In a nutshell, the best low-spread forex brokers in the UK are Plus500, offering competitive spreads and a user-friendly platform; XTB, renowned for its advanced trading tools and low spreads; and IG, recognised for its comprehensive trading tools and low spreads across a wide range of currency pairs.

Looking for your perfect low spread forex broker?

I’ve tested, scored, and ranked the best low spread forex brokers in the UK.

Whether you’re seeking security, user-friendliness, or extensive trading options, I’ve got you covered.

|

Primary Rating:

4.5

|

Primary Rating:

4.4

|

Primary Rating:

4.3

|

|

Description: Award-winning mobile app for forex CFD trading. Comprehensive platform for all levels of experience. |

Description: A reliable trading platform offering a wide range of markets, advanced tools, and educational resources to empower traders of all skill levels. |

Description: Award-winning trading platform offering extensive market access and advanced tools for both beginner and experienced traders. |

|

Pros:

|

Pros:

|

Pros:

|

|

Disclaimer:

80% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

|

Disclaimer:

73% of retail investor accounts lose money when trading CFDs with this provider.

|

Disclaimer:

69% of retail investor accounts lose money when trading CFDs and spread bets with this provider.

|

Award-winning mobile app for forex CFD trading. Comprehensive platform for all levels of experience.

- 70+ currency pairs (CFDs)

- Demo trading account & learning academy

- Trading tools & charts

A reliable trading platform offering a wide range of markets, advanced tools, and educational resources to empower traders of all skill levels.

- User-friendly platforms with intuitive design

- Wide range of instruments, including forex, stocks, and CFDs

- Comprehensive educational tools and webinars

Award-winning trading platform offering extensive market access and advanced tools for both beginner and experienced traders.

- User-friendly platforms with advanced trading tools

- Comprehensive educational resources and demo account

- Wide range of markets

7 Best Low Spread Brokers Ranked

Here is a quick list of the best forex brokers for beginners to use in the UK based on my hands-on analysis:

Best Options Compared

Here I’ve compared the low spread forex brokers based on four key rating criteria you must consider and compare.

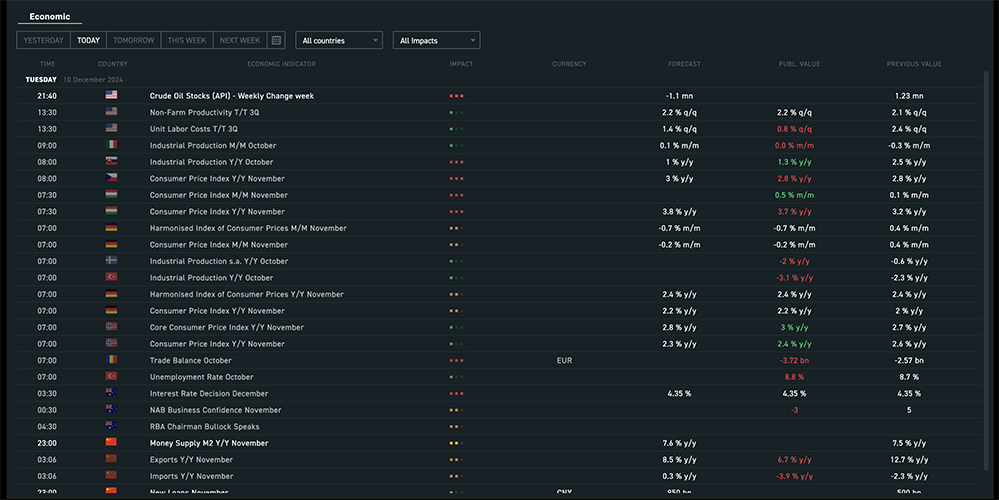

| Rank | FX brokers | Number of currency pairs | Average spread EUR/USD | Minimum deposit | Regulation |

|---|---|---|---|---|---|

| 1 | Plus500 | 70+ | 0.8 | £0 | FCA |

| 2 | XTB | 48 | 1.0 | £0 | FCA |

| 3 | IG | 80+ | 0.86 | £250 | FCA |

| 4 | Trade Nation | 33 | 0.6 | £0 | FCA |

| 5 | AvaTrade | 50+ | 0.92 | $100 | ASIC |

| 6 | Admirals | 50 | 0.1 | $100 | FCA |

| 7 | Pepperstone | 60+ | 0.77 | $200 | FCA |

Reviews

The UK has the largest share of forex trading at 43% globally, making it the largest forex trading center worldwide1.

If you are looking to get started trading forex in the UK, you’re in luck.

There are a variety of excellent brokers available to UK traders, each with its unique features and benefits.

Having worked in the retail investment & trading sector in London over the last four years, I had the opportunity to experience the dynamic and fast-paced forex market first-hand.

In my role working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”, I was able to work with and test some of the biggest UK forex brokers on the market.

Using my experience in this field, I’ve compiled a list of the best low spread forex brokers in the UK based on four key criteria:

- Number of currency pairs

- Average spread EUR/USD

- Minimum deposit

- Regulation

Factors such as usability, education materials, and additional features were also considered.

All the brokers I’ve reviewed below are regulated by the UK’s financial watchdog, the Financial Conduct Authority (FCA).

You can also read about how we test platforms here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

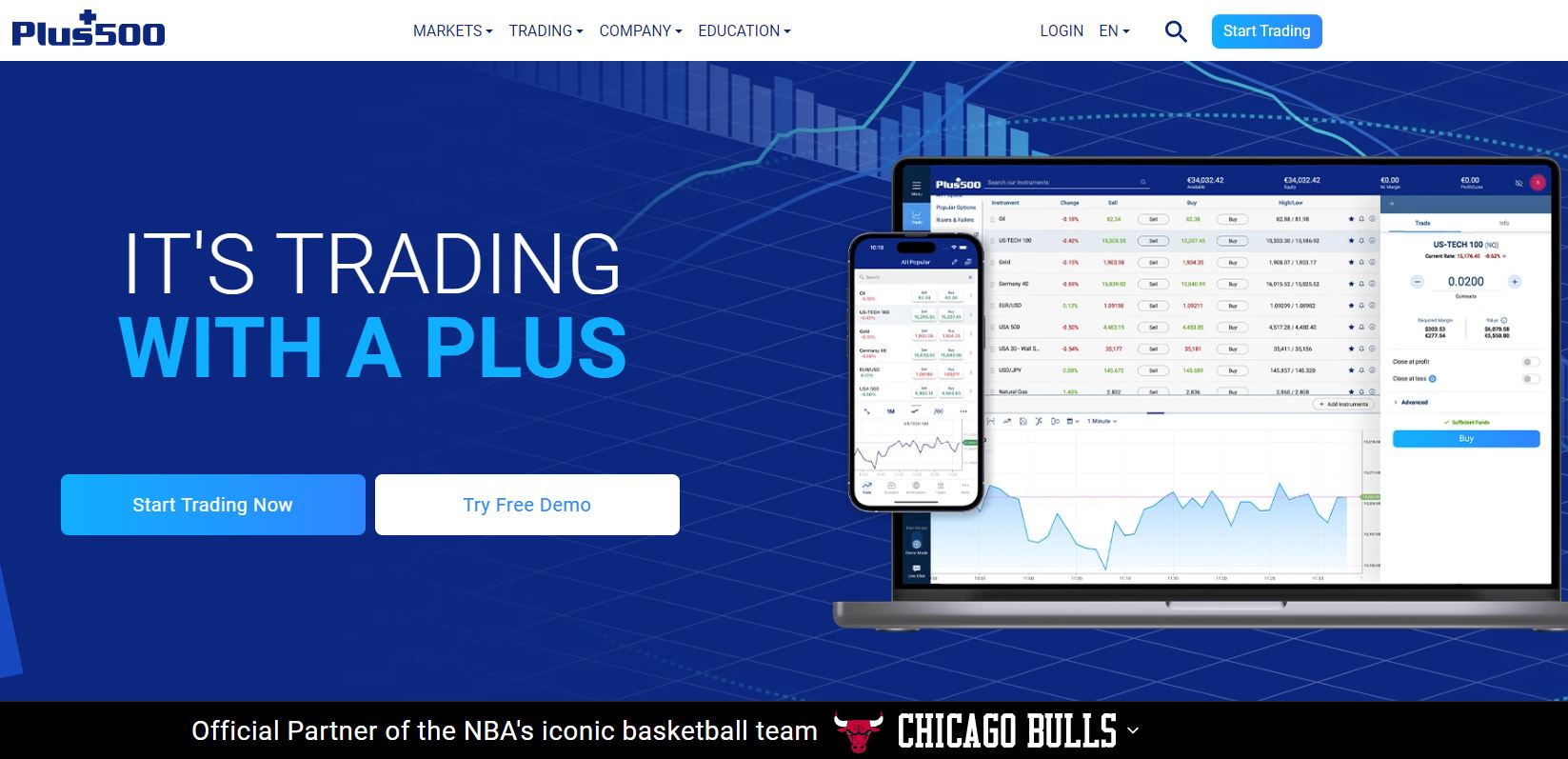

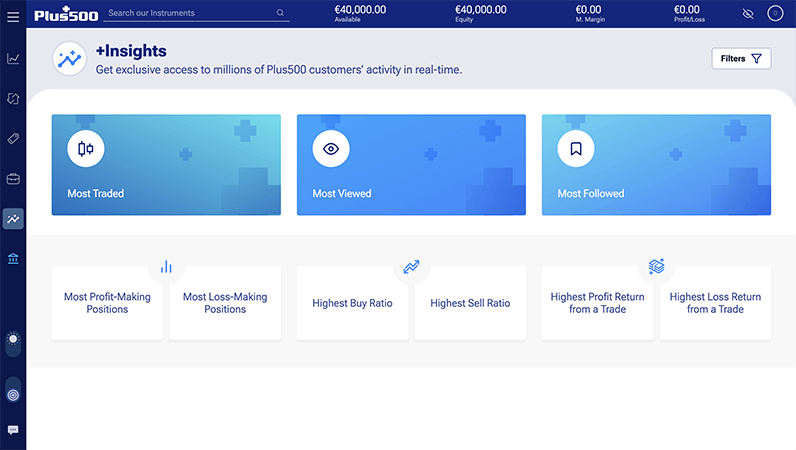

1. Plus500

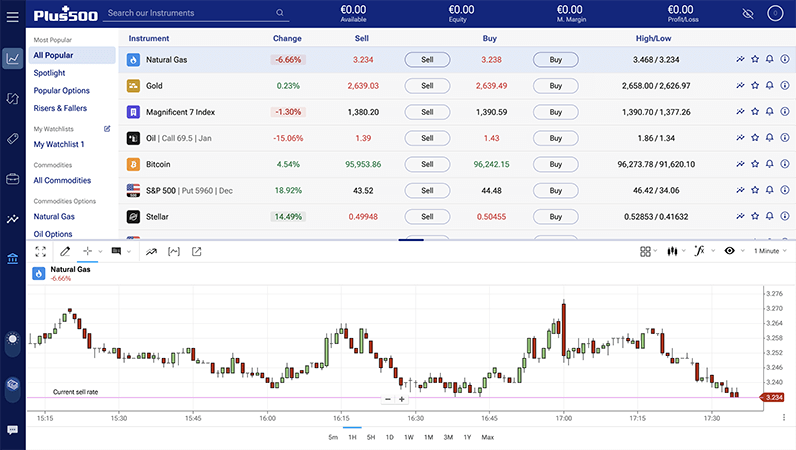

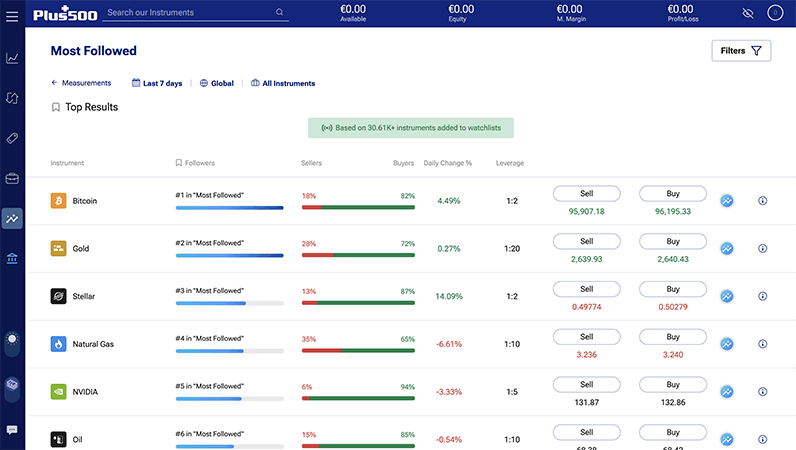

Plus500, recognised globally, excels as a low-spread forex broker in the UK, offering a comprehensive range of CFD trading options.

Its platform is celebrated for its user-friendly interface and advanced tools, providing real-time quotes, efficient order execution, and features like integrated news, risk management tools, and customisable workspaces.

Plus500 provides a streamlined trading experience accessible to both newcomers and experienced traders across multiple devices.

New traders are advised to engage with the Trading Academy and practice using the demo account to gain essential trading skills before investing in real capital.

With competitive spreads across over 2,000 markets and no commission fees, Plus500 stands out for cost-effective trading.

Instruments like EUR/USD and major commodities are available with tight spreads, enhancing trading affordability.

The mobile app extends sophisticated trading capabilities to iOS and Android users, mirroring the web platform’s functionality for trading on-the-go.

Emphasising ease of use, Plus500 supports traders with educational resources, dedicated account assistance, and 24/7 customer service.

Regulated by the FCA and protected under the FSCS up to £85,000, it guarantees a secure trading environment with segregated client accounts and secure transactions.

Plus500’s platform offers rapid trade execution vital for minimising slippage, alongside competitive leverage options up to 1:30, subject to regulatory standards.

Despite average forex CFD fees and an inactivity fee after prolonged non-use, its extensive range of trading instruments and educational support make Plus500 a leading choice for traders seeking a reliable low-spread forex broker in the UK.

Read my complete Plus500 review.

Pros:

- User-friendly and advanced trading platform

- Tight spreads with no commission charges

- Comprehensive mobile trading app

Cons:

- Limited product portfolio compared to some competitors

80% of retail investor accounts lose money when trading spread bets and CFDs with this provider.

2. XTB

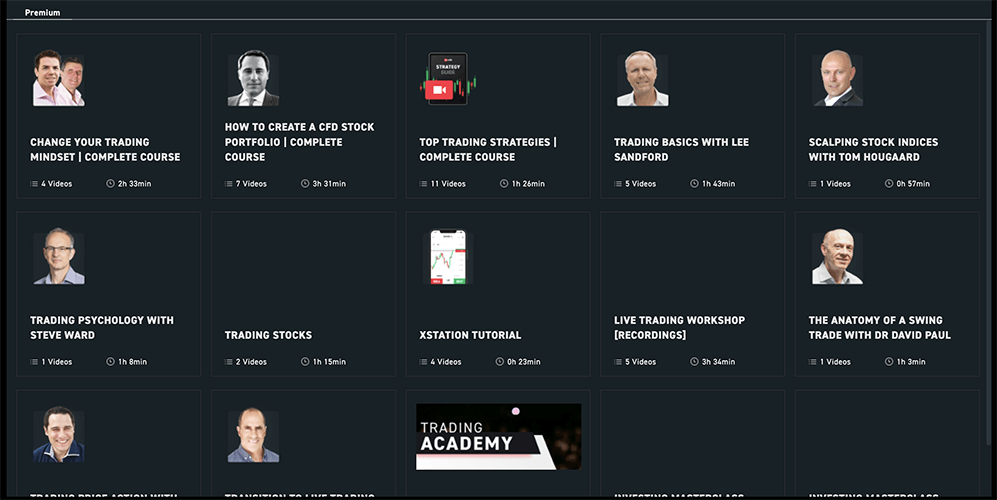

XTB is recognised in the UK as a leading low-spread forex broker, offering a comprehensive array of trading instruments like forex, shares, cryptocurrencies, indices, and commodities.

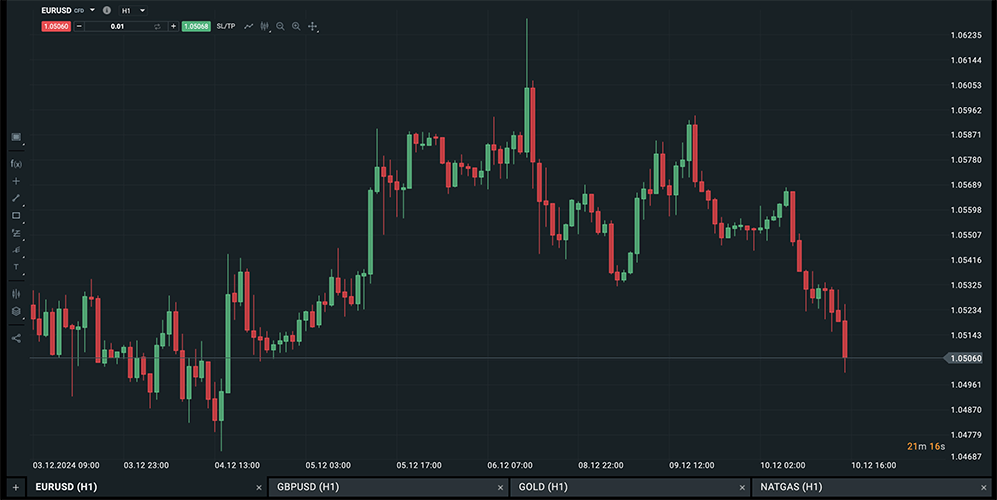

Listed on the stock exchange, XTB is known for its excellent execution on its acclaimed xStation 5 platform, which combines user-friendliness with advanced trading tools.

Key Features:

- Platform Usability: xStation 5 stands out for its customisation, offering swift execution, sentiment analysis, and detailed performance stats. Available across web, desktop, and mobile, it provides a versatile trading experience.

- Competitive Pricing: Spreads start from as low as 0.0 pips for EUR/USD on standard accounts, with clear, transparent fees and fixed commissions on specific markets.

- Mobile Trading: The xStation mobile app offers comprehensive trading functionalities, allowing access to over 2,000 global markets with advanced charting and one-click trading on both iOS and Android.

- Ease of Access: XTB’s platform is designed for intuitive use, supplemented by educational guides and dedicated support to help traders of all levels.

- Regulatory Assurance: Regulated by the FCA, XTB ensures high security and compliance, with segregated client accounts and encryption for data protection. Eligible clients are also covered by the FSCS up to £85,000.

XTB’s platform and MetaTrader 4 cater to diverse trading styles with quick order execution.

Offering variable spreads and commission structures, XTB enables traders to choose the best fit for their strategy, with leverage up to 30:1 for major pairs and different account types to suit various asset preferences.

Despite its vast offerings, XTB maintains a focus on customer support and education, with a multi-lingual website and resources like the Trading Academy to enhance trader knowledge and skills.

With a broad range of forex pairs and CFDs on different assets, XTB allows for substantial market engagement and portfolio diversification.

Pros:

- Wide range of trading instruments

- User-friendly and customisable platform

- Competitive spreads and transparent fee structure

Cons:

- Limited availability of certain trading platforms

- Inactivity fees may apply

73% of retail investor accounts lose money when trading CFDs with this provider.

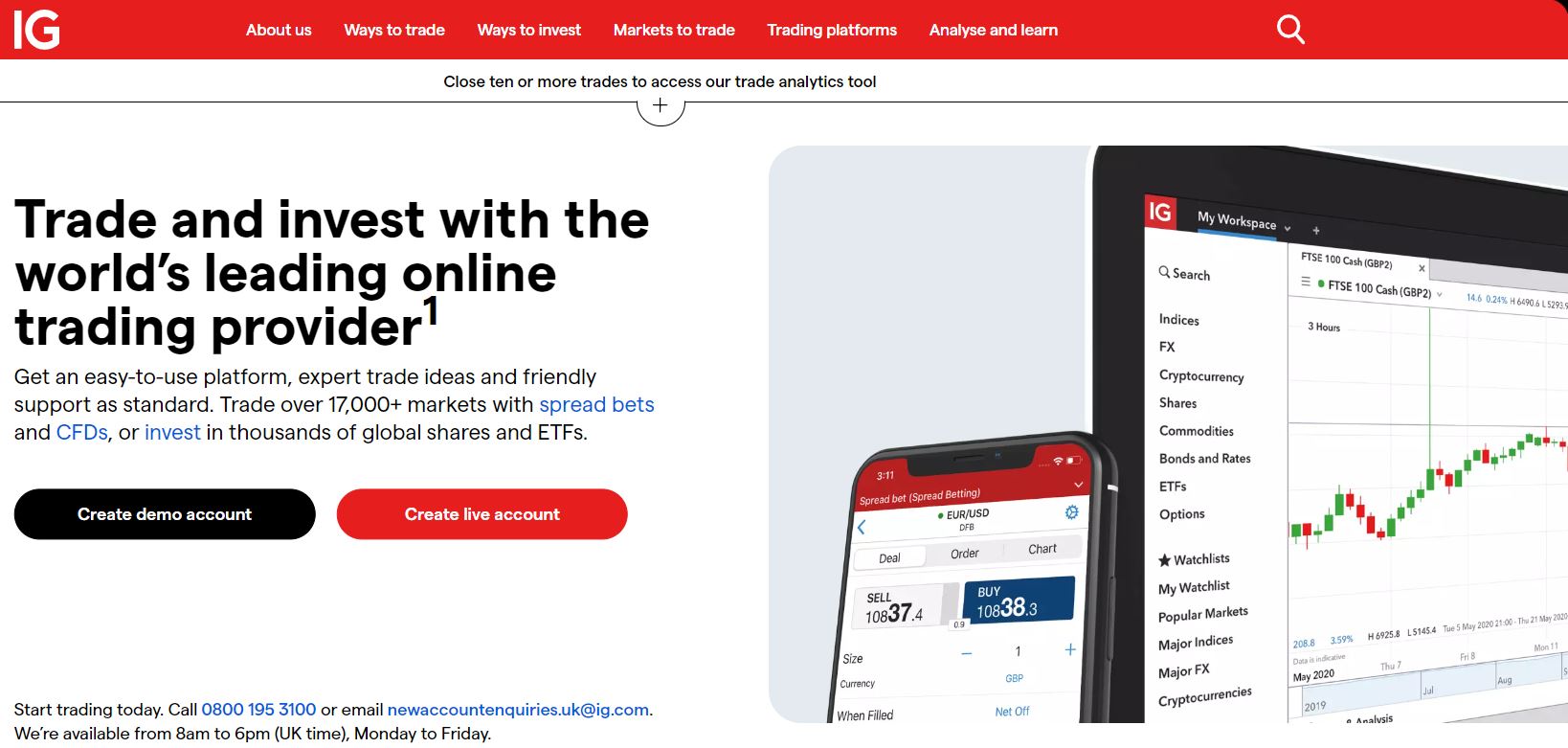

3. IG

IG stands out in the UK as a premier low-spread forex broker, known for its seamless account opening process, comprehensive educational resources, and robust customer service.

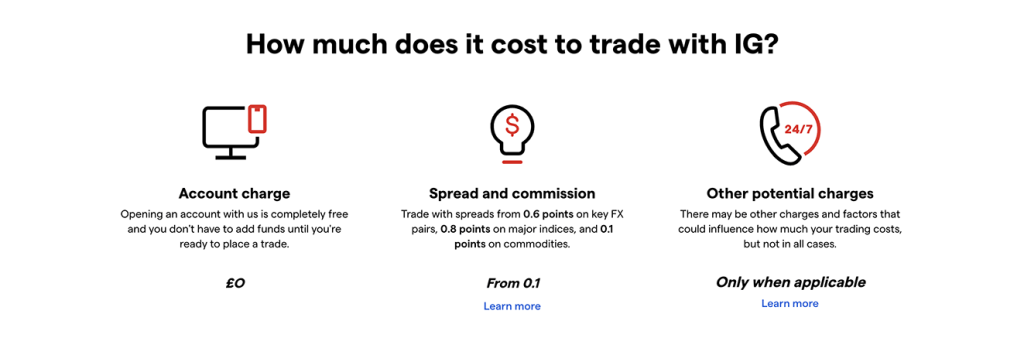

This platform is ideal for traders seeking minimal trading costs, with spreads starting from just 0.6 pips on major currency pairs and no withdrawal fees, making trading more accessible and cost-effective.

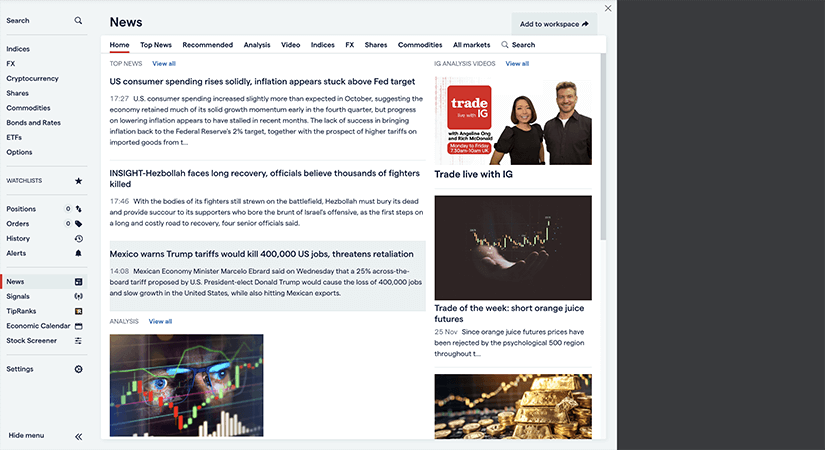

IG provides an intuitive and feature-rich trading experience through its proprietary IG platform and MetaTrader 4 (MT4), catering to both novice and experienced traders.

These platforms offer real-time quotes, rapid order execution, and a variety of tools for effective trading strategies.

Furthermore, IG’s mobile app ensures traders can manage their portfolios on the go, with full feature parity across devices.

Despite its strengths, IG has areas for improvement, including high trading fees for some stock CFDs and slower customer service response times.

However, IG compensates with a £0 minimum deposit, a digital and efficient account opening within a few days, and a diverse offering of financial instruments beyond forex, such as stocks, commodities, indices, and cryptocurrencies.

Regulated by the Financial Conduct Authority (FCA), IG provides a secure trading environment with segregated client accounts and participates in the Financial Services Compensation Scheme (FSCS), offering protection up to £85,000.

With its competitive spreads, extensive market access, and reliable platform, IG solidifies its position as one of the best low-spread forex brokers in the UK.

Read my complete IG review.

Pros:

- Competitive low spreads starting

- £0 minimum deposit and free deposit and withdrawal options

- Comprehensive educational resources

Cons:

- Higher trading fees for some stock CFDs can increase trading costs

- Customer service response times may be slower than expected

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

4. Trade Nation

Trade Nation distinguishes itself as a prominent low-spread forex broker in the UK, offering competitively priced fixed spreads and a seamless trading experience.

Trade Nation is designed to cater to both new and experienced traders, offering easy navigation, customisable charts, and a suite of analytical tools.

It provides real-time pricing and advanced charting on both web and mobile platforms, ensuring accessibility and efficiency for traders on the move.

Recognised for its transparent pricing model, Trade Nation offers fixed spreads with no hidden fees, making it an attractive option for active traders seeking cost-effective trading solutions.

The broker is regulated by top-tier authorities like the FCA and ASIC, guaranteeing a secure trading environment with strict adherence to regulatory standards.

Trade Nation’s mobile app allows traders to stay flexible by offering the same functionalities as the desktop platform. It supports full account management and seamless trading capabilities, making it easy to trade on the go.

The platform’s user-friendliness is complemented by educational resources and personalised support, enhancing the trading experience for beginners.

With a broad range of over 1,000 assets including forex and CFDs, and competitive trading conditions like low stock and index CFD fees and no minimum deposit requirements, Trade Nation stands out as a leading choice for traders in the UK looking for a reliable and efficient broker.

Pros:

- Fixed spreads for transparent trading costs

- User-friendly and intuitive trading platform

- Strong regulatory compliance and safety measures

Cons:

- Limited product portfolio compared to some competitors

- Fixed spreads may not be suitable for all trading strategies

5. AvaTrade

AvaTrade stands out as a leading low-spread forex broker in the UK, distinguished by its diverse array of trading platforms and instruments.

Regulated by esteemed authorities such as the Central Bank of Ireland and ASIC, AvaTrade ensures a secure trading environment, fostering trader confidence.

Its platforms, including MetaTrader 4/5 and AvaTradeGo, cater to various trading styles and strategies, offering advanced tools and personalised support.

AvaTrade’s competitive spreads, starting from 0.9 pips for major forex pairs, contribute to its appeal, making trading cost-effective.

While certain assets may incur commissions, overall trading costs remain low, particularly for active traders. The AvaTradeGo mobile app enhances trading flexibility, allowing for real-time trading, chart analysis, and access to market news on the go.

With its intuitive interface, the app ensures secure trading, even on mobile devices. AvaTrade prioritises user experience, providing user-friendly platforms and comprehensive educational resources to traders of all levels.

AvaTrade upholds high security standards with stringent regulation and advanced protective measures. Client funds are kept in segregated accounts, while SSL encryption ensures safe transactions and data protection.

Eligible clients also benefit from investor compensation schemes, further enhancing trust. AvaTrade’s fast trade execution and diverse trading tools, such as DupliTrade and ZuluTrade for copy trading, augment trading opportunities and strategies.

Through its AvaTrade Academy, the broker offers extensive support and educational materials, empowering traders to enhance their skills and knowledge.

Offering a wide range of trading instruments, including forex, CFDs on stocks, indices, commodities, and cryptocurrencies, AvaTrade caters to diverse trading preferences, solidifying its position as a preferred choice for UK forex traders seeking low spreads and high-quality trading experiences.

Pros:

- Diverse range of trading platforms, including MT4/5 and AvaOptions

- Competitive spreads and transparent pricing

- Extensive educational resources and personalised customer support

Cons:

- Inactivity fees for dormant accounts

- Limited product portfolio compared to some competitors

6. Admirals

Admirals, formerly Admiral Markets, is a top choice for low-spread forex trading in the UK.

Offering state-of-the-art platforms for currency, metals, and CFD trading, Admirals ensures a secure and empowering trading environment.

With platforms like MetaTrader 4/5 and Admirals Mobile App, traders get access to advanced tools and real-time charts.

Competitive spreads starting from 0 pips on forex and tight spreads on indices and commodities make Admirals appealing.

The Admirals Mobile App allows you to trade on the go with ease, offering intuitive features such as real-time pricing, advanced charting tools, and one-click trading for a seamless experience.

Novice and experienced traders benefit from user-friendly platforms and extensive educational resources. Admirals are regulated by top financial authorities like FCA and CySEC, providing high-level security and fairness.

Negative balance protection and participation in compensation schemes further ensure trader safety.

With a wide range of assets including over 3,900 CFDs and real shares, Admirals caters to diverse trading preferences, making it a preferred choice for UK traders.

Pros:

- Competitive forex CFD fees

- Efficient and no-cost deposit and withdrawal process

- Simple and swift account setup

Cons:

- Limited product range, primarily focused on CFDs

- Inactivity charges may apply

- Lack of round-the-clock customer support

7. Pepperstone

Pepperstone is a leading forex broker in the UK, offering a wide range of CFDs across forex, indices, commodities, and shares.

Pepperstone offers a range of powerful trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. These platforms provide fast execution, advanced charting tools, and a seamless trading experience for both beginners and professionals.

Competitive spreads starting from 0.0 pips and transparent fee structures make Pepperstone appealing to traders. The mobile app replicates desktop functionality, allowing traders to manage accounts and access real-time data on the go.

Extensive platform guides and 24/5 multilingual support ensure ease of use for all traders. Pepperstone is regulated by top authorities like FCA, ASIC, and more, ensuring high-security standards.

Negative balance protection and participation in compensation schemes provide added safety. Pepperstone offers leading trading platforms like MT4, MT5, and cTrader, with low fees and competitive spreads.

Leverage options up to 1:400 are available, with multilingual customer support via telephone, email, and live chat.

Educational resources cater to traders of all levels, and Pepperstone offers a wide array of trading instruments, including over 100 currency pairs.

Pros:

- Wide range of trading platforms including MT4, MT5, cTrader, and TradingView

- Competitive spreads starting from 0.0 pips

Cons:

- Inactivity fees may apply to dormant accounts

- Some traders may find the platform features overwhelming initially

Importance of Low Spreads in Forex Trading

Spreads are critical in forex trading and can significantly impact a trader’s profitability, especially for high-frequency trading strategies.

The spread refers to the difference between the bid and ask price of a currency pair. It constitutes a trading cost that eats into returns.

Lower spreads allow traders to enter and exit positions seamlessly around key technical levels without incurring substantial costs.

This fluidity in execution becomes particularly important for scalpers and day traders who open multiple positions throughout the day. Competitive spreads also provide more flexibility in employing wider stop-losses that accommodate market volatility.

While all trading styles benefit from low spreads to a certain degree, they hold special significance for short-term traders.

Strategies like swing trading or position trading focused on larger moves and longer time frames, can sustain slightly higher spreads without entirely compromising profits.

But for those seeking to capture small intraday moves, every pip matters, making ultra-low spreads a must.

Spreads also tend to widen during news events or volatile markets as liquidity decreases.

Therefore, traders must understand a broker’s spread widening policy and typical spreads during regular and irregular market conditions.

This analysis helps determine if the broker can retain competitive spreads during volatility scenarios that often trigger stop-outs.

How to Choose? Factors to Consider

Choosing the best low spread Forex broker in the UK involves considering several factors that go beyond just the spread. Here’s a guide to help you make an informed decision:

Regulatory Compliance

Ensure the broker is regulated by a reputable authority. In the UK, this would be the Financial Conduct Authority (FCA). A regulated broker offers you a level of protection and adherence to standards.

Spread and Commissions

- Low Spread: Look for brokers offering low spreads on the currency pairs you are interested in trading. However, be mindful of whether these are fixed or variable spreads.

- Commissions: Some brokers might offer low spreads but charge higher commissions on trades. Evaluate the overall cost of trading, not just the spread.

Trading Platform

The trading platform should be user-friendly, reliable, and offer the tools and analysis you need. Popular platforms include MetaTrader 4/5 and cTrader. Consider if the broker provides a demo account to test the platform.

Execution Speed

Fast execution speeds are critical in forex trading, where prices can change rapidly. A good broker should offer quick execution to help you trade at the prices you want.

Customer Service

Good customer support is essential, especially for new traders. Check if the broker offers 24/5 support, the channels through which you can reach them (email, live chat, phone), and if they provide support in your preferred language.

Deposit and Withdrawal

The process should be straightforward and without excessive fees. Check the broker’s policies on deposit and withdrawal methods, processing times, and any associated fees.

Account Types

Brokers offer various account types, each with different features, such as leverage, minimum deposit requirements, and spread types. Choose one that suits your trading style and financial situation.

Additional Services

Consider if the broker offers additional services such as educational resources, market analysis, and news feeds. These can be valuable, especially for less experienced traders.

Reputation and Reviews

Research the broker’s reputation within the trading community. Look for reviews and feedback from other traders to gauge the broker’s reliability, customer service, and overall trading experience.

Security

Ensure the broker uses high-level security measures to protect your data and funds. This includes data encryption and two-factor authentication (2FA) for account access.

Comparison and Testing

It’s advisable to narrow down your choices to a few brokers that meet your criteria and then test them using demo trading accounts.

This hands-on experience can be invaluable in making your final decision.

Remember, while low spreads are attractive, they should not be the sole criterion for choosing a broker. The overall trading conditions, regulatory compliance, and reliability of the broker are equally, if not more, important.

Choosing the right broker is easy with our experts. Answer a few quick questions to get your free personalised recommendation. Take the survey now and start investing smarter!

FAQs

Should I use a low spread broker to trade forex?

Using a low spread broker for Forex trading can be beneficial if you are a day trader or scalper, as lower spreads mean reduced trading costs and potentially higher profits from small price movements. However, consider other factors such as commission fees, execution speed, and regulatory compliance of the broker before making a decision.

How are forex spreads calculated?

Forex spreads are calculated as the difference between the bid price (what buyers are willing to pay) and the ask price (what sellers are asking for) of a currency pair. It is typically measured in pips, which is the smallest price movement a currency pair can make. For example, if the EUR/USD bid price is 1.1050 and the ask price is 1.1052, the spread is 2 pips.

Is there a broker with 0 spreads?

Yes, some brokers offer accounts with 0 spreads, typically known as “raw spread” or “zero spread” accounts. These accounts provide spreads from 0 pips on certain currency pairs but usually charge a fixed commission per trade or lot as compensation for the reduced spread. It’s essential to research and compare the overall trading costs, including commissions and other fees, to determine if a zero-spread account is cost-effective for your trading strategy.

You may also like:

Will Fenton

Will Fenton is the founder of Sterling Savvy. He is a personal finance expert and writes about trading, investing, budgeting, and other financial topics.

Along with his education, Will has experience working in the financial services industry in London working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”.

Education:

MA (Hons) Economics and Finance, Heriot-Watt University

Press:

Outside of finance:

Will is also the founder of MIDDER, where he manages a small team of journalists who report on the latest news and developments in AI, Web3, blockchain, NFTs, and crypto within the realm of music.

He's been featured discussing the future of music on The Standard and the Daily Mail.