In a nutshell, the best share dealing accounts in the UK are eToro, known for its social trading platform and a wide range of investment options; XTB, offering a feature-rich platform with comprehensive educational resources and competitive spreads; and IG, providing a robust platform with extensive market access and professional-grade trading tools.

Looking for your perfect share dealing account?

I’ve tested, scored, and ranked the best choices in the UK.

Whether you’re seeking security, user-friendliness, or low fees, I’ve got you covered.

30 million users globally trust eToro for their social investing needs, benefiting from a vast array of shares, ETFs, and investment portfolios.

Top 8 Accounts for Share Dealing Ranked

Here is a quick list of the best share dealing accounts to use in the UK based on my hands-on analysis:

Your capital is at risk.

- eToro – Best for beginners

- XTB – Best for low-cost share and ETF trading

- IG – Best for experienced investors

- Plus500 – One of the best for CFD share trading

- InvestEngine – Best for ETFs

Best Options Compared for UK Investors

Here I’ve compared the accounts based on six key factors you must consider and compare.

| Rank | Accounts | No. of stocks | No. of stock markets | Real stock fees | Non-trading fees | Minimum deposit | Trading platforms |

|---|---|---|---|---|---|---|---|

| 1 | eToro | 3,000+ | 17 | £0 | $5 withdrawal fee, inactivity fee, currency conversion fee | $50 | Proprietary web trading platform and mobile app |

| 2 | XTB | 5,600+ | 17 | 0% commission up to £85,000 monthly volume; 0.2% thereafter (min. €10) | £9/month inactivity fee after 12 months of inactivity | £0 | Proprietary xStation platform (web and mobile) |

| 3 | IG | 12,000+ | 12+ | £8 per UK/EU trade (£3 for active traders), free US trades | £12/month inactivity fee after 2 years of no activity | £250 | Proprietary platform, MetaTrader 4 (MT4), ProRealTime, mobile app |

| 4 | Plus500 | 2,000+ | 20+ | 0% | $10 inactivity fee after 3 months | £100 | Proprietary web trading platform, mobile app |

| 5 | InvestEngine | 600+ ETFs | n/a | £0 | £0 | £100 | Proprietary web and mobile platform |

Reviews

Research shows in 2024 around 2 in 5 Brits (42%) invest and trade, up from 36% in 20211.

Choosing the best share dealing account is crucial for newcomers in the market.

Having worked in the retail investment sector in London over the last four years, I had the opportunity to experience the rise first-hand.

Additionally, in my role working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”, I was able to work with and test some of the biggest UK share dealing accounts on the market.

Using my experience in this field, I’ve compiled a list of the best share dealing accounts in the UK based on six key criteria:

- Number of stocks

- Number of stock markets

- Real stock fees

- Non-trading fees

- Minimum deposit

- Trading platforms

Factors such as usability, research tools, educational materials, and additional features were also considered.

All the share dealing accounts I’ve reviewed below are regulated by the UK’s financial watchdog, the Financial Conduct Authority (FCA).

You can read about how we test platforms here.

This article was reviewed by Tobi Opeyemi Amure, a trading expert and writer at Investopedia, Investing.com, and Trading.biz.

1. eToro – Best for beginners

The overall winner on my list of the best share dealing accounts and what I recommend to beginners is eToro.

eToro stands out by offering commission-free trading on stocks, making it an appealing option for cost-conscious traders.

Its social trading community provides a valuable platform for beginners to interact and learn from experienced traders.

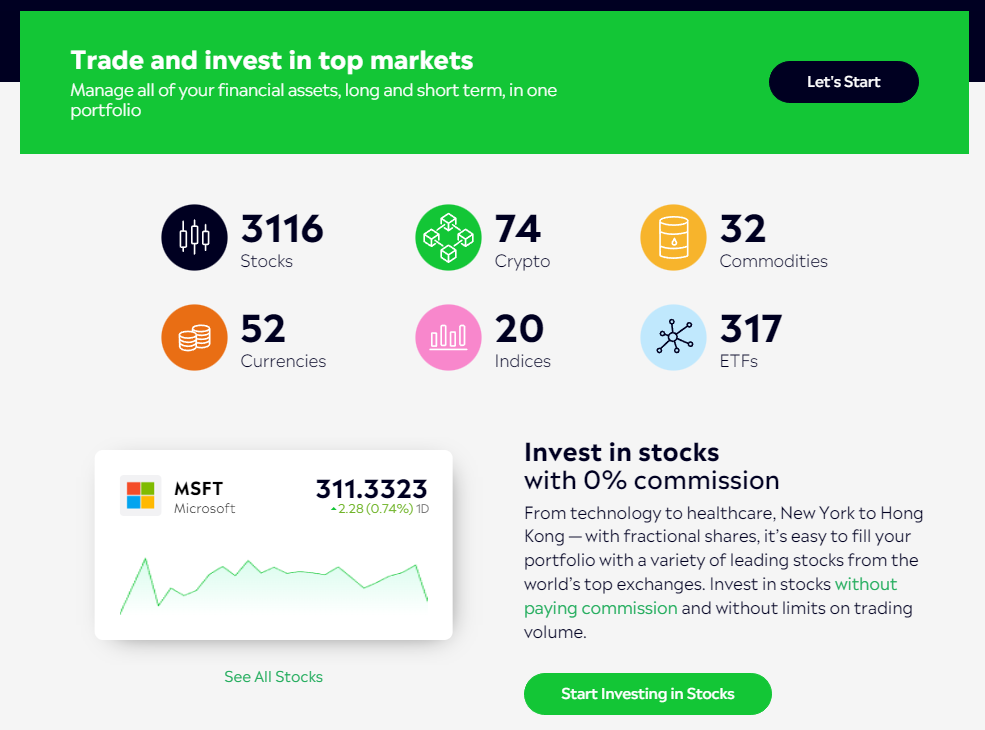

With a user-friendly interface optimised for web and mobile devices, eToro simplifies the trading process, granting seamless access to the stock exchange. The platform offers a diverse range of assets, including stocks, forex, CFDs, ETFs, and cryptocurrencies.

With over 40 pre-constructed Smart Portfolios, eToro streamlines the trading experience, enabling beginners to embark on their investment journey effortlessly.

The platform features a ‘Demo Account’ and ‘General Investment Account,’ both completely free to use, allowing users to explore and familiarise themselves without any fees.

While eToro provides numerous benefits, it’s important to consider factors like the absence of tax wrappers such as ISAs or SIPPs and potential high fees for forex trading.

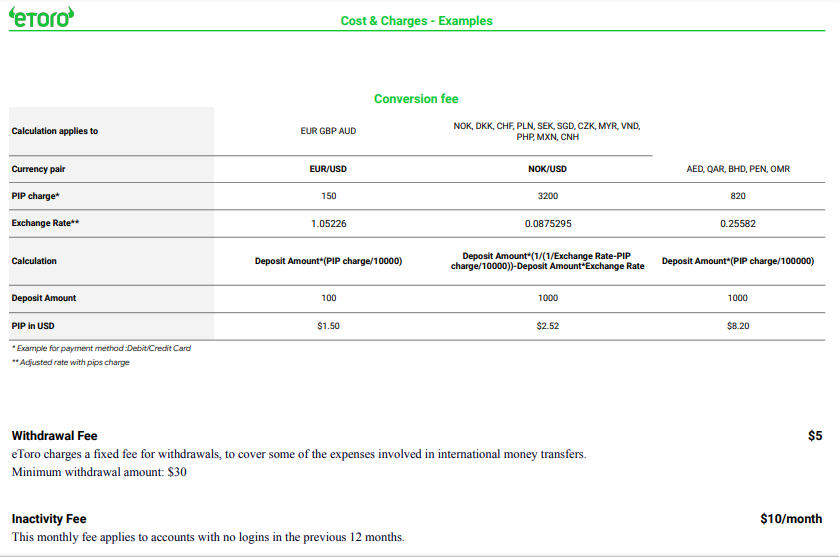

Users should also be mindful of conversion, inactivity, and withdrawal fees.

Overall, eToro remains an excellent choice for those seeking a cost-effective and user-friendly share dealing account with a thriving social trading community.

Finally, it’s worth noting that as of 2023, eToro announced that they reached 30 million registered users worldwide.

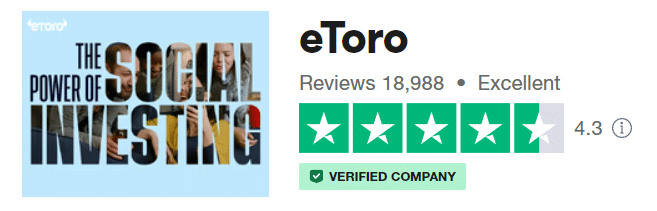

On top of this, they have an ‘Excellent’ rating on Trustpilot (which is quite rare for a trading app), with over 18,000 reviews.

- Fees: Commission-free trading, $5 withdrawal fee, $10 inactivity fee, currency conversion fees

- Minimum balance: $50

- Instruments: Stocks, Index CFDs, ETF CFDs, Investment Trusts, Forex, Crypto and Commodities.

Pros:

- Commission-free trading for stocks and ETFs.

- Smooth and straightforward account setup process.

- Access to social trading features.

Cons:

- $5 charge for withdrawals.

- Limited to a single account currency option.

- Room for improvement in customer support services.

Read my eToro review.

{etoroCFDrisk}% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Other fees apply. Your capital is at risk. For more information, click here.

2. XTB – Best for low-cost share and ETF trading

Second on my list of the best share dealing accounts in the UK is XTB, which stands out for its low-cost structure and robust platform, which is ideal for both beginner and seasoned investors.

XTB is a global broker known for offering commission-free trading on shares and ETFs up to a monthly limit (£100,000 in nominal value).

Beyond this, competitive commission rates apply, making it a cost-effective choice for investors aiming to maximise returns.

Unlike some platforms that focus solely on CFDs, XTB provides the option to trade real shares, which is a significant advantage for those who prefer long-term investing.

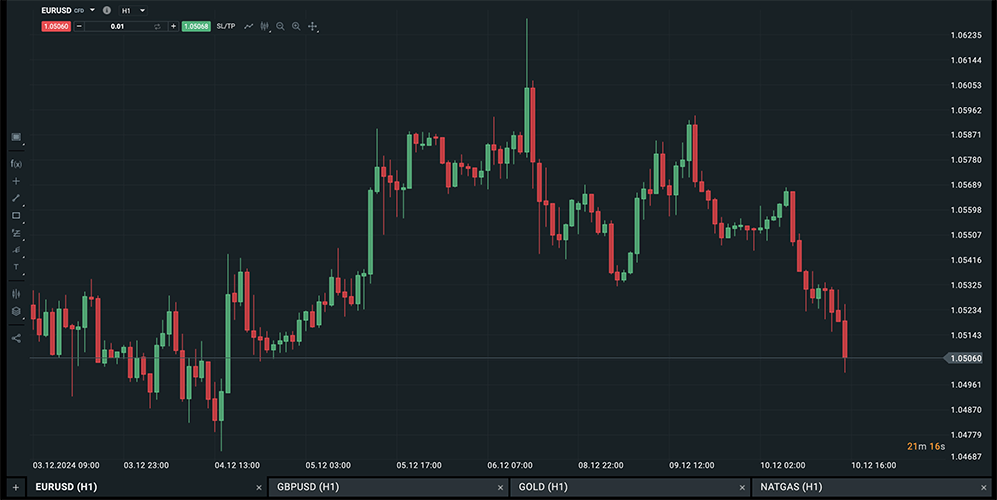

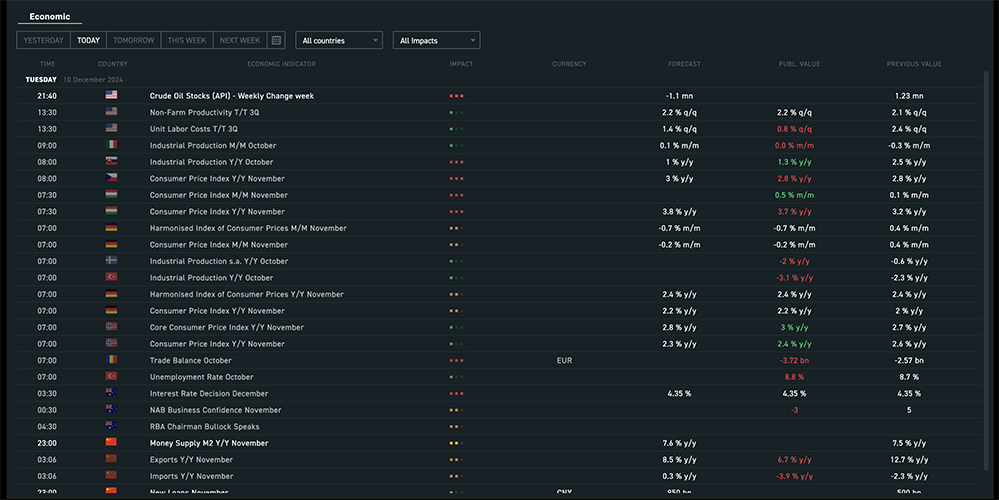

From my experience, XTB’s proprietary platform, xStation 5, is highly intuitive and packed with features such as advanced charting, risk management tools, and real-time market sentiment indicators.

I’ve particularly appreciated the customisable layouts and the ease with which I can access research materials and educational content directly from the platform.

Their mobile app also offers a seamless experience for managing investments on the go.

One of the features I found most appealing is XTB’s commitment to transparency.

There are no hidden fees, and the platform clearly outlines all potential charges, including currency conversion fees and overnight holding costs for leveraged positions.

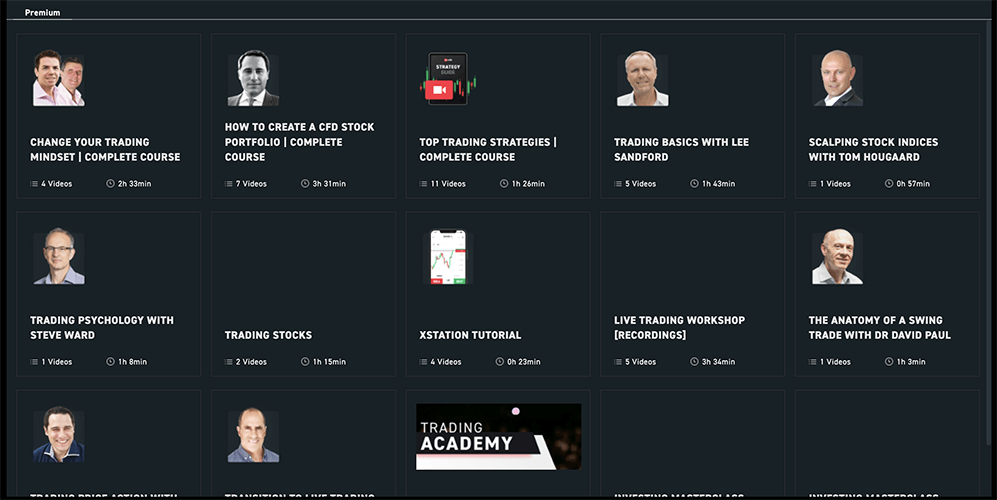

For traders who value educational resources, XTB excels with its comprehensive library of tutorials, webinars, and market analysis.

Pros:

- Commission-free trading on shares and ETFs (up to the monthly limit).

- Powerful and user-friendly xStation 5 platform.

- Excellent educational resources and market analysis.

Cons:

- Limited product range compared to competitors.

- Currency conversion fees for non-GBP trades.

73% of retail investor accounts lose money when trading CFDs with this provider.

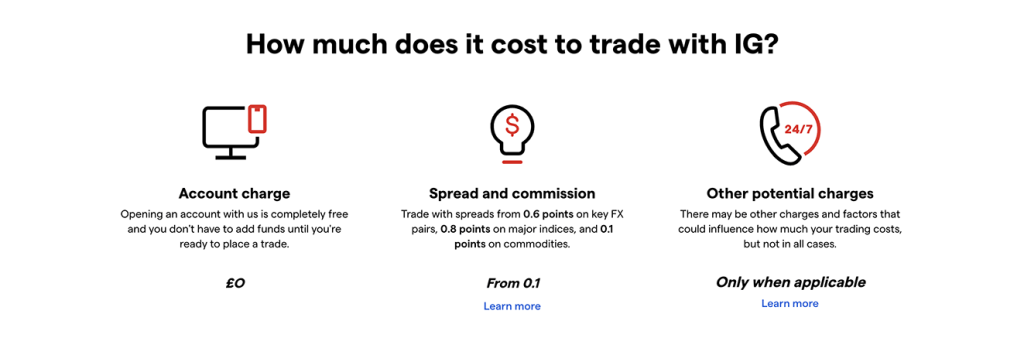

3. IG – Best for experienced investors

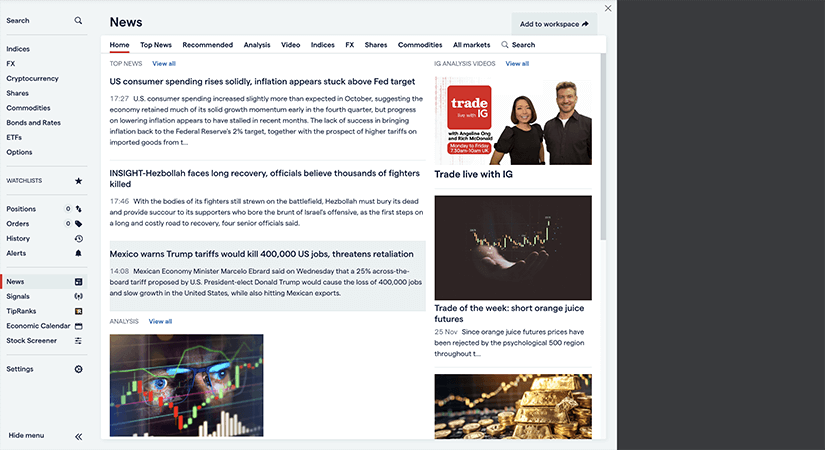

IG ranks highly on my list of the best share dealing accounts, especially recommended for experienced investors seeking a comprehensive platform with advanced trading tools.

IG offers over 12,000 global shares, allowing investors to diversify their portfolios across multiple markets, including the UK, US, and European exchanges. While UK and European shares come with a £8 commission per trade, active traders (those who execute three or more trades per month) benefit from a reduced fee of £3 per trade. Additionally, US shares can be traded commission-free.

One of IG’s standout features is its range of trading platforms, including its proprietary platform, MetaTrader 4 (MT4), and ProRealTime, offering advanced charting tools and technical analysis for more sophisticated traders.

The platform is accessible via web, mobile, and desktop, ensuring flexibility for all types of investors.

IG offers a Stocks and Shares ISA for tax-efficient investing, allowing investors to grow their portfolios without paying capital gains or income tax on their profits.

Additionally, a Self-Invested Personal Pension (SIPP) is available for those planning retirement.

IG provides a demo account, allowing users to test the platform and develop strategies before committing real funds. The platform’s educational resources, including webinars and market analysis, benefit investors looking to expand their market knowledge.

While IG offers a wide array of tools and resources, beginners may find the platform’s advanced features slightly overwhelming. Furthermore, after two years of no trading activity, an inactivity fee of £12 per month is applied.

Overall, I recommend IG for seasoned investors seeking extensive market access, advanced trading tools, and tax-efficient investment accounts.

- Fees: £8 per trade on UK/EU shares (£3 for active traders); free US shares

- Minimum balance: £250

- Instruments: Stocks, Index CFDs, ETFs, Investment Trusts, Forex, Crypto, Commodities

Pros:

- Access to over 12,000 global shares.

- Reduced commission for active traders.

- Advanced trading platforms with charting tools.

- Offers Stocks and Shares ISA and SIPP.

Cons:

- The platform may be complex for beginners.

- £12 inactivity fee after two years of no activity.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading spread bets and CFDs with this provider. You should consider whether you understand how spread bets and CFDs work, and whether you can afford to take the high risk of losing your money.

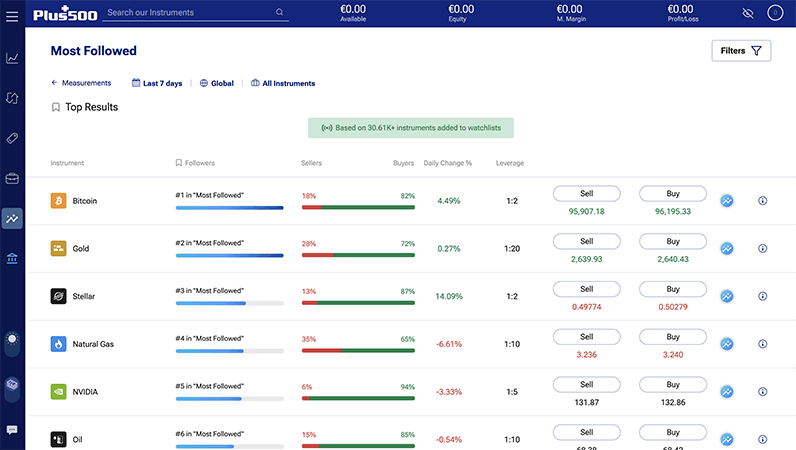

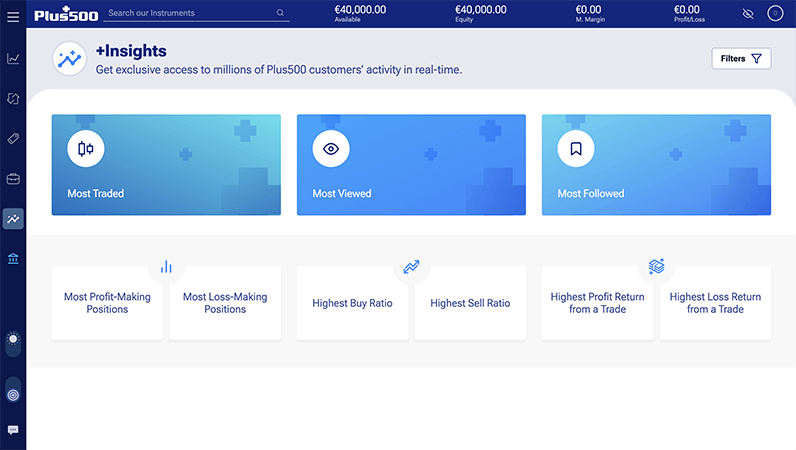

4. Plus500 – One of the best for CFD share trading

Fourth on my list of the best share dealing accounts is Plus500, which is best known for its excellence in CFD share trading.

While Plus500 does not offer traditional share dealing where you own the actual shares, it provides a platform to trade Contracts for Difference (CFDs) on a wide range of shares from global markets. This allows you to speculate on price movements of shares without owning the underlying assets, enabling both long and short positions.

From my experience, Plus500 offers a user-friendly and intuitive platform optimised for both web and mobile devices.

The platform features advanced charting tools, real-time market data, and various risk management tools like stop-loss and take-profit orders, which I’ve found invaluable for managing trades effectively.

One of the standout features of Plus500 is its zero-commission trading model, with competitive spreads and no hidden fees. This is particularly beneficial for active traders aiming to minimise costs.

The minimum deposit to get started is £100, making it accessible for traders with varying budgets.

It’s important to note that CFD trading involves significant risk due to leverage and may not be suitable for all investors. Plus500 provides features like negative balance protection to help manage these risks.

As of 2025, Plus500 continues to expand its global presence, serving millions of customers worldwide. It is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, ensuring a secure and transparent trading environment.

- Fees: 0% commission on trades, competitive spreads, overnight funding charges, currency conversion fees, and a £10 inactivity fee after three months of no login activity.

- Minimum Balance: £100

- Instruments: CFDs on Shares, Indices, ETFs, Forex, Commodities, Options, and Cryptocurrencies.

Pros:

- Intuitive interface suitable for both beginners and experienced traders.

- Access to numerous shares from global markets.

- Tight spreads with zero commission on trades.

Cons:

- You do not own the underlying shares; you’re trading CFDs.

- CFDs involve significant risk due to leverage.

Read my complete Plus500 review.

80% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

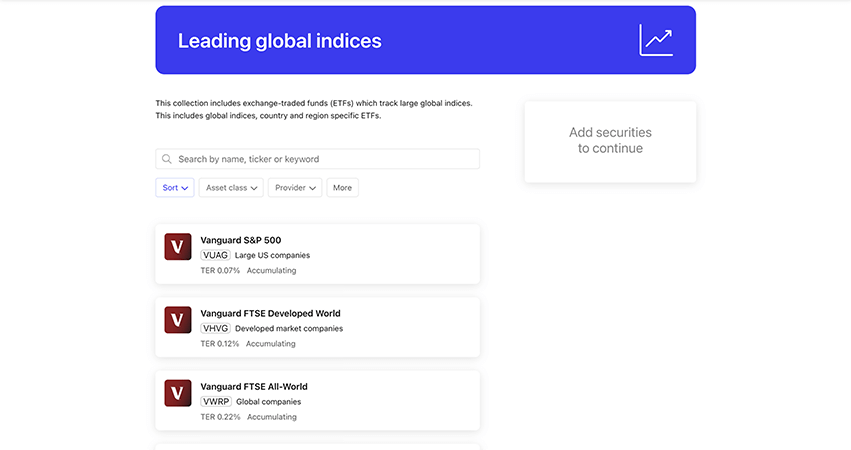

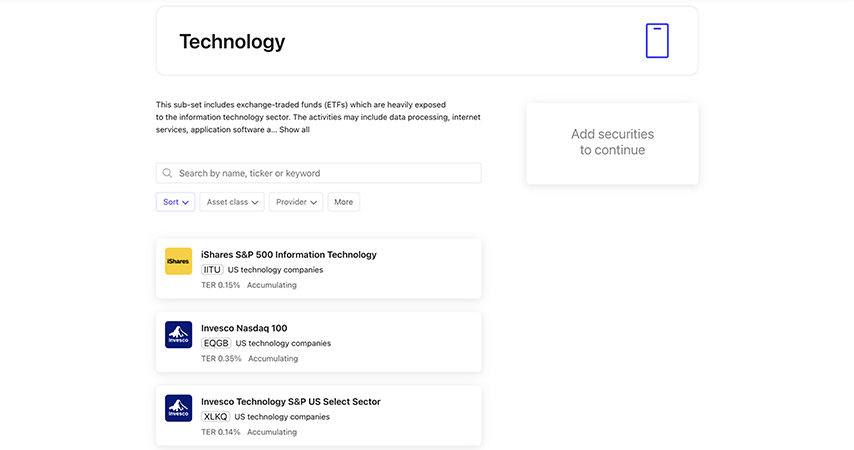

5. InvestEngine – Best for ETFs

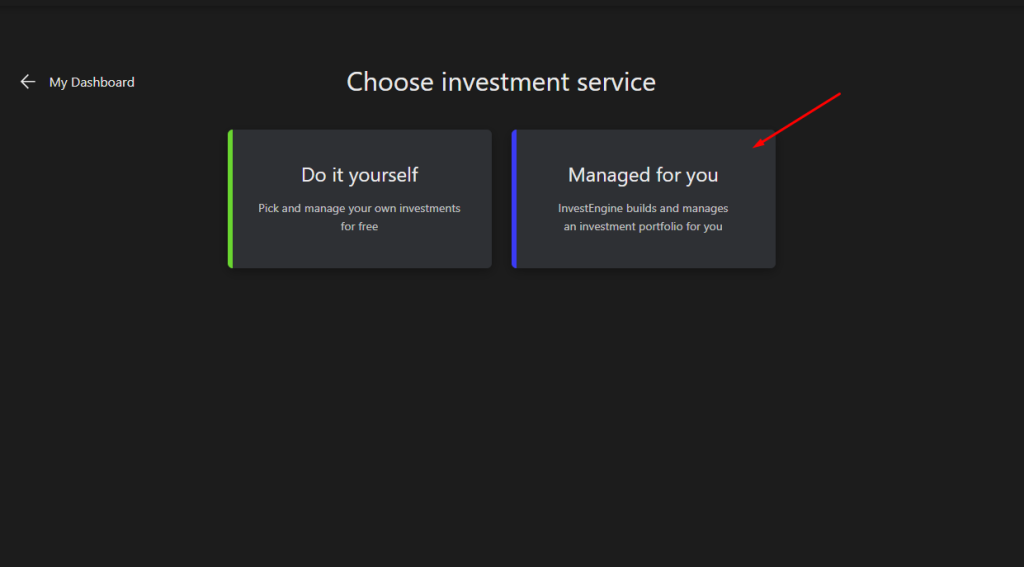

InvestEngine, primarily an ETF (Exchange Traded Funds) trading platform, offers a blend of value and versatility that makes it stand out in the crowded UK market.

Despite its specialised focus on ETFs, it provides an exceptional platform with a host of beneficial tools tailored to the needs of its clients, proving itself to be more of an asset than a limitation.

InvestEngine stands out with its transparent and highly competitive fee structure, ensuring investors know exactly what they’re paying. There are no hidden charges; for those opting for self-directed investing, the platform doesn’t impose any account fees, only the standard trading costs. If you choose their managed portfolios, the annual fee is an impressively low 0.25%.

Both beginners and savvy investors can find their stride with InvestEngine; with options for both managed and self-directed portfolios, there’s a fit for everyone.

For beginners or those preferring a hands-off approach, InvestEngine’s managed portfolios come in handy.

The firm’s team of experts handles daily investment decisions, creating a portfolio tailored to your risk tolerance and preferences.

Advanced investors can take advantage of the platform’s range of over 500 ETFs, taking the reins of their investments.

Fractional investing, another feature of InvestEngine, enables you to own portions of an ETF with as little as £1, thereby facilitating the creation of a diversified portfolio even with limited funds.

This makes it an excellent choice for limited companies looking to explore the market while maintaining diversity.

Notably, InvestEngine boasts an impressive customer support system.

As a specialist in ETFs, they have the expertise to assist their customers effectively, making the trading process smoother and more manageable.

ETFs are great for all investors, thanks to their low cost and their approach to diversification – in most cases, it’s better to diversify across a range of businesses instead of putting your cash into one stock or share.

Goncalo, Investment Manager at InvestEngine.

While the platform focuses solely on ETFs, it offers an impressive range of more than 500 options. This ensures that clients still have plenty of choice, despite its specialised nature.

In summary, InvestEngine, with its high-quality platform, exceptional customer service, wide range of ETFs, and low-cost structure, proves to be an excellent choice for both individuals and limited companies in the UK.

The only caveat is the ETF-only trading restriction, which might not appeal to investors looking for a wider variety of asset classes.

InvestEngine offers products such as a Stocks and Shares ISA, Personal Account, and Business Account, making it a comprehensive solution for a variety of investing needs.

Given its advantages and unique features, it stands as one of the most cost-effective platforms in the UK.

Pros:

- Fee-free investing with 0% fees.

- Extensive selection of ETFs.

- User-friendly interface.

- Highly cost-effective managed option with a 0.25% fee.

- Excellent customer support.

- Low minimum investment requirement (£100).

- Ability to invest within a business account.

Cons:

- Limited investment options to only ETFs.

- No provision for personal pensions.

- Limited additional features or offerings.

Read my InvestEngine review.

Factors to Consider When Choosing

Choosing the best share dealing account in the UK involves considering several factors.

Here are some tips to help you make an informed decision:

Fees: Compare the fees associated with each share dealing account, including trading commissions, account maintenance fees, inactivity fees, and any other charges. Look for accounts that offer competitive rates and cost-effective pricing structures.

Range of Investments: Assess the variety of investments available through the account. Consider whether you can trade stocks, exchange-traded funds (ETFs), investment trusts, bonds, and other securities that align with your investment goals.

Platform Features: Evaluate the functionality and user experience of the trading platform. Look for features such as ease of use, real-time market data, customisable watchlists, research tools, charting capabilities, and mobile accessibility.

Customer Service and Support: Consider the level of customer service provided by the account provider. Look for responsive customer support, including phone, email, or live chat options, to address any queries or issues you may encounter.

Account Types: Determine whether the share dealing account offers different types of accounts, such as Individual Savings Accounts (ISAs), Self-Invested Personal Pensions (SIPPs), or general investment accounts. Assess whether these account types align with your tax planning and investment objectives.

Reputation and Security: Research the reputation and credibility of the account provider. Check customer reviews, ratings, and any regulatory certifications or memberships that ensure the security of your investments and personal information.

Educational Resources: Consider whether the account provides educational resources, such as investment guides, tutorials, webinars, or market analysis, to help you enhance your investment knowledge and make informed decisions.

Additional Services: Evaluate any additional services or benefits offered by the account provider, such as dividend reinvestment plans, access to initial public offerings (IPOs), research reports, or financial planning tools.

Access to International Markets: If you’re planning to diversify your portfolio internationally, you should consider whether the share dealing account provides access to global stock exchanges, such as the NYSE, NASDAQ, or Asian and European markets. From my personal experience, having access to the US markets through platforms like Interactive Brokers has allowed me to invest in tech giants and diversify beyond the UK-centric firms, which significantly impacted my portfolio’s performance, especially during the tech boom.

Technological Stability: The robustness of the trading platform’s technology is crucial, particularly during high market volatility. A platform that can maintain uptime and provide consistent access without lag during these periods is vital. For instance, during high-volume trading days like those seen during market corrections, my platform’s reliability in executing orders without delays was instrumental in effective trading.

Advanced Order Types: For more seasoned investors, the availability of advanced order types like stop losses, limit orders, and conditional orders is necessary. These tools can significantly enhance your ability to manage risk and enter or exit positions at strategic price points.

Integration with Financial Tools: Some platforms offer integrations with tax software or financial planning tools, which can be incredibly helpful for managing your investments more holistically. This can streamline reporting and ensure you stay on top of your financial health.

Environmental, Social, and Governance (ESG) Options: As sustainable investing becomes more important to many investors, consider whether the platform offers ESG-focused investments. Using a platform that provides detailed ESG ratings, I’ve aligned my investments with my personal values without compromising performance, which adds an enriching layer to managing my portfolio.

Real-time Analytics and Data: The quality of real-time data and the ability to perform technical analysis within the platform can be a game-changer, especially for those who use data-driven strategies. Platforms that offer comprehensive analytics tools have enabled me to make more informed decisions quickly, directly impacting my trading outcomes.

By carefully considering these factors, you can choose a share dealing account that aligns with your investment preferences, goals, and trading style in the UK.

Final Thoughts

Choosing the right share dealing account in the UK depends on your investment goals, trading style, and preferred platform features.

My guide highlights and reviews the top accounts, helping you make a choice.

But, for beginners, I’d recommend eToro as the best share dealing account in the UK.

30 million users globally trust eToro for their social investing needs, benefiting from a vast array of shares, ETFs, and investment portfolios.

FAQs

What are share dealing fees?

Share dealing fees refer to the charges imposed by a share dealing platform or broker for buying or selling shares. These fees can vary among providers and may include commission fees, account maintenance fees, custody fees, and transaction fees. Commission fees are typically charged as a percentage of the transaction value or as a fixed fee per trade.

How do I open a share dealing account in the UK?

To open a share dealing account in the UK, start by researching and selecting a broker that aligns with your investment goals, such as eToro, interactive investor, or Hargreaves Lansdown. Once you’ve chosen a broker, you’ll typically need to fill out an online application form providing personal information and financial details. After your application is approved, you’ll need to fund your account through methods like bank transfer, credit/debit card, or e-wallets. With your account funded, you can then start buying and selling shares.

You may also like:

Sources:

Will Fenton

Will Fenton is the founder of Sterling Savvy. He is a personal finance expert and writes about trading, investing, budgeting, and other financial topics.

Along with his education, Will has experience working in the financial services industry in London working for one of the UK’s leading financial companies, “a trustworthy and respected provider of news, education and market analysis for the everyday investor”.

Education:

MA (Hons) Economics and Finance, Heriot-Watt University

Press:

Outside of finance:

Will is also the founder of MIDDER, where he manages a small team of journalists who report on the latest news and developments in AI, Web3, blockchain, NFTs, and crypto within the realm of music.

He's been featured discussing the future of music on The Standard and the Daily Mail.