In a nutshell, the best CFD brokers in the UK are eToro, popular for its social trading features and extensive asset variety; XTB, offering a powerful trading platform with advanced charting tools and a wide range of assets; and IG, renowned for its robust trading platform and extensive market research tools.

Looking for your perfect CFD broker?

I’ve tested, scored, and ranked the best CFD brokers and platforms in the UK.

Whether you’re seeking security, user-friendliness, or extensive trading options, I’ve got you covered.

|

4.7

|

4.6

|

4.5

|

|

30 million users globally trust eToro for their social trading needs, benefiting from a vast array of stocks, ETFs, forex, commodities, and cryptocurrencies. |

A reliable trading platform offering a wide range of markets, advanced tools, and educational resources to empower traders of all skill levels. |

Award-winning trading platform offering extensive market access and advanced tools for both beginner and experienced traders. |

|

|

|

|

61% of retail CFD accounts lose money.

|

73% of retail investor accounts lose money when trading CFDs with this provider.

|

69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

|

30 million users globally trust eToro for their social trading needs, benefiting from a vast array of stocks, ETFs, forex, commodities, and cryptocurrencies.

- User-friendly platform for beginners

- Copy the moves of professional traders

- Social trading & educational features

A reliable trading platform offering a wide range of markets, advanced tools, and educational resources to empower traders of all skill levels.

- User-friendly platforms with intuitive design

- Wide range of instruments, including forex, stocks, and CFDs

- Comprehensive educational tools and webinars

Award-winning trading platform offering extensive market access and advanced tools for both beginner and experienced traders.

- User-friendly platform with advanced trading tools

- Comprehensive educational resources and demo account

- Wide range of markets

5 Best CFD Trading Platforms Ranked

Here is a quick list of the best CFD trading platforms to use in the UK based on my hands-on analysis:

76% of retail CFD accounts lose money.

- eToro – Best overall

- XTB – Best stock exchange-listed broker

- IG – Largest CFD broker in the world

- Plus500 – One of the best for beginners

- Trading 212 – Commission-free CFD trading with a free share upon sign-up

What are the best CFD trading platforms in the UK?

Here I’ve compared the CFD brokers based on four key rating criteria you must consider and compare.

| Rank | CFD broker | Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

|---|---|---|---|---|---|

| 1 | eToro | $50 | $3.1 | 3,317 | 1 |

| 2 | XTB | £0 | £1.10 | 5,800+ | 2 |

| 3 | IG | £250 | $2.6 | 19,537 | 8 |

| 4 | Plus500 | £100 | 0.7 points (average spread cost) | 2,800 | 6 |

| 5 | Trading 212 | $1 | $1.5 | 1,785 | 2 |

Reviews of Each Platform

It is forecast that the global online trading market will increase at a compound annual growth rate of 6.4% per year1.

Choosing the best CFD trading platform is crucial for newcomers in the market.

Having worked in the retail investment sector in London over the last four years, I had the opportunity to experience the rise first-hand.

Additionally, in my role working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”, I was able to work with and test some of the biggest CFD brokers on the market.

Using my experience in this field, I’ve compiled a list of the best CFD trading platforms in the UK based on five key criteria:

- Minimum deposit

- S&P 500 index CFD fee

- No. of tradeable instruments

- Tier-1 licenses (regulation)

Factors such as usability, trading platforms available, research tools, education materials, and additional features were also considered.

All the CFD trading platforms I’ve reviewed below are regulated by the UK’s financial watchdog, the Financial Conduct Authority (FCA) or similar.

You can read about how we test platforms here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

1. eToro – Best overall

eToro is the best overall on my list of the best CFD trading platforms.

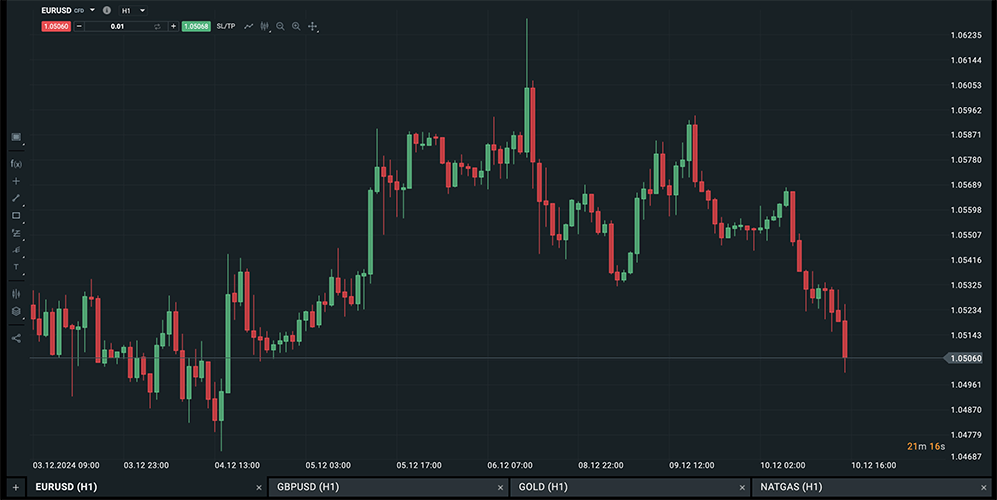

The platform allows you to trade stocks, forex, ETFs, indices, and commodities.

You’ll have access to CFD trading with leverage to boost market exposure and reduce capital needs.

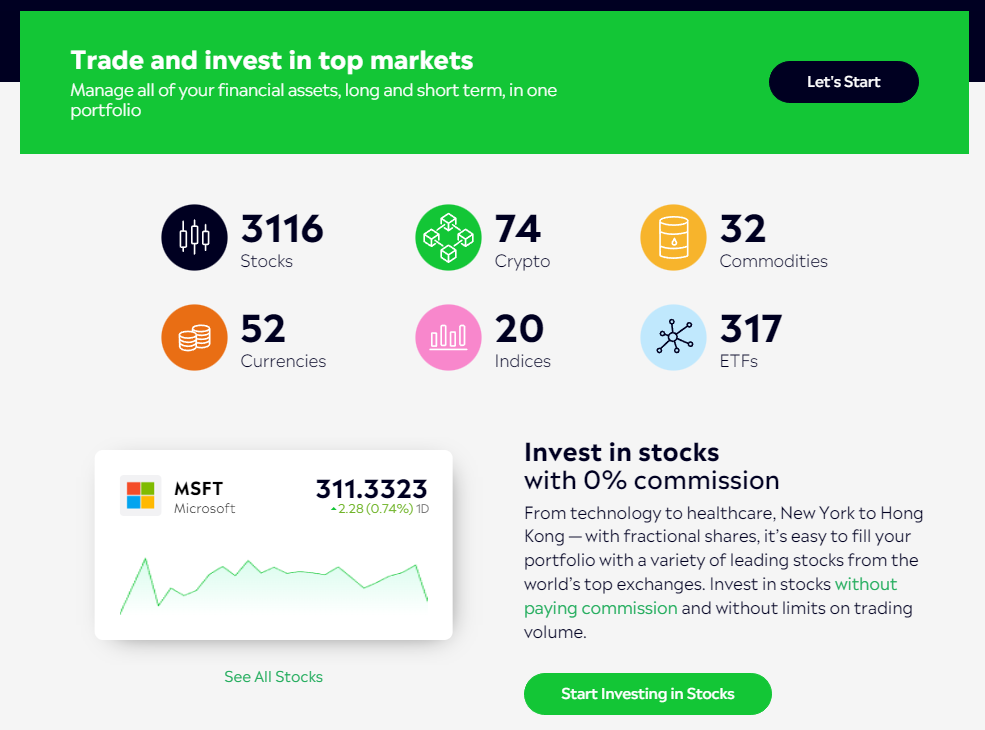

eToro offers a wide range of analysis tools for traders at all levels. These tools include both fundamental and technical resources, helping users trade wisely.

eToro provides traders with real-time news, economic data, social sentiment trends, and advanced charts.

The platform’s ProCharts tool lets you compare charts across various financial tools and periods.

As CFD trading is risky, you’ll have access to risk management tools such as stop loss, take profit, and trailing stop Loss to guard your investments and manage positions better.

One of its biggest advantages is its CopyTrader functionality. If you’re not sure how or what to trade, this unique functionality allows you to automatically replicate the trades of successful traders on the platform.

If you fancy yourself as a skilled trader, you can apply to eToro’s Popular Investor Program. By doing so, you can earn monthly if other users copy your trades.

If you are new to CFD trading, eToro makes it simple to get started. Plus, I recommend you practice trading strategies and gain confidence utilising their demo account ($100,000 virtual funds).

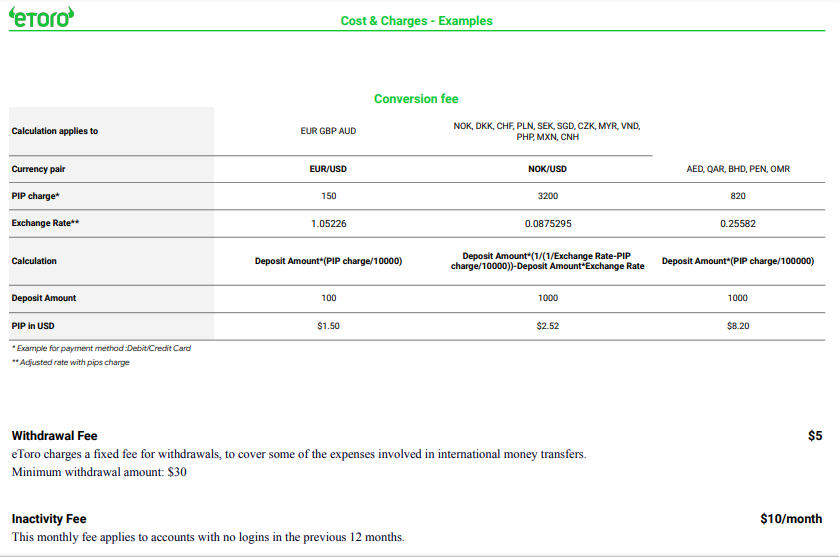

eToro has competitive trading fees: 1 pip for forex CFDs, 2 pips for commodities, 0.75 points for indices, and 0.15% for stocks and ETFs.

In my experience, eToro’s CFD platform has great tools, an easy interface, and many investment choices.

I recommend eToro for beginner or intermediate traders as one of the simplest CFD trading platforms, however, it may be too simple for experienced traders looking for complex tools and charts.

On top of this, they have an ‘Excellent’ rating on Trustpilot (which is quite rare for a trading app), with over 18,000 reviews.

Key rating criteria:

| Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

| $50 | $3.1 | 3,479 | 3 |

Read my full eToro review.

Pros:

- Trading platform compatible across all devices

- Social trading and copy features

- No commission on stocks and ETFs, coupled with competitive spreads

- Low minimum deposit requirement

- Offers a free demo account

Cons:

- Conversion fees for GBP

- Higher non-trading fees

- £5 withdrawal fee

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Other fees apply. Your capital is at risk. For more information, click here.

2. XTB – Best stock exchange-listed broker

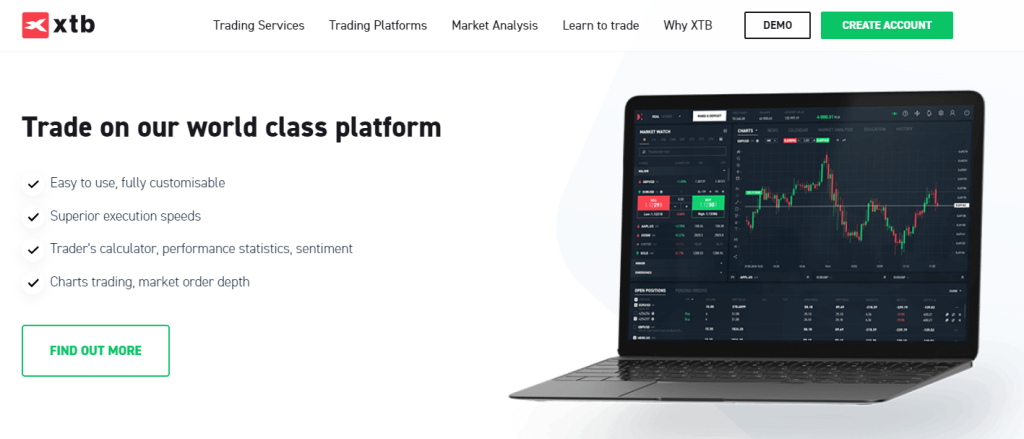

XTB has established itself as a top CFD broker in the UK, offering an intuitive and highly customisable trading experience.

XTB gives you quick access to over 6,900 markets. These include forex, indices, commodities, stock CFDs, and ETF CFDs.

You’ll want to take advantage of impressively tight spreads starting at 0.1 pips, leverage of up to 30:1, and zero commissions on stock and ETF CFDs.

The xStation trading software, available on iOS, Android, and desktop devices, caters to the needs of both beginner and advanced traders.

The interface is user-friendly and gives you charting tools and risk management options.

With the built-in trading calculator, you’ll be able to easily estimate costs, profits, and losses before initiating positions.

Modifying stop loss and take profit orders directly on the chart or closing all positions with a single click is a great benefit.

XTB offers many educational resources like videos, webinars, and courses for traders of all skill levels.

You won’t have to worry knowing a personal account manager is on hand to resolve issues and ensure a smooth trading experience.

Opening an XTB CFD trading account is free. It may be helpful to utilise the demo account with £100,000 in virtual funds to test your trading strategies before live trading.

Deposits in GBP, EUR, and USD are free of charge; however, some deposit methods may involve additional fees charged by payment providers (XTB does not charge any fees). Withdrawals below £50, €50, or $50 are subject to a £5, €5, or $5 fee, respectively. Withdrawals above these amounts are free of charge.

After one year of trading inactivity, an inactivity fee of £10 per month applies, provided no deposit has been made in the preceding 90 days. Additionally, a currency conversion charge of 0.5% may apply.

However, clients can hold up to four accounts in different currencies with XTB, mitigating potential conversion costs.

Spreads start at 0.1 pip for forex CFDs, 0.004 points for commodity CFDs, and 0.04 points for index CFDs. As said before, stock and ETF CFDs are commission-free.

However, be cautious of the overnight fees.

I suggest XTB if you plan to utilise its proprietary platform (xStation 5 platform), which offers useful customisation, search functions, and modern design.

Key rating criteria:

| Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

| £0 | £1.10 | 5,800+ | 2 |

Pros:

- User-friendly trading platform

- Low forex fees

- Swift deposit and withdrawal process without any fee

- Customer service is available through live chat

Cons:

- High charges for stock CFDs.

- Account inactivity fees

73% of retail investor accounts lose money when trading CFDs with this provider.

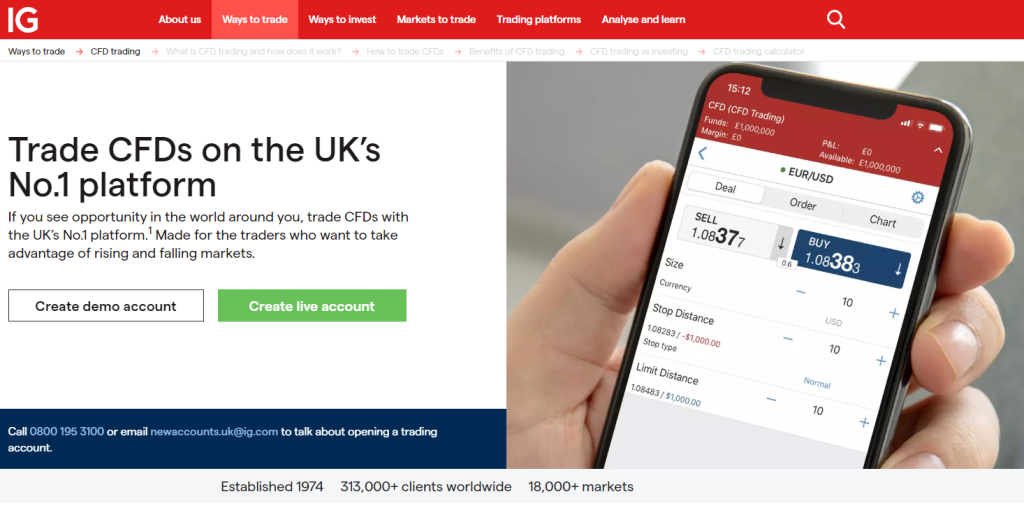

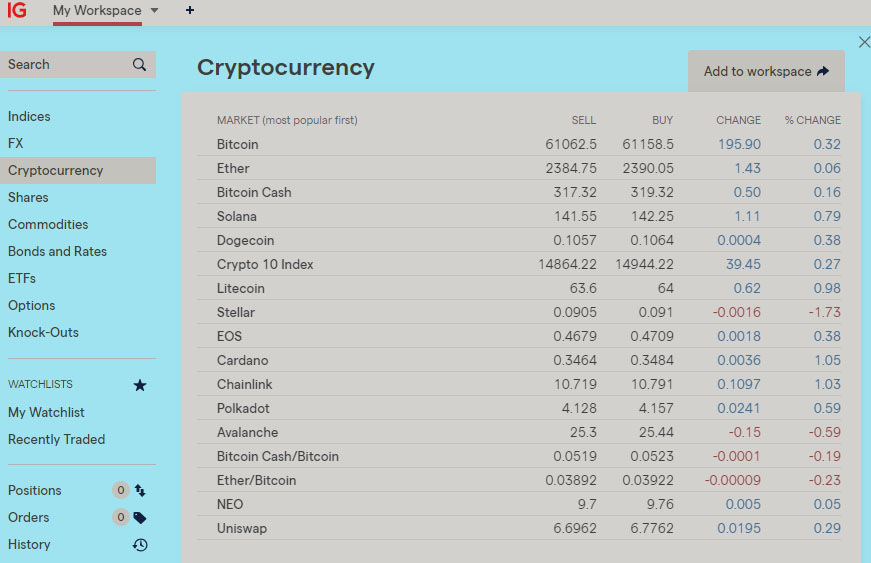

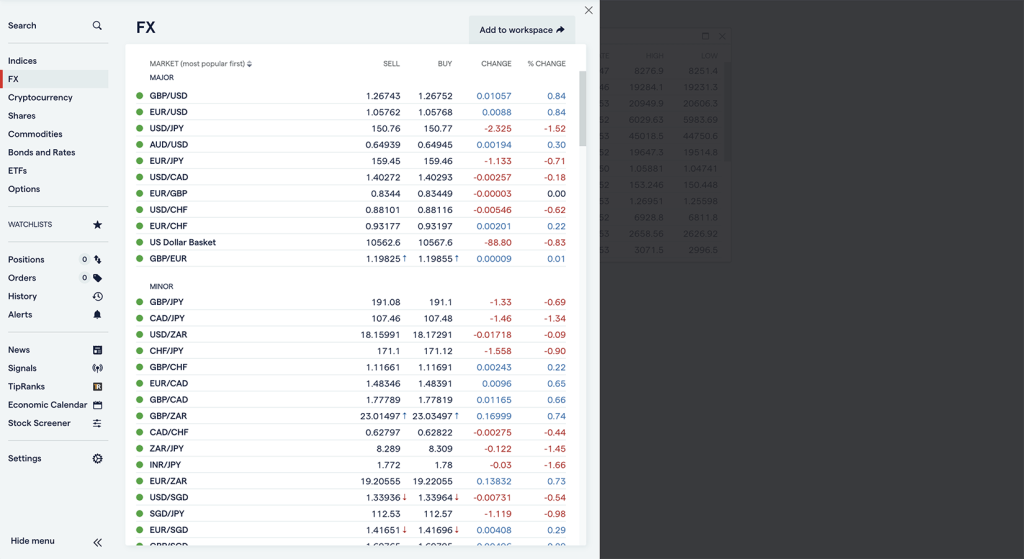

3. IG – Largest CFD broker in the world

IG holds the distinction of being the largest CFD broker in the world, with a rich history dating back to its establishment in 1974.

As a regulated broker, it operates under the oversight of esteemed financial authorities, including the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and Germany’s Federal Financial Supervisory Authority (BaFin).

It was also rated ‘Most Trusted Broker in 2023, Best Overall Broker in 2023‘ at ForexBrokers.com Annual Awards2. Rest assured, IG provides a secure and trustworthy trading environment.

One of its greatest advantages is its vast selection of over 17,000 tradable instruments (largely through CFDs and spread bets). Many are available for trading 24 hours a day.

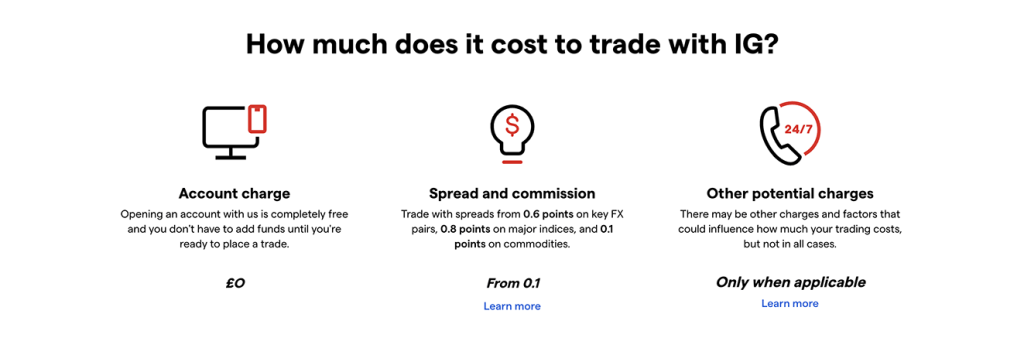

The broker maintains competitive spread charges, starting as low as 0.1 pips.

In terms of non-trading costs, there are deposit and withdrawal fees, while the inactivity fee is favorable, only coming into effect after two years of inactivity.

IG impresses with its advanced yet user-friendly trading platform. It’s comprehensive and full of customisable features.

The MetaTrader 4 (MT4) platform has many charting tools and technical indicators, giving traders full control over their trades.

At the same time, IG offers the L2 Dealer, enabling Direct Market Access (DMA) trading. The expert order control feature facilitates swift order execution directly from the tradable markets, enhancing efficiency.

Similar to my experience with IG in the FX world, I’d recommend it highly as a CFD trading platform. My only critique is its steep stock CFD trading fees.

Key rating criteria:

| Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

| £250 | $2.6 | 19,537 | 8 |

Read my full IG review.

Pros:

- Access to more than 17,000 tradeable instruments

- Choice of three diverse trading platforms

- Comprehensive educational and research resources

- No charges for deposits and withdrawals

Cons:

- High stock CFD fees

- Higher initial deposit requirement

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

4. Plus500 – One of the best for beginners

Plus500 is one of the best for beginners, thanks to its easy-to-use web and mobile platform.

Established in 2008 and regulated by the FCA in the UK, the platform provides a diverse range of tradable assets, including forex, stocks, commodities, indices, options, and ETFs.

Plus500 operates on a commission-free model but generates its profits from spreads, which are among the tightest in the market.

You need to pay attention to additional fees though, including overnight funding, currency conversion, guaranteed stop orders, potential deposit and withdrawal fees, and an inactivity fee.

Plus500 has many payment methods, including debit/credit cards, bank transfers, and e-wallets, making deposits and withdrawals easy.

To begin trading with Plus500, a minimum deposit of £100 is required.

Plus500’s trading platform works on all devices. Traders can easily use the CFD trading app on mobile and track trades.

I would recommend Plus500 for intermediate and experienced traders. The lack of research and educational resources makes other CFD brokers much more suitable for beginners.

Key rating criteria:

| Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

| £100 | Spreads and other fees apply. 0.7 points is the average spread cost during peak trading hours. The spread is subject to change as it is dynamic. | 19,537 | 8 |

Read my full Plus500 review.

Pros:

- No commission on buy/sell transactions

- Competitive spreads

- Free unlimited Demo account

- Over 2,800 tradable instruments

- Real-time quotes and sophisticated analytical tools

- Fast and dependable order execution

Cons:

- No available API integrations

- Lack of social copy trading

- Limited educational and research tools

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

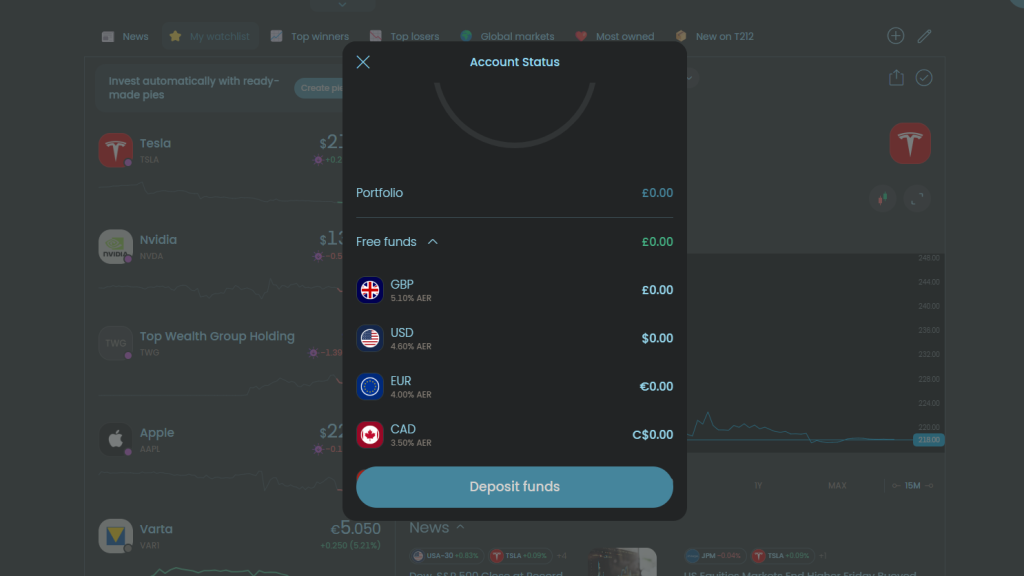

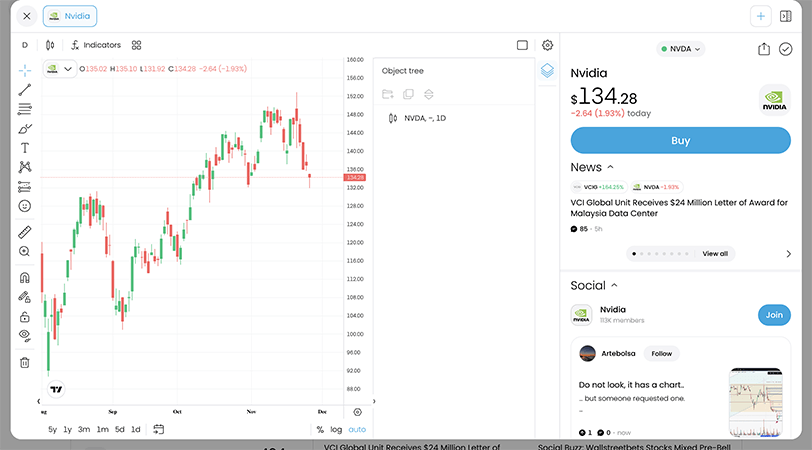

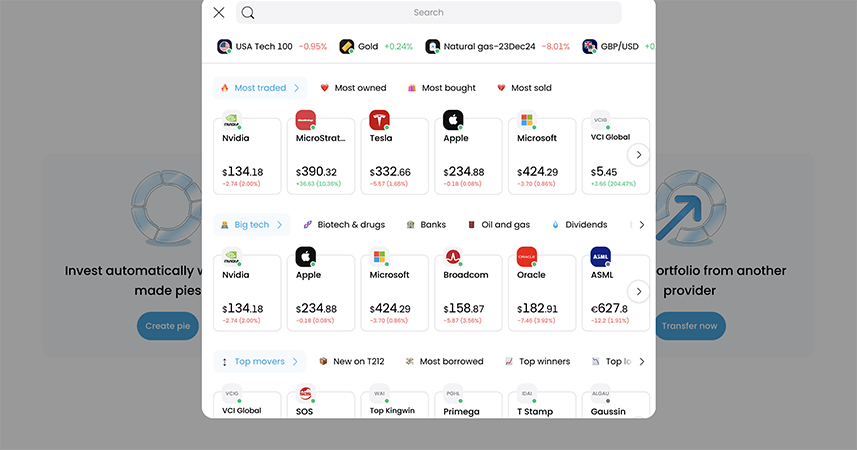

5. Trading 212 – Commission-free CFD trading with a free share upon sign-up

If you’re looking for an easy-to-use CFD trading platform, you might want to check out Trading 212.

Trading 212 provides CFDs on 29 commodities, 36 indices, 1,536 shares, and 184 forex pairs. They also give traders access to securities like fractional shares. However, they have stopped offering cryptocurrency trading.

With a low minimum deposit, traders can kick-start their journey with a modest £1 investment for the Invest and ISA accounts, or £10 for the CFD trader account.

Trading 212 offers commission-free trading. However, when trading CFDs and forex, you’ll have to pay a spread.

You must pay attention to potential charges, including deposit fees for amounts over £2,000 and currency conversion fees.

Trading 212 sets itself apart with its user-friendly CFD trading app that is compatible across all account types and offers comprehensive trading services.

It offers one of the easiest CFD trading apps that is compatible across all account types and has over 10 million downloads on Google Play.

It offers educational resources for new traders but lacks features for experts. Users can easily sort markets and sync their watchlists with the web platform.

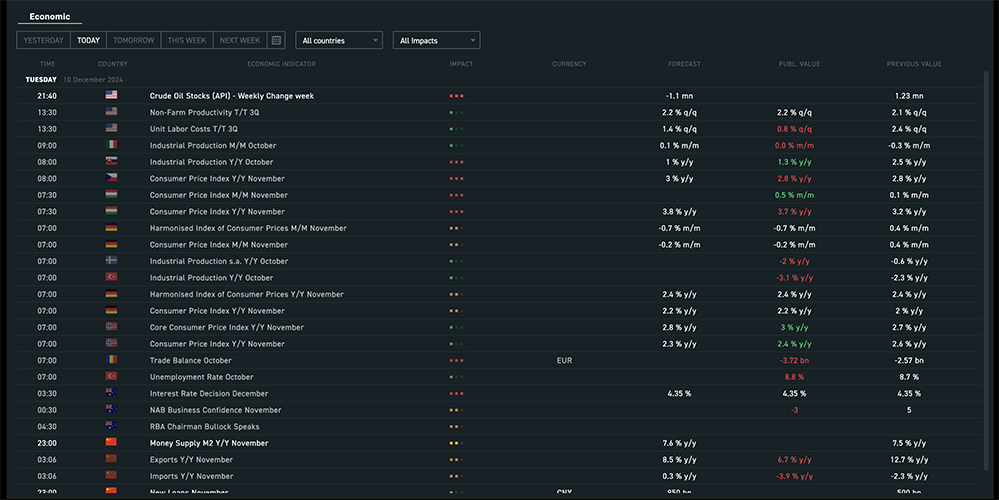

The app showcases an economic calendar detailing upcoming events, their potential impact, and forecasts. Despite its strengths, it misses key research tools and trading customisations, like good-till-date order options.

An added perk is its Google Chrome plugin. The charting tool comes with 45 indicators and 19 drawing tools.

Despite its benefits, Trading 212 has certain limitations, including a lack of research tools, no educational articles, and no access to MetaTrader.

In my experience, Trading 212’s platform is user-friendly for beginners. However, seasoned traders might find it lacking compared to the top CFD brokers in the UK.

Key rating criteria:

| Minimum deposit | S&P 500 index CFD fee | No. of tradeable instruments | Tier-1 licenses (regulation) |

| $1 | $1.5 | 1,785 | 2 |

Read my full Trading 212 review.

Pros:

- No commission is charged on real stocks and ETFs

- Fast and straightforward account setup

- Easy-to-use trading platforms

Cons:

- Restricted range of research tools

- No educational articles

- No MetaTrader

Factors to Consider When Choosing

Choosing the best CFD broker in the UK is a crucial decision that can significantly impact your trading experience and success.

Along with the key rating criteria I used to rank the platforms, here’s what to look for:

- Regulation: Ensure the broker is regulated by a reputable financial authority, such as the Financial Conduct Authority (FCA) in the UK. Regulation provides a level of investor protection and ensures the broker operates in compliance with established standards.

- Security: Look for brokers with robust security measures, including data encryption and segregated client funds. This helps safeguard your personal and financial information.

- Range of Instruments: It’s important to consider the variety of instruments offered by the broker. Look for a diverse selection, including forex, stocks, indices, commodities, and cryptocurrencies, to access multiple markets and diversify your portfolio.

- Trading Platforms: Evaluate the trading platforms offered by the broker. A user-friendly and feature-rich platform is essential for executing trades efficiently. Keep in mind factors such as charting tools, order types, and customisation options.

- Fees & Spreads: Compare the fee structure and spreads charged by different brokers. Make sure you look for competitive spreads, transparent pricing, and assess factors like commissions, overnight fees, and withdrawal charges.

- Leverage & Margin: Be aware of the leverage options available. Higher leverage can amplify potential profits but also increase risk. Ensure the broker provides suitable leverage levels that align with your risk tolerance and trading strategy.

- Customer Support: Take time to test the quality and availability of customer support. A responsive and knowledgeable support team can assist when needed, especially during critical trading periods.

- Educational Resources: Evaluate the educational resources offered by the broker. Look for materials like tutorials, webinars, and trading guides that can enhance your trading knowledge and skills.

- Demo Accounts: Check if the broker offers a free demo account. This allows you to practice trading with virtual funds and familiarise yourself with the platform before risking real money.

- Reviews & Reputation: Research the broker’s reputation by reading reviews and testimonials from other traders. This can provide valuable insights into the broker’s reliability, execution speed, and overall customer satisfaction.

We also have an expert tip from one of our latest interviews with Andrew Merry who is the Chief Commercial Officer at Trade Nation.

The final step, in my opinion, would be to look at the cost of trading with the broker. This final step is not straightforward as brokers tend to hide the cost of trading with misleading marketing messages but it is worth spending time and doing your homework to find your best option.

Andrew Merry, IChief Commercial Officer at Trade Nation. From our interview.

Final Thoughts

When it comes to CFD trading platforms in the UK, several top contenders stand out.

Each platform has its unique features and strengths that cater to different types of traders.

eToro is the best overall, offering a user-friendly social trading experience, while Pepperstone provides advanced trading tools and competitive spreads.

IG Markets excels in its wide range of tradable instruments and trusted platform.

Ultimately, the best CFD trading platform for you will depend on your trading style, experience level, and specific requirements.

You must spend time researching and comparing the factors discussed in my guide.

FAQs

Is it legal to trade CFDs in the UK?

Yes, it is legal to trade CFDs in the UK. CFD trading is a regulated activity and is subject to oversight by the Financial Conduct Authority (FCA), which is the regulatory body responsible for supervising financial markets and ensuring consumer protection in the UK. The FCA sets rules and guidelines that CFD brokers must adhere to, including capital requirements, client fund segregation, and fair trading practices. Traders should ensure that they engage with regulated CFD brokers that are authorised and licensed by the FCA or another recognised regulatory authority.

Is CFD trading tax-free in the UK?

No, CFDs are not tax-free in the UK. While you don’t pay stamp duty because you don’t own the underlying asset, profits from CFD trading are subject to Capital Gains Tax. However, losses can be used to offset tax liabilities. It’s important to consult a tax advisor for precise information as tax laws can be complex and vary from person to person.

You may also like:

Sources:

Will Fenton

Will Fenton is the founder of Sterling Savvy. He is a personal finance expert and writes about trading, investing, budgeting, and other financial topics.

Along with his education, Will has experience working in the financial services industry in London working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”.

Education:

MA (Hons) Economics and Finance, Heriot-Watt University

Press:

Outside of finance:

Will is also the founder of MIDDER, where he manages a small team of journalists who report on the latest news and developments in AI, Web3, blockchain, NFTs, and crypto within the realm of music.

He's been featured discussing the future of music on The Standard and the Daily Mail.