easy to use, making it suitable for both beginners and experienced traders. It provides advanced trading tools such as API access, institutional-grade liquidity, and advanced order types for professional traders. However, it lacks some features like futures trading and leverage, which may be a drawback for high-risk traders.

Overall, Bitstamp is an excellent choice for high-volume traders, institutional investors, and security-focused users. However, its high credit card fees and limited coin selection may not suit casual traders looking for a wider variety of assets.

Bitstamp Pros & Cons

| Pros | Cons |

|---|---|

| FCA-regulated and highly secure | 5% fee on credit/debit card deposits |

| Competitive fees for high-volume traders | Fewer cryptocurrencies than Binance |

| Fast UK bank deposits via Faster Payments | No futures or margin trading |

| 98% cold storage & insured funds | |

| Advanced trading tools for professionals |

6. OKX – Best for Futures & Derivatives Trading

OKX is a global cryptocurrency exchange known for its futures, margin trading, and advanced trading tools. It offers low trading fees, deep liquidity, and a wide range of cryptocurrencies, making it a great choice for professional traders and derivatives investors. While OKX is not FCA-regulated, it remains accessible to UK users.

OKX supports over 300 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, and emerging altcoins. It also provides staking and DeFi options, allowing users to earn passive income on their holdings. The platform is designed for both spot trading and derivatives, offering futures, perpetual swaps, and options with up to 125x leverage.

OKX is one of the cheapest exchanges in terms of trading fees. Spot trading fees start at 0.08% (maker) and 0.1% (taker), while futures trading fees are as low as 0.02% (maker) and 0.05% (taker). Deposits via bank transfer are free, and withdrawal fees vary depending on the asset.

Security-wise, OKX uses cold storage for most funds, two-factor authentication (2FA), and anti-phishing protection. However, since it is not FCA-regulated, UK users should be cautious when using the platform. OKX also requires KYC verification for full access to withdrawals and advanced trading features.

The trading interface is designed for professionals, featuring advanced charting tools, API support, and automated trading bots. While it is great for experienced traders, beginners may find the platform complex compared to simpler exchanges like Coinbase or eToro.

Overall, OKX is an excellent exchange for derivatives trading, professional traders, and users looking for low fees. However, its lack of FCA regulation and complex interface may not suit casual traders.

OKX Pros & Cons

| Pros | Cons |

|---|---|

| Low trading fees (0.08% spot, 0.02% futures) | Not FCA-regulated in the UK |

| Supports 300+ cryptocurrencies | Complex interface for beginners |

| Futures and options trading with 125x leverage | Limited fiat withdrawal options |

| Cold storage & strong security measures | |

| Advanced tools for professional traders |

7. Crypto.com – Best for Crypto Rewards & Cashback

Crypto.com is a popular cryptocurrency exchange and financial platform offering crypto trading, staking, a Visa debit card, and DeFi services. It is FCA-registered, making it a secure and regulated choice for UK users. With over 250 cryptocurrencies, competitive fees, and a range of financial products, Crypto.com is ideal for those looking to trade, spend, and earn rewards on crypto.

One of its standout features is the Crypto.com Visa Card, which allows users to spend crypto and earn cashback rewards of up to 5% on purchases. Cashback rewards depend on the amount of Cronos (CRO) tokens staked. The card also offers free Spotify, Netflix, and airport lounge access, making it an attractive option for frequent spenders.

Crypto.com offers spot trading, margin trading, and staking. Trading fees start at 0.075% per trade, making it cheaper than Coinbase (1.49%) and competitive with Binance (0.1%). UK users can deposit GBP for free via bank transfers, but card deposits incur a 2.99% fee. Withdrawals vary by asset and are subject to network fees.

Security is a strong focus, with FCA registration, cold storage for funds, and insurance protection against cyberattacks. Two-factor authentication (2FA) and withdrawal whitelisting add extra protection for users.

Crypto.com’s mobile app is user-friendly, making it a great choice for beginners. However, the platform encourages users to hold CRO tokens to access lower fees and cashback rewards, which may not appeal to all traders.

Overall, Crypto.com is a great exchange for crypto investors who want to earn cashback, stake coins, and trade with competitive fees. However, its card deposit fees and reliance on CRO staking for rewards may not suit everyone.

Crypto.com Pros & Cons

| Pros | Cons |

|---|---|

| FCA-registered and highly secure | Card deposits have a 2.99% fee |

| Crypto.com Visa Card with up to 5% cashback | Best rewards require CRO staking |

| Low trading fees (0.075%) | Withdrawal fees vary by asset |

| Supports 250+ cryptocurrencies | |

| Free GBP bank deposits (Faster Payments) |