In a nutshell, the best copy trading brokers in the UK are eToro, AvaTrade, and IG. eToro is known for its user-friendly interface and extensive range of assets to copy. AvaTrade offers various automated trading solutions, while IG provides a professional-level platform with the option to follow experienced traders.

Looking for your perfect copy trading broker?

I’ve tested, scored, and ranked the best options in the UK.

Whether you’re seeking security, user-friendliness, or extensive trading options, I’ve got you covered.

30 million users globally trust eToro for their copy and social trading needs, benefiting from a vast array of stocks, ETFs, forex, commodities, and cryptocurrencies.

- User-friendly platform for beginners

- Copy the moves of professional traders

- Social trading & educational features

7 Best Copy Trading Platforms Ranked

Here is a quick list of the best copy trading brokers to use in the UK based on my hands-on analysis:

- eToro – Best for beginners

- AvaTrade – Best app

- IG – Best low-cost platform

- Pepperstone – Best for CFDs & trading options

- FXTM – Best for forex

- FP Markets – Best for competitive spreads & diverse trading instruments

- Vantage – Best for advanced traders

Your capital is at risk.

Top Picks Compared for UK Traders

Here I’ve compared the copy trading platforms based on four key factors you must consider and compare:

| Rank | Trading platform | Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

|---|---|---|---|---|---|

| 1 | eToro | $50 | 0.8 | 0% | Stocks, indices, ETFs, currencies, commodities, crypto |

| 2 | AvaTrade | £100 | 0.5 | 0% | Forex, stocks, commodities, indices |

| 3 | IG | £250 | 0.4 | Varies | Real stocks & ETFs, exchange-traded securities, CFDs (currency pairs, stock indices, stocks, ETFs, commodities, crypto, bonds, and futures) |

| 4 | Pepperstone | £0 | 0.4 | 0.10% plus spread | Forex, commodities, indices, currency indices, crypto, stocks, ETFs |

| 5 | FXTM | $10 | 1.0 | The fees are built into the spread, 1 point is the average spread cost during peak trading hours |

Forex, CFDs on stocks commodities, indices, crypto |

| 6 | FP Markets | $50 | 0.5 | Varies | Forex, CFDs, crypto, stocks |

| 7 | Vantage | $50 | 0.7 | $3.00 per lot per trade plus spread cost | Forex, CFDs, crypto |

Reviews

The popularity of copy trading is on the rise, with a staggering 80% of retail investors in the UK expressing their interest in copy trading platforms1.

Choosing the best copy trading platform is crucial for newcomers in the market.

Having worked in the retail investment sector in London over the last four years, I had the opportunity to experience the rise first-hand.

Additionally, in my role working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”, I was able to work with and test some of the biggest platforms on the market.

Using my experience in this field, I’ve compiled a list of the best copy trading platforms in the UK based on four key criteria:

- Minimum deposit

- S&P 500 CFD spread (average)

- Commission

- Types of assets

Factors such as usability, trading platforms available, research tools, educational materials, and additional features were also considered.

All the copy trading apps and platforms I’ve reviewed below are regulated by the UK’s financial watchdog, the Financial Conduct Authority (FCA) or similar.

You can read about how we test platforms here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

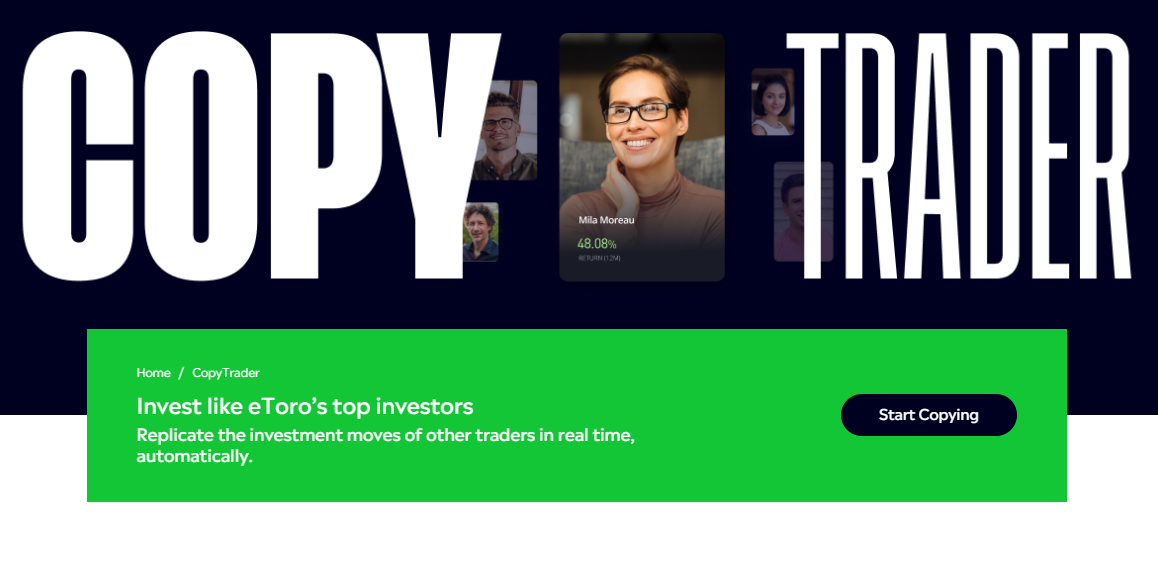

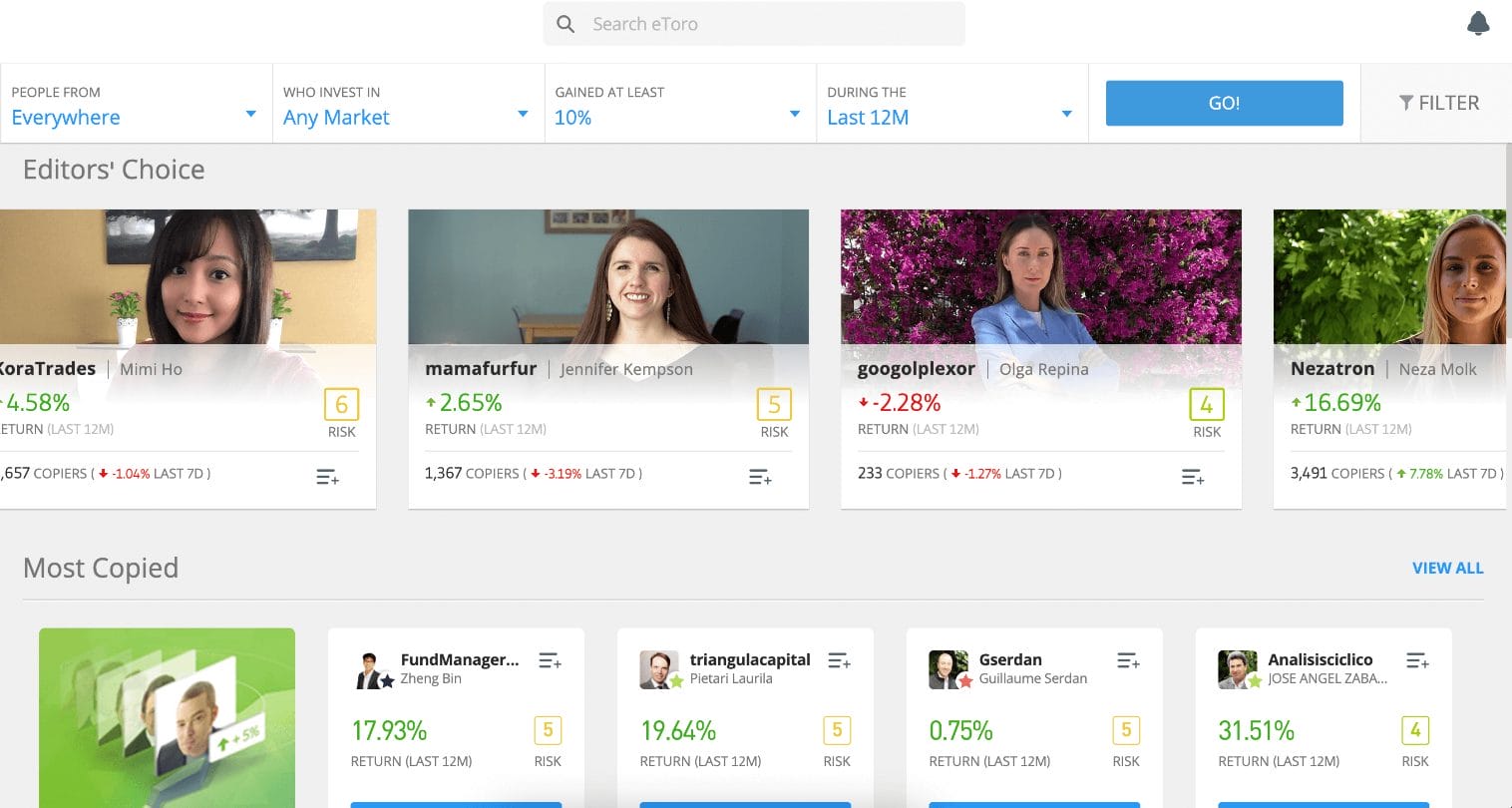

1. eToro – Best for beginners

The overall winner on my list of the best copy trading platforms and what I recommend to beginners is eToro.

As someone who has used eToro extensively, I can confidently say that it is one of the most popular copy trading platforms in the UK.

One of the standout features of eToro is its pioneering copy trading functionality.

Being the first broker to introduce this feature, eToro has set a high standard in the industry, attracting over 30 million traders worldwide2.

Since its launch in 2007, eToro has continued to enhance its CopyTrader feature, which allows you to easily find expert traders who align with your trading preferences and replicate their trades.

The flexibility of CopyTrader ensures that you remain in control of your portfolio, allowing you to adjust and customise your copying strategy as needed. Best of all, the CopyTrader feature is free of charge.

eToro values the importance of social trading and has created a social news feed feature that keeps you updated on the latest trades and market insights from expert traders.

You can actively engage with the community, sharing your trading ideas, commenting on others’ posts, and learning valuable strategies to improve your trading skills.

When it comes to trust and security, eToro holds up to scrutiny, it is registered by the UK’s Financial Conduct Authority (FCA).

eToro maintains a minimum deposit requirement of approximately $50, making it accessible for investors with different budget sizes.

In my experience, eToro’s copy trading platform has revolutionised my trading journey by providing access to a vast community of successful traders and enabling me to leverage their expertise.

Whether you are a beginner seeking guidance or an experienced trader looking to diversify your portfolio, eToro offers a comprehensive and user-friendly platform that can help you achieve your investment goals.

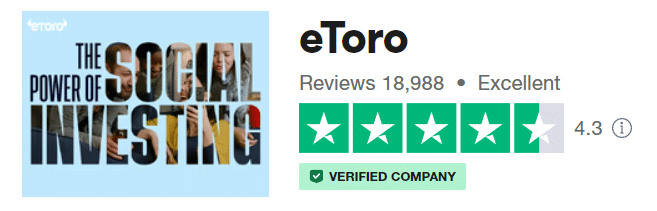

For extra reassurance, they have an ‘Excellent’ rating on Trustpilot (which is quite rare for a trading app), with over 18,000 reviews.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| $50 | 0.8 | 0% | Stocks, indices, ETFs, currencies, commodities, crypto |

Other fees: $5 withdrawal fee, $10 inactivity fee, currency conversion fees

Read my eToro review.

Pros:

- CopyTrader functionality enables seamless replication of experienced traders’ moves

- Incentive program benefits skilled traders when their strategies are mirrored by others

- Zero-commission stock transactions

- Multiple payment options such as wire transfers, card payments, and digital wallets are supported

Cons:

- Support services are not accessible over the weekend

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Other fees apply. Your capital is at risk. For more information, click here.

2. AvaTrade – Best app

After using AvaTrade’s copy trading platform, I found it to be a powerful tool for connecting with traders worldwide and gaining access to their investment strategies through the “AvaSocial” app.

When considering AvaTrade, it’s important to note the minimum deposit requirement of $100 when opening an account.

While this initial deposit may appear relatively high, I discovered that it can sustain your trading activities for a considerable period before needing to make additional deposits.

It’s worth mentioning that AvaTrade is not regulated by the Financial Conduct Authority (FCA) in the UK, which is an aspect to consider when evaluating its regulatory framework. Instead, it’s regulated by the Central Bank of Ireland.

Despite lacking FCA regulation, AvaTrade still adheres to a maximum leverage of 30:1, which aligns with the restrictions imposed on regulated brokers by the FCA.

It’s important to note that AvaTrade imposes an inactivity fee of $50 (USD), €50 (EUR), or £50 (GBP) for accounts that remain inactive for an extended period.

Additionally, there is an administration fee of $100 (USD), €100 (EUR), or £100 (GBP) for certain account types.

However, it’s worth highlighting that AvaTrade does not charge any deposit or withdrawal fees, making it convenient for traders to manage their funds without incurring additional costs.

Overall, my experience with AvaTrade’s copy trading platform has been positive, allowing me to connect with experienced traders and benefit from their investment insights.

While the absence of FCA regulation is a consideration, AvaTrade’s competitive spreads, reasonable trading fees, and access to a diverse community of traders make it a platform worth exploring for those seeking copy trading opportunities.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| £100 | 0.5 | 0% | Forex, stocks, commodities, indices |

Pros:

- Simplifies the process of grasping trading fundamentals

- Revolutionary app for copy trading

- Facilitates global interaction among traders

- Enables round-the-clock trading across a diverse asset range

Cons:

- In its infancy, with room for enhancement in certain areas

3. IG – Best low-cost platform

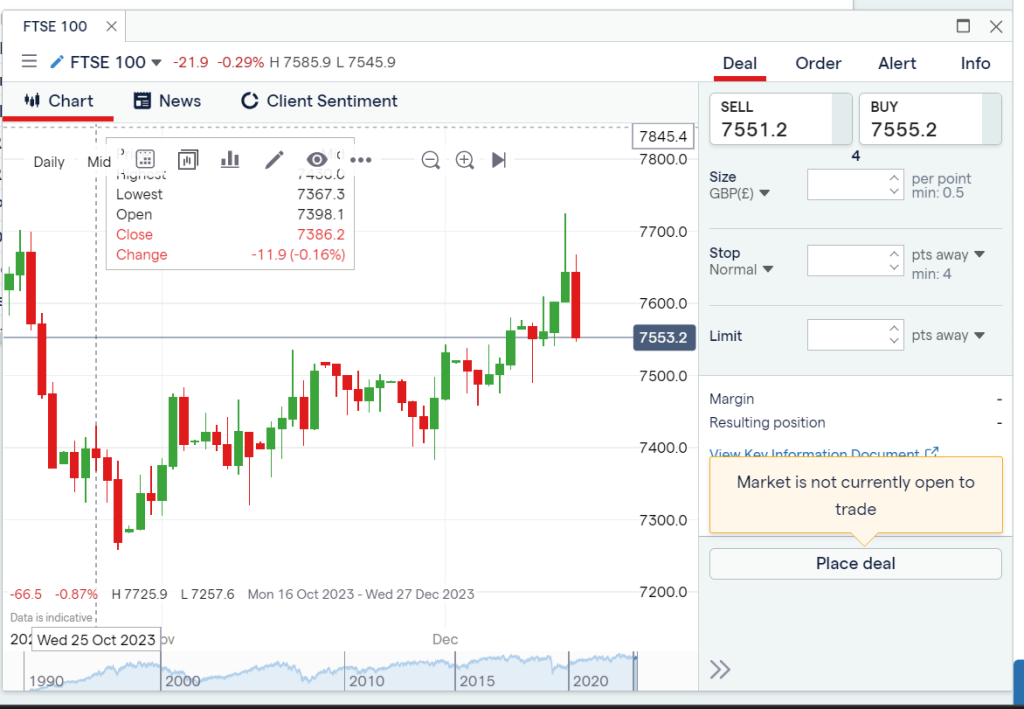

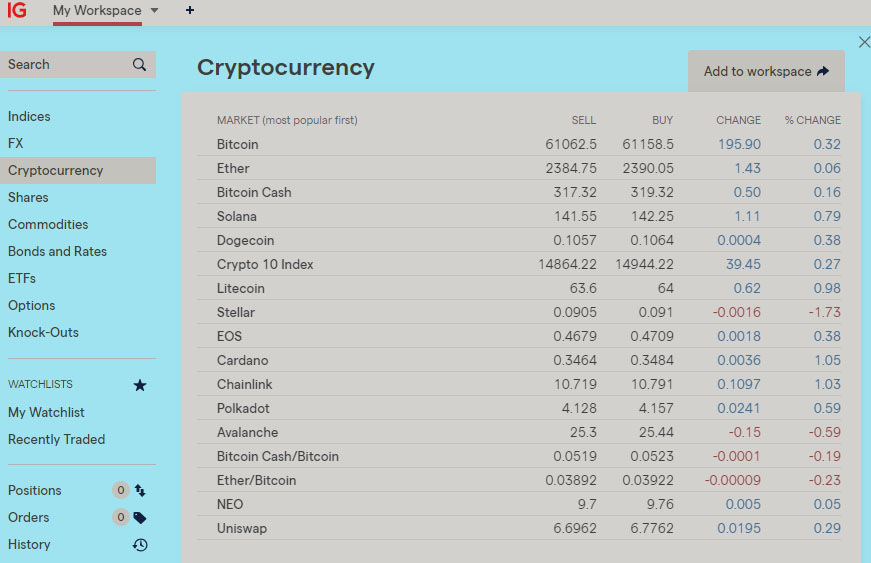

IG holds the distinction of being the largest CFD broker in the world, with a rich history dating back to its establishment in 1974.

I’ve found that it offers an impressive trading experience.

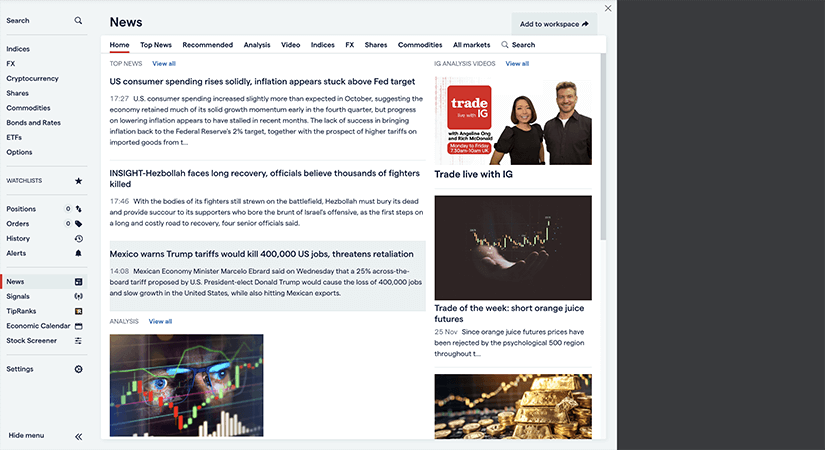

The standout feature is the IG Community trading platform, which provides free access to a vibrant online forum.

Interacting with global traders and sharing trading ideas has been invaluable in expanding my knowledge and improving my strategy.

Additionally, IG offers a range of robust trading platforms, including ProRealTime, MetaTrader 4, and L-2 Dealer, catering to traders of all levels.

These platforms are user-friendly, customisable, and equipped with advanced charting tools for effective market analysis.

The Direct Market Access feature in L-2 Dealer allows direct dealing in the order books, enhancing trade execution.

With access to over 17,000 markets (largely through CFDs and spread bets), IG Markets provides ample opportunities for diversification.

The platform’s long-standing history since 1974 and regulation by the Financial Conduct Authority (FCA) instill confidence in the safety of my investment capital.

Although the trading charges are relatively higher, the wealth of research materials, including advanced charting packages and news feeds, greatly assist in making informed trading decisions.

Moreover, IG Markets offers a wealth of educational resources to support skill development and enhance trading proficiency.

Overall, I’d recommend IG for more experienced traders seeking a comprehensive and reliable trading experience.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| £250 | 0.4 | Varies | Real stocks & ETFs, exchange-traded securities, CFDs (currency pairs, stock indices, stocks, ETFs, commodities, crypto, bonds, and futures) |

Read my IG review.

Pros:

- Sophisticated graphing tools for in-depth market scrutiny

- Multiple trading interfaces are available for selection

- Complimentary membership to IG Community for social trading

- Rapid and adaptable trade execution through the MT4 platform

Cons:

- Higher cost structure

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

4. Pepperstone – Best for CFDs & trading options

Pepperstone is a top choice for novice traders in the UK seeking an intuitive and user-friendly trading experience.

The platform’s seamless performance across all devices, coupled with the option to download the WebTrader app for easy access on a desktop, ensures convenience and flexibility.

What sets Pepperstone apart as one of the best copy trading brokers is its impressive range of third-party social trading platforms, including myfxbook, MetaTrader Signals, and DupliTrade.

Utilising these platforms, you can connect with fellow traders, share trading ideas, and even mirror the trades of expert traders.

This invaluable feature has not only helped automate my trading activities but also accelerated my learning process by studying successful trading strategies.

Beyond copy trading, Pepperstone offers a selection of renowned trading platforms such as TradingView, cTrader, MetaTrader 4, and MetaTrader 5.

These platforms are known for their user-friendly interfaces and extensive customisation options. Equipped with a wide range of built-in technical indicators, expert advisors, and charting tools, they empower traders to efficiently analyse the markets and stay informed about their trading activities.

Pepperstone provides a wealth of educational resources, including tutorial videos, webinars, and articles, to enhance traders’ knowledge and understanding of the market.

These resources are highly valuable, allowing you to quickly grasp key concepts and develop effective trading strategies.

Additionally, the availability of a risk-free demo trading account allows you to familiarise yourself with Pepperstone’s features and functionality before committing your capital.

Pepperstone is a top-rated choice for novice traders in the UK, offering an accessible and user-friendly trading platform, an array of social trading options, and a comprehensive suite of educational materials.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| £0 | 0.4 | 0.10% plus spread | Forex, commodities, indices, currency indices, crypto, stocks, ETFs |

Pros:

- A wide array of intuitive and customisable trading interfaces

- Includes a social trading option to mimic successful trades

- Abundant learning resources and research tools are available

Cons:

- The initial deposit requirement of £200, which is steeper than many competitors

- Overnight holding charges

5. FXTM – Best for forex

As a leading broker in the industry, FXTM has carved a reputable niche in the field of copy trading in the UK.

First established in 2011, FXTM has since built an impressive, award-winning portfolio offering CFD and forex trading services.

It’s authorised and regulated by the FCA and compliant with ESMA, instilling trust and reliability among its users.

In 2016, FXTM introduced “FXTM Invest”, a progressive feature designed for novice traders or those lacking the time to strictly monitor market movements.

The platform allows you to follow and automatically emulate the trading patterns of professional traders. This feature allows you to access trading opportunities without having extensive technical knowledge, thereby revolutionising the concept of social trading.

FXTM Invest encompasses two kinds of users – Investors and Strategy Managers.

Post registration, investors can sift through a list of successful traders, scrutinise their profiles, and choose the ones whose trading patterns they wish to copy.

The selection of strategy managers hinges on their risk-reward profiles aligning with the investor’s objectives and needs.

A minimum deposit of USD 100, EUR 100, or GBP 100 is required to begin.

On the flip side, strategy managers can set their preferred fee for the strategies they provide.

They have the liberty to manage their risk-reward parameters without paying a commission to FXTM.

A dedicated page can be created for their account, facilitating connection with potential investors.

FXTM’s fee structure is notable, however. For CFDs, a holding fee of $29.50 is levied for a $2,000-long position on Apple, a factor that should be borne in mind. Forex fees are competitive at $7.80 for a $20,000 long position on the GBP/USD pair for a week.

Other non-trading fees include a $5 monthly charge after six months of inactivity, a $3 withdrawal fee, and a minimum initial deposit of $50.

Despite the relatively high CFD fees, the real-time notifications, easy fund access, and the potential to profit from the trades of experienced traders make FXTM Invest an attractive option.

The support from a dedicated management team further adds value.

To sum up, FXTM is a robust platform for those interested in diversifying their trading experience.

With its user-friendly interface, responsive customer services, and innovative features like FXTM Invest, it has rightfully secured its spot as one of the best social trading platforms in the UK.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| $10 | 1.0 | The fees are built into the spread, 1 point is the average spread cost during peak trading hours |

Forex, CFDs on stocks commodities, indices, crypto |

Pros:

- Outstanding client support services

- Top-notch analytical instruments for market research

- Swift and streamlined account onboarding process

Cons:

- Mediocre fees for trading CFDs

- Charges for account inactivity and fund withdrawals

- Lacking educational resources and training

6. FP Markets – Best for competitive spreads & diverse trading instruments

FP Markets, a renowned broker established in 2005, offers an outstanding platform for copy trading, particularly praised for its low-cost structure in forex and CFD trading.

This Australian-based broker is regulated in two Tier-1 jurisdictions, ensuring a high level of trust and safety for traders.

While it primarily focuses on MetaTrader and cTrader platforms, it also provides access to over 10,000 tradeable symbols through the Iress platform suite, catering more to share trading.

The broker’s MetaTrader offering, limited to about 130 symbols, is versatile and affordable, but it does fall short in terms of research and educational content compared to industry leaders.

FP Markets has made strides in improving its educational resources, adding courses and articles, though there’s still room for growth, particularly in providing advanced performance metrics in its social trading portal.

FP Markets’ commission-based Raw ECN account stands out for its ultra-competitive spreads, averaging 0.1 pips for EUR/USD as of October 2023.

The broker’s pricing structure is particularly advantageous for active traders or those with higher balance accounts.

For those seeking a more basic, cost-effective option, FP Markets also offers the Iress Investor trading platform, albeit with certain limitations and a less comprehensive charting package.

The broker’s mobile app, a recent addition, provides a good layout but lacks some advanced features found in the best mobile trading apps.

FP Markets compensates for this with reliable alternatives in MetaTrader and cTrader platforms.

In terms of market research, FP Markets offers a mix of daily written articles, video content, and streaming news from reputable sources.

Its research section could benefit from a broader array of daily content to match the offerings of top brokers.

The FP Markets Academy is a step in the right direction for education, providing a range of learning materials for different experience levels.

Overall, FP Markets is a solid choice for traders looking for competitive pricing and a reliable trading environment, particularly for forex trading.

Its expansion into social copy trading, coupled with continuous improvements in research and education, makes it a broker worth considering.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| $50 | 0.5 | Varies | Forex, CFDs, crypto, stocks |

Pros:

- Regulated in two Tier-1 jurisdictions

- Competitive spreads with Raw ECN account

- Offers over 10,000 tradeable symbols on Iress

Cons:

- Limited research and educational content

- Iress platform focused more on share trading

- Mobile app lacks advanced features

7. Vantage – Best for advanced traders

Vantage, acclaimed for its proficiency in copy trading, stands out as one of the UK’s leading platforms in this domain.

Founded in 2009 and operating under multiple regulatory bodies including the ASIC and FCA, Vantage has established itself as a reliable choice for traders interested in Contracts for Difference (CFDs).

However, it’s important to note that CFDs are complex instruments carrying a high risk due to leverage.

The platform’s strengths lie in its diverse offerings and flexibility. It supports various social trading platforms, integrates seamlessly with MetaTrader, and provides a proprietary mobile app.

This integration of TradingView into the MetaTrader suite is particularly commendable, offering a robust trading experience.

Additionally, Vantage offers the Smart Trader add-ons for MetaTrader, enhancing the trading capabilities of its users.

However, the platform is not without its limitations. The Pro ECN account demands a high minimum deposit, potentially alienating budget investors.

Moreover, access to certain advanced tools requires substantial deposits, which might not be feasible for all traders.

One of Vantage’s most significant advantages is its regulatory status in two Tier-1 jurisdictions, providing a high level of trust and reliability.

This trust is further bolstered by the holding of indemnity insurance, offering additional protection beyond regulatory coverage.

Furthermore, Vantage has been recognised among the Best MetaTrader Brokers and Best Copy Trading Brokers for 2023, reflecting its excellence in these areas.

In terms of trading costs, Vantage’s pricing aligns with industry averages but doesn’t outshine the leaders in this aspect.

The broker offers a range of account types, each with its pricing structure, catering to different trading preferences and strategies.

The mobile app, while a solid foundation for trading on the go, is somewhat marred by the presence of ads, which can detract from the user experience.

However, the app does provide effective integration of research and trading tools.

Despite these strengths, Vantage has room for improvement in areas such as research and education, where it lags behind industry leaders.

Expanding and enhancing these offerings could make the platform even more appealing to a broader range of traders.

Vantage is a commendable choice for those interested in copy trading and using MetaTrader platforms, especially for those who prioritise a mix of regulatory safety and flexible trading options.

Key rating criteria:

| Minimum deposit | S&P 500 CFD spread (average) |

Commission | Types of assets |

| $50 | 0.7 | $3.00 per lot per trade plus spread cost | Forex, CFDs, cryptos |

Pros:

- Regulated by multiple authorities

- Diverse trading platform options

- No inactivity fees

Cons:

- Limited educational resources

- High minimum deposit for Pro ECN

- Limited research tools without a $1,000 deposit

How to Choose? Factors to Consider

Choosing the best copy trading platform in the UK requires careful consideration of several key factors.

Along with the key rating criteria I used to rank the platforms, here’s what to look for:

- Regulation & Security: Ensure that the copy trading platform you choose is regulated by a reputable financial authority in the UK, such as the Financial Conduct Authority (FCA). Regulation provides an added layer of protection for your investments and helps ensure the platform adheres to certain standards and practices.

- Copy Trading Options: Assess the copy trading features offered by the platform. Look for platforms that allow you to easily find and filter expert traders based on their performance, risk levels, and trading strategies. The platform should provide comprehensive data on each trader’s past performance, including metrics like return on investment, win ratio, and drawdown. This information will help you make informed decisions when selecting traders to copy.

- Platform Tools & Resources: Consider the platform’s additional tools and resources for market analysis and research. Look for platforms that offer advanced charting packages, technical indicators, economic calendars, and news feeds. These tools can assist you in assessing market conditions and making better-informed investment decisions.

- Transparency & Social Interaction: Evaluate the platform’s transparency and social interaction features. A good copy trading platform should provide transparent statistics and performance metrics for each expert trader, enabling you to assess their track record and risk profile. Additionally, look for platforms that foster social interaction among users, such as forums or chat functionalities, allowing you to connect with other traders, share insights, and learn from their experiences.

- Risk Management Tools: Consider the risk management tools offered by the platform. Look for features like stop-loss orders, risk allocation settings, and the ability to set investment limits. These tools help you manage and control the level of risk associated with copying trades.

- Fees & Costs: Compare the fee structures of different copy trading platforms. Take into account any commission charges, spread markups, subscription fees, or performance fees that may apply. Ensure that the platform’s fee structure aligns with your investment budget and trading frequency.

- Customer Support: Evaluate the quality and availability of customer support provided by the platform. Look for platforms that offer responsive customer service through multiple channels, such as live chat, email, or phone support. Prompt and reliable customer support can be valuable when you have questions or encounter issues while using the platform.

Choosing the right broker is easy with our experts. Answer a few quick questions to get your free personalised recommendation. Take the survey now and start investing smarter!

Final Thoughts

The best copy trading brokers in the UK enhance your trading journey by mirroring expert moves.

My guide helps you select a platform that aligns with your goals, offering convenience and confidence in your investment choices.

But, for beginners, I’d recommend eToro as the best copy trading platform in the UK.

30 million users globally trust eToro for their copy and social trading needs, benefiting from a vast array of stocks, ETFs, forex, commodities, and cryptocurrencies.

- User-friendly platform for beginners

- Copy the moves of professional traders

- Social trading & educational features

FAQs

Is copy trading legal in the UK?

Yes, copy trading is legal in the United Kingdom. It's a practice well-regulated by the Financial Conduct Authority (FCA), the regulatory body responsible for overseeing financial markets in the UK. Platforms that offer copy trading services in the UK must be authorised and compliant with the rules and regulations laid out by the FCA. This includes rules on transparency, customer communication, and the handling of client funds.

Is copy trading taxable in the UK?

Yes, profits from copy trading in the UK are generally subject to tax. They can be treated as capital gains and therefore may be liable to Capital Gains Tax. It's crucial to maintain accurate records of your trading activities and consult with a tax professional to ensure compliance with all relevant tax regulations.

You may also like:

- Best traders to copy on eToro

- Best trading platforms UK

- Best stock trading apps UK

- Best investment apps UK

- Best investment platforms UK

Sources: