What are the best trading platforms in the UAE? The best trading platforms in the UAE are IG, AvaTrade, and eToro. IG offers advanced tools and the widest market range, ideal for pros. AvaTrade suits beginners with low deposits and a simple app. eToro is best for social trading with DFSA regulation and multi-asset access.

I’ve reviewed the top trading platforms available in the UAE to help you choose the right one.

Whether you’re trading stocks, forex, or crypto, this guide breaks down the best UAE trading apps based on fees, features, and local regulations.

Best Online Trading Platforms in the UAE

| Broker | Overall Score | Min Deposit | Open Account | Regulators | Stock Fees | Forex Fees | Inactivity Fee |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | 4.9 | $0 | 1-3 days | FCA, SEC, ASIC, CIRO, CBI, SFC, MAS | Low | Average | Yes |

| Saxo | 4.8 | $0 | 1 day | FSA, FCA, FINMA, ASIC | Low | Low | Yes |

| eToro | 4.7 | $50 | 1 day | FCA, SEC, ASIC | Low | Average | Yes |

| XTB | 4.7 | $0 | 1 day | FCA | Low | Low | Yes |

| NinjaTrader | 4.5 | $0 | >3 days | CFTC, NFA | – | – | Yes |

| Swissquote | 4.5 | $0 | 1 day | FINMA, FCA | High | Low | Yes |

| Trading 212 | 4.4 | $1 | 1 day | FCA, ASIC, BaFin | Low | Average | Yes |

| Admirals | 4.4 | $100 | 1 day | FCA, ASIC | Low | Low | Yes |

| Oanda | 4.4 | $0 | 1-3 days | FCA, CIRO, ASIC | Low | Low | Yes |

| IG | 4.4 | $0 | 1-3 days | FCA, BaFin, ASIC | Low | Low | Yes |

Top 10 Trading Platforms in UAE

- Interactive Brokers – Very low fees and wide asset choice. Best for experienced traders.

- Saxo Bank – Top research tools and premium platform. Great for active investors.

- eToro – Easy to use with free stock and ETF trading. Ideal for beginners.

- XTB – Quick setup and low CFD fees. Good for trading forex, indices, and stocks.

- NinjaTrader – Strong futures tools and education. Not ideal for stock trading.

- Swissquote – Global access and no inactivity fee. Stock fees are higher.

- Trading 212 – Simple app with real stock and ETF trading. Beginner-friendly.

- Admirals (Admiral Markets) – Low forex fees and easy payments. Fewer tools for stocks.

- Oanda – Great for forex with strong research. Limited asset variety.

- IG – Powerful platform and education. Stock trading is more expensive.

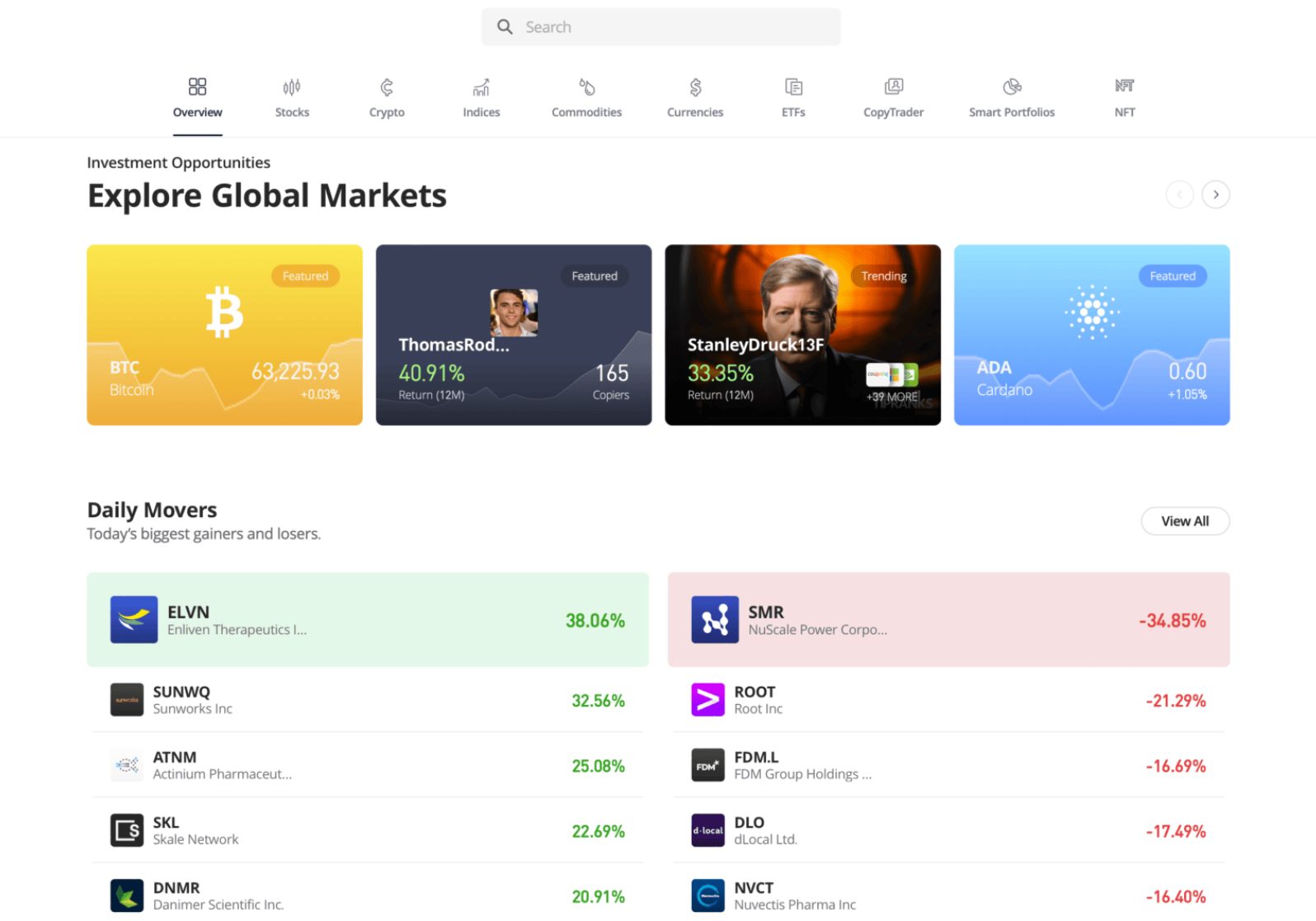

1. eToro – Overall best trading platform UAE

eToro UAE overview

| Feature | Details |

|---|---|

| Rating | 4.5/5 |

| Min Deposit | $100 |

| Time to open account | 1 Day |

| Overall fee class | Low |

| Mobile app score | 4.9 |

eToro is a leading multi-asset platform known for its social trading tools like CopyTrader, which lets you replicate the portfolios of top-performing traders in real time.

It’s fully regulated in the UAE by ADGM’s FSRA and globally by the FCA (UK), ASIC (Australia), and CySEC (Cyprus), ensuring strong investor protection.

Users can trade over 3,000 real stocks from 17 global exchanges, along with ETFs, forex, commodities, and 70+ cryptocurrencies.

US stock and ETF trades are commission-free, while forex spreads average 1.0 pips on EUR/USD.

The platform charges a $5 withdrawal fee and a $10 monthly inactivity fee after 12 months, but logging in resets the timer.

Opening an account takes less than 24 hours and requires a low $100 minimum deposit in the UAE.

A $100,000 demo trading account is included, ideal for beginners looking to practice.

The mobile app is one of the highest-rated in the industry (4.9/5), offering Face ID login and a clean, intuitive interface. Islamic accounts are available, supporting Sharia-compliant investing.

Downsides include the lack of AED deposit/withdrawal support, which may lead to currency conversion fees, and limited tools for advanced charting or automation.

For new traders who want to learn by copying others, eToro offers a powerful mix of simplicity, security, and global market access.

Read our complete eToro review.

Pros

✅ CopyTrader & Smart Portfolios – Easily copy top traders’ moves

✅ Top-rated mobile app – 4.9/5 score, secure with Face ID

✅ Islamic accounts available – Sharia-compliant investing

✅ Commission-free US stocks & ETFs – Great for low-cost investing

✅ Diverse asset selection – 3,000+ stocks, 70+ cryptos, forex, and more

✅ $100,000 demo account – Risk-free trading practice

Cons

❌ $5 withdrawal fee – Applies to every withdrawal

❌ No AED support – Currency conversion fees may apply

❌ Basic tools only – Lacks advanced charting for pros

❌ Limited research features – Educational content is fairly light

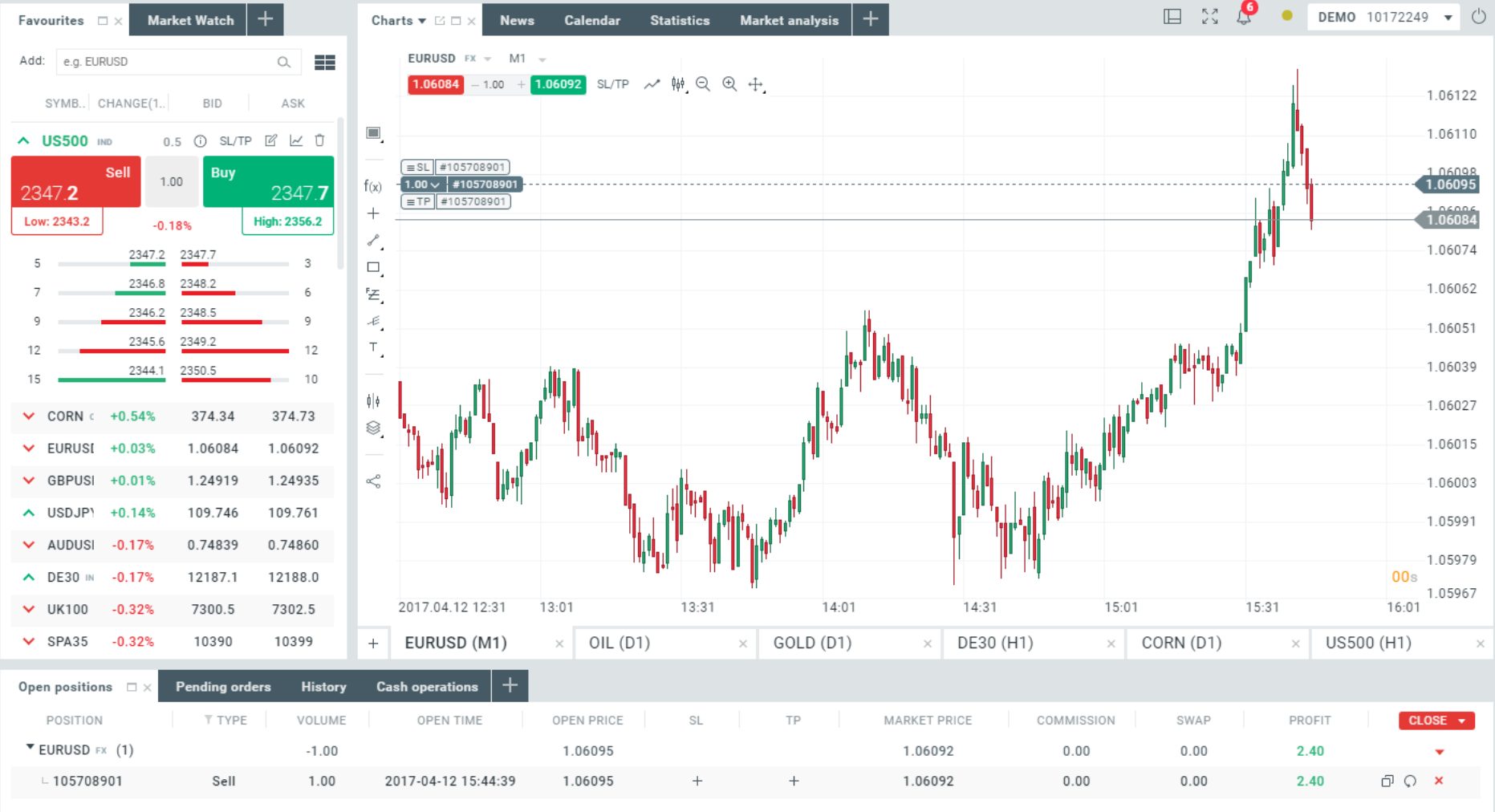

2. XTB – Best proprietary platform

XTB UAE overview

| Feature | Details |

|---|---|

| Rating | 3.8/5 |

| Min Deposit | $0 |

| Time to open account | 1 Day |

| Overall fee class | Low |

| Mobile app score | 4.5 |

XTB is a global broker focused on forex and CFD trading, offering access to over 2,100 instruments including currency pairs, indices, commodities, stocks, ETFs, and crypto.

It operates under top-tier regulators like the FCA and CySEC, though it’s not directly regulated in the UAE.

The proprietary xStation 5 platform is fast, user-friendly, and packed with tools like advanced charting, price alerts, and performance analytics.

Spreads start from 0.1 pips, with zero commissions on selected assets like stocks and ETFs up to €100,000 per month.

UAE users can open accounts with no minimum deposit and access Sharia-compliant Islamic accounts.

Deposits and withdrawals are typically free when using bank transfers, and the account can be opened digitally in under 24 hours.

However, XTB does not support AED accounts, which can lead to currency conversion costs. There’s a €10 monthly inactivity fee after one year without trading activity.

While mobile functionality is solid, it lacks two-factor authentication for extra security. Traditional asset classes like bonds and mutual funds are not available.

Overall, XTB is a strong low-cost option for active forex and CFD traders in the UAE who value speed, tools, and flexibility.

Pros

✅ Access to 2,100+ instruments including crypto, forex, and stocks

✅ xStation 5 is intuitive with real-time data and smart tools

✅ Islamic accounts available for ethical trading

✅ No minimum deposit and free bank withdrawals

✅ Competitive spreads from 0.1 pips

Cons

❌ Not regulated in the UAE

❌ No AED support, leading to potential FX conversion fees

❌ Inactivity fee after one year

❌ Lacks support for bonds, mutual funds, and options

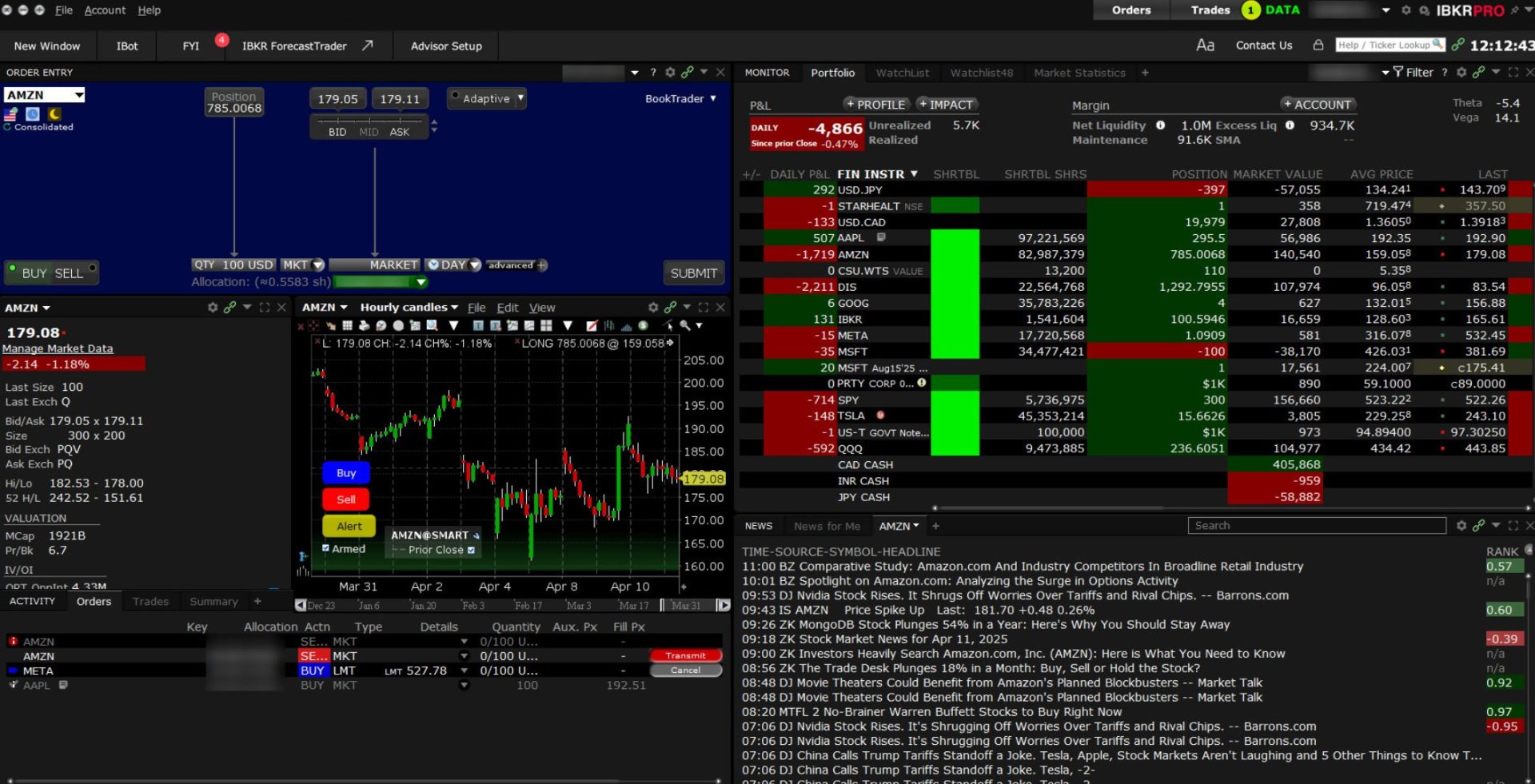

3. Interactive Brokers – Best for global market access

Interactive Brokers UAE overview

| Feature | Details |

|---|---|

| Rating | 4.9/5 |

| Min Deposit | $0 |

| Time to open account | 1–3 Days |

| Overall fee class | Low to Average |

| Mobile app score | 5.0 |

Interactive Brokers (IBKR) offers UAE traders direct access to over 90 global markets, including stocks, ETFs, options, bonds, futures, and crypto.

It is regulated in the UAE by the DFSA and internationally by top-tier regulators such as the SEC, FCA, and ASIC.

IBKR is known for its low trading fees, including $0.005 per US stock share (minimum $1), and industry-leading margin rates starting at 6.1% for Pro accounts.

There is no minimum deposit and no inactivity fee, making the platform accessible to all account sizes. UAE users can open AED-based accounts to avoid conversion charges.

Advanced traders benefit from the Trader Workstation (TWS) platform, which offers detailed charting, analytics, and smart order routing.

Beginners can use the GlobalTrader app, which has a simpler interface. The first withdrawal each month is free, but only bank transfers are supported.

Account opening is fully digital and takes up to three days, though the process can be complex. The mobile app is powerful but lacks price alerts and some order types.

For serious investors who want global exposure and efficient pricing, IBKR remains one of the top choices in the UAE.

Read our complete Interactive Brokers review.

Pros

✅ Global access to 90+ markets across all major asset classes

✅ Regulated by DFSA and other top-tier financial authorities

✅ AED multi-currency accounts reduce conversion costs

✅ Ultra-low US stock fees from $0.005 per share

✅ TWS platform offers advanced trading tools and automation

✅ No minimum deposit and no inactivity fee

Cons

❌ Account opening can take 1 to 3 days and is not beginner friendly

❌ Mobile app lacks some order types and price alerts

❌ Customer support can be slow during peak times

❌ Bank transfer is the only available funding method

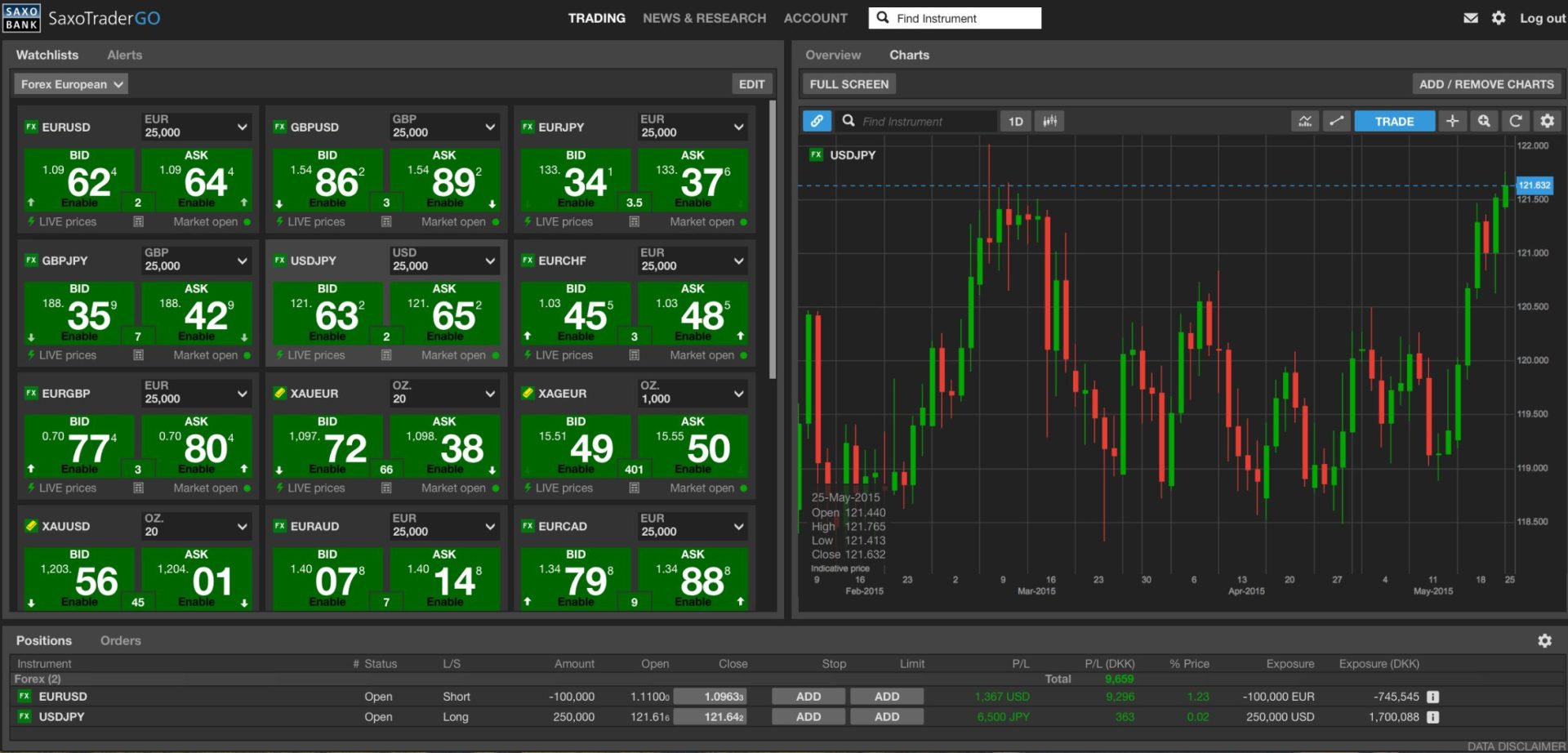

4. Saxo Bank – Best for advanced tools

Saxo Bank UAE overview

| Feature | Details |

|---|---|

| Rating | 4.9/5 |

| Min Deposit | $5,000 |

| Time to open account | 1 Day |

| Overall fee class | Average to High |

| Mobile app score | 5 |

Saxo Bank is a high-end trading platform offering access to over 50,000 instruments, including global and UAE-listed stocks, ETFs, bonds, forex, options, futures, and crypto.

It is regulated by the DFSA in the UAE, as well as the FCA and FINMA globally, giving UAE clients a secure, fully compliant trading environment.

SaxoTraderGO and SaxoTraderPRO provide advanced charting, custom layouts, and deep market analysis, making them ideal for experienced and professional traders.

The platform offers low fees on stocks and forex, with US stock trades starting at 0.08% of trade value ($1 minimum), dropping to 0.03% for VIP clients.

However, trading options and futures can be costly, with commissions as high as $2 per contract. A custody fee of 0.15% per year applies unless you opt into stock lending.

The minimum deposit for UAE clients is $5,000, which limits access for beginners. Islamic accounts are not available, and AED is not supported as a base currency.

Deposits and withdrawals are free, and account setup is digital and completed within one day. The mobile app scores 5.0 and mirrors the web platform’s professional features.

Overall, Saxo Bank is best suited for active UAE traders with larger portfolios seeking global access and institutional-grade tools.

Read our Saxo Bank review.

Pros

✅ Access to 50,000+ assets including UAE and global markets

✅ SaxoTrader platforms offer deep analysis and custom tools

✅ Regulated by DFSA and other global authorities

✅ Tiered pricing lowers fees for high-volume traders

✅ Rich education and research tailored for advanced users

Cons

❌ High minimum deposit of $5,000 in the UAE

❌ No Islamic accounts available

❌ No AED base currency support

❌ Higher fees on options, futures, and small portfolios

5. Pepperstone – Best for forex trading

Pepperstone UAE overview

| Feature | Details |

|---|---|

| Rating | 4.9/5 |

| Min Deposit | $0 |

| Time to open account | 1–3 Days |

| Overall fee class | Low |

| Mobile app score | 4.2 |

Pepperstone is a top choice in the UAE for traders focused on forex and CFDs, offering access to over 1,200 instruments including currencies, indices, commodities, and crypto.

It is regulated by ASIC, FCA, and CySEC, but does not currently hold a UAE license.

With spreads starting from 0.0 pips and $3.50 commissions per lot, its Razor account offers professional-grade pricing, while Standard accounts are commission-free.

The platform supports MT4, MT5, and cTrader, each suited to different trading styles, and includes Sharia-compliant Islamic accounts.

Account opening is fast, fully digital, and requires no minimum deposit.

Users can trade more than 60 forex pairs with high execution speed and access tools like Capitalise.ai for no-code automation.

Pepperstone charges no withdrawal or inactivity fees, though bank withdrawals outside the EU or Australia incur a $20 fee.

AED is not supported as a base currency, which may lead to conversion costs for UAE clients. The mobile trading app is functional but lacks two-step login.

While the product range is limited to CFDs and forex, the platform is ideal for active traders seeking low-cost, high-speed execution.

Read our complete Pepperstone review.

Pros

✅ Tight forex spreads from 0.0 pips on Razor accounts

✅ MT4, MT5, and cTrader platforms with fast execution

✅ Islamic accounts available for interest-free trading

✅ No deposit, withdrawal, or inactivity fees

✅ Access to 60+ currency pairs and solid education tools

Cons

❌ Not regulated in the UAE

❌ No AED base currency support

❌ Limited to CFDs and forex, no real stocks or mutual funds

❌ Mobile app lacks two-step login security

6. AvaTrade – Best for MT4 and MT5 users

AvaTrade UAE overview

| Feature | Details |

|---|---|

| Rating | 4.9/5 |

| Min Deposit | $100 |

| Time to open account | 1 Day |

| Overall fee class | Average |

| Mobile app score | 4.6 |

AvaTrade is a beginner-friendly trading platform offering access to over 1,000 instruments, including forex, stock CFDs, indices, commodities, and crypto.

It is regulated in the UAE by ADGM’s FSRA, making it one of the few platforms with local oversight, alongside global licenses from the FCA, ASIC, and CySEC.

Traders can use MT4, MT5, or the proprietary AvaTradeGO app, which includes tools like AvaProtect for loss protection. Sharia-compliant Islamic accounts are available, supporting interest-free trading for Muslim clients.

The minimum deposit is just $100, and both deposits and withdrawals are free. AvaTrade offers low forex fees, with EUR/USD spreads from 0.8 pips and no commissions.

However, the platform charges a $10 inactivity fee after three months, and a steep $100 annual administration fee after 12 months of inactivity.

It doesn’t support AED accounts, so UAE users may face currency conversion costs. The mobile app scores 4.6/5 and is intuitive for new traders.

While AvaTrade doesn’t offer real stocks or mutual funds, it’s a solid entry point for UAE residents seeking a locally regulated CFD broker.

Read our complete AvaTrade review.

Pros

✅ Regulated by ADGM for secure UAE trading

✅ MT4, MT5, and AvaTradeGO platforms available

✅ Sharia-compliant Islamic accounts supported

✅ Free deposits and withdrawals

✅ Low $100 minimum deposit and beginner-friendly tools

Cons

❌ Inactivity and annual administration fees apply

❌ No AED base currency support

❌ Limited product range (forex and CFDs only)

❌ No two-step login on mobile or web platforms

7. ActivTrades – Best for CFD trading

ActivTrades UAE overview

| Feature | Details |

|---|---|

| Rating | 4.4/5 |

| Min Deposit | $0 |

| Time to open account | 1 Day |

| Overall fee class | Average |

| Mobile app score | 4.9 |

ActivTrades is a solid CFD broker offering access to over 1,000 instruments, including forex, stock CFDs, indices, and crypto.

It is regulated by the FCA and other global authorities but is not licensed in the UAE.

Traders in the UAE can use the proprietary ActivTrader platform, which features risk management tools, market sentiment data, and a 4.9-rated mobile app.

Forex spreads start from 0.8 pips with no commission, and stock CFDs are priced at $0.02 per share with a $1 minimum.

There’s no minimum deposit required, making the platform accessible for beginners. ActivTrades also offers Sharia-compliant Islamic accounts for interest-free trading.

Deposits and withdrawals are free, and the account can be opened digitally within one day. However, AED is not supported as a base currency, and a 0.3% currency conversion fee applies.

A £10 inactivity fee kicks in after one year of no trading activity. The platform focuses only on CFDs, which may limit appeal for long-term investors.

Despite this, ActivTrades stands out for low fees, strong tools, and a beginner-friendly setup for UAE-based CFD traders.

Pros

✅ No minimum deposit and fast, digital account opening

✅ Low spreads on forex and $0.02 per share stock CFDs

✅ Sharia-compliant Islamic accounts available

✅ User-friendly ActivTrader platform and highly rated mobile app

✅ Free deposits and withdrawals via multiple methods

Cons

❌ Not regulated in the UAE

❌ 0.3% currency conversion fee and no AED base currency

❌ £10 monthly inactivity fee after one year

❌ Limited product range focused only on CFDs and forex

How to Choose the Best UAE Trading App & Platform?

Choosing the right trading platform depends on your trading goals, experience level, and the markets you want to access.

Here are key factors to consider:

- Regulation and safety: Always choose a platform regulated by a respected financial authority. In the UAE, look for DFSA or ADGM regulation to ensure local compliance and investor protection.

- Fees and commissions: Compare spreads, trading fees, and non-trading charges like withdrawal or inactivity fees. Low fees matter more for active traders, while long-term investors should focus on commission-free options.

- Assets available: Make sure the platform offers the instruments you plan to trade. Some platforms focus on forex and CFDs, while others include stocks, ETFs, bonds, and crypto.

- Platform features and tools: Look for advanced charting, market analysis, order types, and risk management tools. Beginners may prefer a simple interface, while advanced traders need more depth and customizability.

- Mobile app performance: A well-rated mobile app is essential if you plan to trade on the go. Check for stability, speed, user reviews, and whether key features are available on mobile.

- Account types and base currencies: UAE traders should check if the platform supports Islamic accounts and AED as a base currency to avoid conversion fees.

- Education and support: Quality tutorials, webinars, and learning tools help beginners build confidence. Fast, multilingual customer support can also make a big difference.

Before you decide, test the platform with a demo account if available. It’s the best way to check the interface, tools, and trade execution before risking real money.

Which Platform Should I Choose? Best Trading Platforms by Category

The best UAE trading platform for you depends on what you want to trade, your experience level, and your budget.

Here’s a breakdown of the top choices in the UAE by category to help you decide:

| Category | Best Platform | Why It Stands Out |

|---|---|---|

| Best for MT4 and MT5 users | AvaTrade | Simple interface, $100 minimum, regulated by ADGM, good education tools |

| Best for social/copy trading | eToro | Copy top traders automatically, supports stocks, ETFs, crypto, and more |

| Best for advanced tools | Saxo Bank | SaxoTraderGO/PRO platforms, 50,000+ assets, deep analytics |

| Best for forex trading | Pepperstone | Tight spreads from 0.0 pips, MT4/MT5/cTrader support |

| Best for CFD trading | ActivTrades | Low fees, strong ActivTrader platform, great mobile app |

| Best for global market access | Interactive Brokers | 90+ markets, multi-currency accounts, low commissions |

| Best proprietary platform | XTB | xStation 5 is user-friendly with real-time stats and advanced charting |

| Best commission-free stock trading | Trading 212 | $0 commission for stocks and ETFs, clean mobile app |

| Best for ETF and stock investing | DEGIRO | Low-cost investing in ETFs and global shares, no inactivity fees |

| Best for multi-asset trading | IG | Wide range of products (CFDs, forex, indices, crypto), regulated globally |

| Best for automated investing | Sarwa | UAE-based robo-advisor, ideal for passive investors with Sharia options |

| Best for deep research | Swissquote | Strong research tools, secure platform, access to Swiss and global markets |

| Best for MetaTrader fans | Admiral Markets | Offers MT4/MT5, good range of CFDs, competitive pricing |

| Best for micro-lot forex trading | XM | Low deposit ($5), supports micro-lot trading, MT4/MT5 platforms |

| Best for technical traders | OANDA | Excellent charting, trusted broker with strong execution and pricing |

| Best for mobile trading | Plus500 | App-first experience, intuitive interface, clean design for CFD traders |

✅ If you’re just getting started, look for platforms with low deposit requirements, demo accounts, and good educational support.

✅ If you’re an experienced trader, prioritize platforms with low spreads, advanced charting, and wide market access.

Try a demo account first if you’re unsure. It’s the easiest way to test the features and find a platform that fits your style.

How We Review Trading Platforms in the UAE

We independently test each platform using a live account funded with real money. Our review process covers key areas:

- Fees – We compare trading, non-trading, and withdrawal fees across platforms.

- Account setup – We evaluate how fast and easy it is to open, verify, and fund an account.

- Platform usability – We test mobile and desktop apps for speed, layout, and user experience.

- Assets and markets – We check the range of stocks, ETFs, forex, crypto, and other instruments offered.

- Regulation and safety – We only include brokers licensed by trusted regulators with a strong reputation.

- Features and tools – We look at research tools, education, order types, and customization options.

- Customer support – We contact support teams directly to check speed and helpfulness.

This hands-on approach ensures our reviews are accurate, up to date, and built around what matters most to traders in the UAE.

Stock Trading Fees at Top UAE brokers

| Broker | US Stock Fee | UK Stock Fee |

|---|---|---|

| Interactive Brokers | $1.00 | $3.80 |

| Saxo | $1.60 | $3.80 |

| eToro | $0.00 | $0.00 |

| XTB | $0.00 | $0.00 |

| Swissquote | $10.00 | $12.60 |

| Trading 212 | $0.00 | $0.00 |

| Admirals | $0.00 | $0.00 |

| Oanda | $0.00 | $3.60 |

| IG | $10.00 | $10.10 |

What is a Trading Platform in the UAE?

A trading platform in the UAE is a digital tool or app that allows individuals to buy and sell financial instruments like stocks, forex, commodities, and cryptocurrencies. These platforms connect traders to global and regional markets, often through regulated brokers.

In the UAE, top platforms are usually regulated by the DFSA (Dubai Financial Services Authority) or FSRA under Abu Dhabi Global Market (ADGM). This regulation ensures the platform meets strict standards for safety, transparency, and client protection.

Trading platforms in the UAE are available as desktop software, web-based platforms, and mobile apps.

Most offer features like real-time charts, market news, risk management tools, and support for Sharia-compliant Islamic accounts, which are interest-free and tailored for observant Muslim traders.

Whether you’re a beginner or a seasoned investor, trading platforms in the UAE provide access to both local markets and international exchanges, allowing you to trade efficiently from anywhere.

Is It Safe to Trade Online in the UAE?

Yes, online trading is generally safe in the UAE, as long as you use a regulated broker.

Platforms licensed by the DFSA (Dubai Financial Services Authority) or ADGM’s FSRA (Financial Services Regulatory Authority) must meet strict standards for security, transparency, and client protection.

These licensed brokers are required to:

- Keep client funds in segregated accounts

- Offer negative balance protection

- Comply with anti-money laundering (AML) and know your customer (KYC) rules

To trade safely, avoid offshore or unregulated platforms. Always verify the broker’s regulatory status before opening an account. Also, use secure internet connections, enable two-step login if available, and never share your account credentials.

When you stick to reputable, regulated platforms, trading online in the UAE is secure for both beginners and experienced investors.

Steps to Open a Trading Account in the UAE

Opening a trading account online in the UAE is quick and easy. Here’s a step-by-step guide to get started:

- Choose a regulated broker: Pick a platform regulated by ADGM, DFSA, or a trusted global authority like FCA (UK) or ASIC (Australia) for added safety.

- Go to the broker’s website or app: Click “Sign Up” or “Open Account” to start the registration process.

- Fill in your details: Enter your full name, email, phone number, and country of residence. You may also be asked about your trading experience and financial background.

- Verify your identity: Upload a clear photo of your passport or Emirates ID, and a proof of address (like a utility bill or bank statement from the past 3 months).

- Fund your account: Deposit funds using a bank transfer, credit/debit card, or e-wallet. Some platforms accept AED, while others may require USD or EUR.

- Choose your account type: Select between a Standard, Islamic, or Demo account depending on your needs.

- Start trading: Once verified and funded, you can access the trading platform and begin placing trades.

✅ Tip: Use a demo account first to get familiar with the platform without risking real money.

Best Trading Apps in the UAE

| Trading App | App Rating | Best For | Key App Features | UAE Regulation / Islamic Account Support |

|---|---|---|---|---|

| AvaTradeGO | ★★★★☆ (4.6/5) | Beginners | Simple layout, AvaProtect, free demo, good education tools | ✅ Regulated by ADGM ✅ Islamic account available |

| eToro | ★★★★★ (4.9/5) | Social & copy trading | CopyTrader, social feed, crypto wallet, real stock trading | ✅ Islamic account available ❌ No UAE license |

| SaxoTraderGO | ★★★★★ (5.0/5) | Advanced analysis | 50,000+ assets, pro-level charts, deep analytics | ✅ Regulated by DFSA ❌ No Islamic account |

| Pepperstone (MT4/5/cTrader) | ★★★★☆ (4.2/5) | Forex traders | Tight spreads, fast execution, supports algo tools | ❌ No UAE license ✅ Islamic account available |

| ActivTrader | ★★★★★ (4.9/5) | CFD traders on stocks & indices | Market sentiment, risk tools, two-step login | ❌ No UAE license ✅ Islamic account available |

| IBKR GlobalTrader | ★★★★★ (5.0/5) | Global market access | 90+ markets, fractional shares, multi-currency support | ✅ Regulated by DFSA ❌ No Islamic account |

| xStation (XTB) | ★★★★☆ (4.5/5) | All-in-one trading | Real-time stats, intuitive UI, 0 minimum deposit | ❌ No UAE license ✅ Islamic account available |

| Trading 212 | ★★★★☆ (4.6/5) | Commission-free stock investing | $0 stock and ETF trades, sleek mobile interface | ❌ No UAE license ❌ No Islamic account |

| DEGIRO | ★★★★☆ (4.4/5) | Low-cost investing | Low fees, global stocks and ETFs | ❌ No UAE license ❌ No Islamic account |

| IG Trading App | ★★★★☆ (4.5/5) | Multi-asset trading | Strong charts, CFDs, options, educational tools | ✅ DFSA regulated (IG MENA) ❌ No Islamic account |

| Sarwa | ★★★★☆ (4.3/5) | Automated investing | UAE-based robo-advisor, passive portfolios, Sharia option | ✅ Regulated in UAE ✅ Islamic investing available |

| Swissquote | ★★★★☆ (4.4/5) | Deep research tools | Secure trading, Swiss and global markets | ❌ No UAE license ❌ No Islamic account |

| Admiral Markets (MT5) | ★★★★☆ (4.4/5) | MetaTrader users | MT5-based trading, strong CFD coverage | ❌ No UAE license ✅ Islamic account available |

| XM (MT4/5) | ★★★★☆ (4.3/5) | Micro-lot forex traders | $5 deposit, MT4/5 support, beginner friendly | ❌ No UAE license ✅ Islamic account available |

| Plus500 | ★★★★☆ (4.6/5) | App-first CFD trading | Intuitive app, alerts, watchlists, quick setup | ❌ No UAE license ❌ No Islamic account |

| OANDA fxTrade | ★★★★☆ (4.4/5) | Technical traders | Advanced charts, forex focus, news integration | ❌ No UAE license ❌ No Islamic account |

How to Trade Online in the UAE

Online trading in the UAE is legal, accessible, and growing in popularity.

Whether you’re investing in global stocks or trading forex, here’s how to start step by step:

1. Choose a regulated trading platform

Pick a broker that is licensed by a trusted regulator. For UAE residents, the most secure options are:

- UAE-based regulation: DFSA (Dubai) or ADGM (Abu Dhabi)

- Global authorities: FCA (UK), ASIC (Australia), CySEC (Cyprus)

✅ Look for platforms with a strong mobile app, good support, and access to the markets you want (stocks, crypto, forex, etc.).

2. Open your trading account

The account opening process is online and usually takes 1–3 business days. You’ll need:

- Valid ID – such as your Emirates ID or passport

- Proof of address – like a utility bill or bank statement

- Basic financial info – to confirm your experience and income

Most brokers don’t charge fees to open an account. Platforms like eToro, XTB, and Trading 212 allow you to start with $0–$50.

3. Deposit funds

Once verified, you can add funds to your account using:

- Bank transfer (local or international)

- Credit/debit cards

- E-wallets – such as PayPal, Skrill, or Neteller (available on some platforms)

⚠️ Not all brokers support AED. If your platform converts funds to USD or EUR, expect small currency conversion fees.

4. Choose your markets

UAE traders can access global financial markets, including:

- Stocks and ETFs (US, UK, EU, Asia)

- Forex pairs (like USD/AED, EUR/USD)

- Cryptocurrencies (Bitcoin, Ethereum, etc.)

- Commodities (gold, oil)

- CFDs on various assets

Use demo accounts or research tools to test strategies and understand risk.

5. Place your first trade

Once you’ve picked an asset:

- Select the asset in the platform’s search bar

- Choose your order type (Market, Limit, Stop)

- Set your amount and optional tools like stop-loss or take-profit

- Review and confirm your trade

Begin with small trades to get used to the platform.

6. Monitor your positions

Use the platform’s app or web tools to track:

- Price movements

- Portfolio performance

- News and alerts

You can set automated rules (like closing a trade if it hits a certain price) to manage risk.

7. Withdraw your profits

Withdrawals typically go back to your original deposit method. Timeframes vary:

- E-wallets: Instant or same day

- Cards and bank transfers: 1–3 business days

Some platforms charge a small withdrawal fee (e.g. $5 at eToro), while others are free.

✅ Tip: If you’re a Muslim trader, check whether the platform offers Islamic accounts. These accounts avoid interest (swap) charges and are compliant with Sharia law.

UAE Tax Laws for Online Trading

The United Arab Emirates is known for its investor-friendly tax policies, and online trading is no exception.

Here’s what traders in the UAE need to know about taxes on trading profits:

✅ No personal income tax

Individuals in the UAE do not pay personal income tax, including on:

- Profits from stock trading

- Gains from crypto, ETFs, or forex

- Dividends or capital gains

This makes the UAE one of the most tax-efficient countries for retail traders and long-term investors.

???? No capital gains tax for individuals

There is no capital gains tax on the sale of shares or other investment products if you’re trading in a personal capacity. This applies to both local and international assets.

???? Corporate tax may apply to business entities

As of June 1, 2023, the UAE introduced a 9% corporate tax for businesses earning over AED 375,000 in net profits. This could apply if:

- You trade under a legal entity (LLC or free zone company)

- Trading is considered your main business activity

However, many individual traders fall outside this scope and remain untaxed.

???? Withholding tax on foreign dividends

Some countries may withhold tax on dividends or profits sent to your UAE account, especially from:

- US stocks (typically 15% withholding tax via W-8BEN form)

- European markets (varies by country)

These are imposed by the source country, not the UAE.

???? Zakat (optional)

While not enforced by the UAE government, some Muslim investors choose to calculate Zakat (2.5% on qualifying assets) voluntarily as part of their personal finance responsibilities.

UAE Tax Resources

- Federal Tax Authority (FTA)

Main UAE tax authority

???? https://www.tax.gov.ae

Corporate tax info:

???? https://tax.gov.ae/en/taxes/corporate.tax.aspx - UAE Ministry of Finance

Official policy updates and tax law information

???? https://mof.gov.ae/

Corporate tax overview:

???? https://mof.gov.ae/uae-corporate-tax-to-bolster-future-economic-sustainability/ - U.S. IRS – W-8BEN Form (for UAE residents trading US stocks)

Form info and submission details:

???? https://www.irs.gov/forms-pubs/about-form-w-8-ben

U.S.–UAE Tax Treaty:

???? https://www.irs.gov/businesses/international-businesses/united-states-income-tax-treaties-a-to-z

Stock Exchanges in the UAE

The UAE has three main regulated stock exchanges where investors can trade stocks, bonds, ETFs, and derivatives:

- Abu Dhabi Securities Exchange (ADX): Based in Abu Dhabi, ADX lists major UAE companies such as First Abu Dhabi Bank, ADNOC, and Aldar Properties. It supports trading in equities, ETFs, and fixed-income products, and has recently expanded into derivatives. ADX is known for strong liquidity and growing foreign investment.

- Dubai Financial Market (DFM): DFM is popular with retail traders and offers a wide range of securities, including stocks, ETFs, and Sharia-compliant instruments. Key listings include Emaar Properties, Dubai Islamic Bank, and Air Arabia. It was the first exchange in the region to go public and emphasizes accessible, regulated trading.

- NASDAQ Dubai: Designed for global and institutional investors, NASDAQ Dubai lists international companies, regional leaders like DP World, and products like Sukuk and equity futures. Although separate from DFM, it shares the same trading infrastructure, so investors can access both markets through DFM brokers.

All three exchanges are overseen by the Securities and Commodities Authority (SCA) and support both local and foreign investor access through approved platforms.

Final Thoughts

Choosing the right trading platform in the UAE depends on your goals, experience, and preferences.

eToro stands out for its beginner-friendly features and social trading tools, while platforms like Interactive Brokers and Saxo offer deeper functionality for advanced users.

Make sure to compare fees, account options, and supported markets before getting started. A regulated, well-reviewed broker is key to trading with confidence.

FAQs

What is the best online trading platform in the UAE?

eToro is the best online trading platform in the UAE for most users. It offers commission-free stock trading, easy account setup, and access to social trading features.

Which is the most trusted platform for trading in the UAE?

IG is widely considered the most trusted trading platform in the UAE. It’s regulated by the DFSA and multiple tier-1 authorities like the FCA and ASIC. With over 45 years in the market, a London Stock Exchange listing, and strong investor protections like negative balance protection, IG offers a secure and reputable trading environment.

How can I trade in UAE?

To trade in the UAE, open an account with a broker licensed by DFSA or ADGM. Choose a platform that supports your preferred assets and offers AED funding or local support. After verifying your account, deposit funds and start trading using apps like MetaTrader 4 or the broker’s platform. Always use a regulated broker to stay protected.

Is trading legal in the UAE?

Yes, trading is legal in the UAE. The market is regulated by financial authorities like the DFSA (Dubai Financial Services Authority) and ADGM (Abu Dhabi Global Market). Residents can legally trade forex, stocks, and CFDs through licensed brokers.

What is the best trading app in Dubai?

Some of the best trading apps in Dubai include eToro, IG, and AvaTrade. These apps are regulated, beginner-friendly, and offer access to forex, stocks, and crypto. Each supports mobile trading with strong security and a wide range of assets.

What is the best trading broker in UAE?

The best trading broker in the UAE is IG, thanks to its DFSA regulation, low spreads from 0.6 pips, and powerful platforms like IG Web and MT4. Other top options include AvaTrade for its Sharia-compliant accounts and eToro for its user-friendly social trading features.